I have a number of Canadian subscribers who often ask me for high-yield Canadian stock ideas—most recently, for an ETF that trades on the Toronto Stock Exchange.

Now, for American income investors, and Canadians willing to deal with the hassle that comes from cross-border investing, I’ve covered several over the past few months.

But for my Canadian readers, here’s the best high-yield ETF listed in Toronto right now…

The Hamilton Enhanced U.S. Covered Call ETF (TSX: HYLD, HYLD.U) is a fund of funds, which means its portfolio consists of shares of other ETFs. As the name indicates, HYLD owns a portfolio of U.S.-listed ETFs that use covered call strategies to generate income.

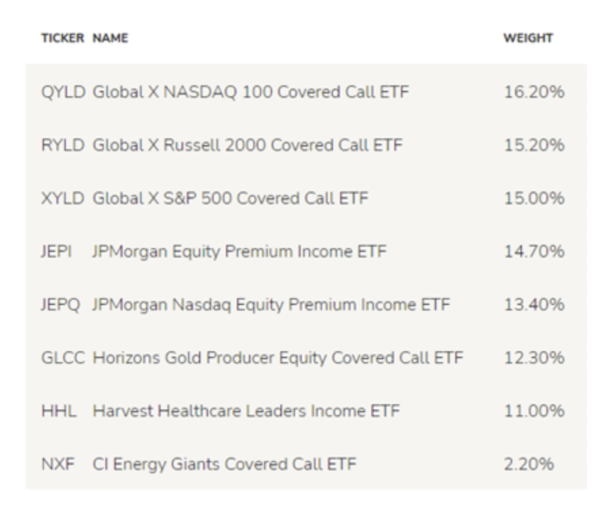

Here are the portfolio holdings as of January 6, 2023:

Here are the portfolio holdings as of January 6, 2023:

According to the fund’s website, JEPI, JEPQ, QYLD, RYLD, and XYLD trade on the U.S. stock exchanges. The remaining funds are Canada-based and trade on the Toronto Stock Exchange (TSX). Currently, JEPI, JEPQ, and RYLD are recommended Dividend Hunter investments.

According to the fund’s website, JEPI, JEPQ, QYLD, RYLD, and XYLD trade on the U.S. stock exchanges. The remaining funds are Canada-based and trade on the Toronto Stock Exchange (TSX). Currently, JEPI, JEPQ, and RYLD are recommended Dividend Hunter investments.

The Hamilton Enhanced U.S. Covered Call ETF trades on the TSX under two symbols. HYLD trades in Canadian dollars (CAD) and hedges against the U.S. Dollar (USD). HYLD.U trades in USD and is unhedged.

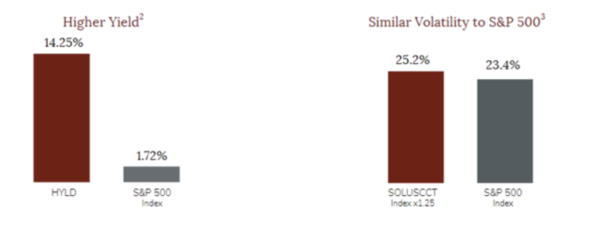

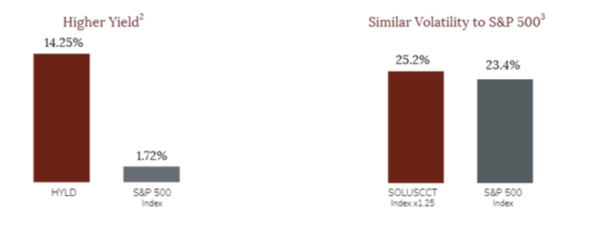

HYLD uses modest leverage of 25%, which the fund managers say enhances growth potential and yield. Volatility has been comparable to that of the S&P 500:

HYLD pays monthly dividends, currently set at $0.14 per share. The current yield is 14%. For investors in Canada, HYLD offers an interesting, and, I think, appealing high yield opportunity.

HYLD pays monthly dividends, currently set at $0.14 per share. The current yield is 14%. For investors in Canada, HYLD offers an interesting, and, I think, appealing high yield opportunity.

— Tim Plaehn

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley