Stocks with a Margin of Safety

During uncertain economic times – as we are experiencing currently – the ever-important principles of valuation and margin of safety become even more important. As 2022 brought us a bear market after enjoying a very strong and long-running bull market, valuations have improved tremendously.

Nevertheless, since the market was so overvalued for so many years, even though valuations are better today, there are not many stocks offering a margin of safety.

With that in mind, as the economy continues to grapple with rising interest rates and inflation and economic uncertainties, the importance of valuation and margin of safety is critical.

With that in mind, as the economy continues to grapple with rising interest rates and inflation and economic uncertainties, the importance of valuation and margin of safety is critical.

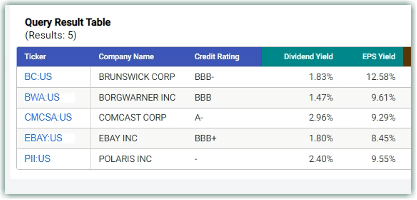

Consequently, with this video I offer a high-level overview of 5 companies that pay a decent and growing dividend is well covered by cash flows. But most importantly, these 5 companies also offer the risk-averse investor a margin of safety and great value. Therefore, I humbly submit these 5 research candidates for your consideration and further research.

FAST Graphs Analyze out Loud on eBay (EBAY), Brunswick Corp (BC), Comcast Corp (CMCSA), BorgWarner (BWA), Polaris (PII)

— Chuck Carnevale

He issued warnings for RNG before it crashed 89%, BYND before it crashed 90%, TDOC before it crashed 84%, and FVRR before it crashed 86%. Now, he's stepping forward to name the popular stock that could go down as one of the worst-performing tickers of the year. It could be the most dangerous stock of 2026. Click here for its name and ticker, 100% free.

Source: FAST Graphs