2022 was a terrible year for the broader market. The S&P 500 finished down nearly 20% for the year. That’s one of the worst years of all time.

However, there are a number of individual names that held up much, much better. In fact, my own portfolio, which I call the FIRE Fund, actually finished up on the year for 2022.

Now, I did put some capital to work, and that was a tailwind. But the vast majority of the Fund’s outperformance was totally organic.

How did this happen? Well, the Fund is chock-full of high-quality dividend growth stocks. And, as I’ve mentioned time and time again, high-quality dividend growth stocks tend to outperform the market over the long run. This shouldn’t be a surprise.

Only great businesses can produce the reliable, rising profits necessary in order to afford reliable, rising dividends. And great businesses should perform much better than average.

Today, I want to share five of my best-performing stocks of 2022, and whether or not they look buyable today.

Ready? Let’s dig in.

The first dividend growth stock I’m highlighting today is Archer-Daniels-Midland (ADM). Archer-Daniels-Midland is a multinational food processing and commodities trading corporation.

Archer-Daniels-Midland, commonly known as ADM, is a wonderful business that flies way under the radar. It’s part of the backbone of the global food supply. And guess what? We’ve all gotta eat. With food supply disruptions stemming from the war in Eastern Europe, ADM’s critical nature has only become more critical. This has helped to propel the business and stock to higher heights than ever before.

This stock shot up by about 37% in 2022. That market-crushing price action is before factoring in the dividends, which is another area in which ADM beats the market. Let’s get into that. This is a vaunted Dividend Aristocrat. We’re talking about 47 consecutive years of dividend increases, which is a remarkable track record.

The 10-year DGR is 8.4%. And the stock’s yield of 1.9% beats the market even after such an amazing year causing the price to rise and yield to fall. However, the stock’s five-year average yield is 2.8%. So the current yield isn’t nearly as appealing as it usually is. That said, the payout ratio is only 19%, based on TTM adjusted EPS. That’s laughably low. So I can’t imagine any future in which ADM doesn’t continue to increase the dividend at an inflation-beating rate.

Love this business. Love this stock. Don’t love this valuation. I bought ADM years ago when it was around $35/share. I thought it was a great deal then. Here at right about $86/share, I don’t feel the same. Now, most metrics aren’t indicating expensiveness.

For example, the P/E ratio is only 11.9. But it’s all about the E in the P/E ratio. As in, how resilient is that number? This business has been on fire, but the last two years have been outliers when you look at the long-term earnings history. Before buying, I’d wait for either a significant pullback in the stock pricing or further confirmation of a concretely higher earnings base. For now, I’m on the sidelines in terms of adding to my own position.

For example, the P/E ratio is only 11.9. But it’s all about the E in the P/E ratio. As in, how resilient is that number? This business has been on fire, but the last two years have been outliers when you look at the long-term earnings history. Before buying, I’d wait for either a significant pullback in the stock pricing or further confirmation of a concretely higher earnings base. For now, I’m on the sidelines in terms of adding to my own position.

On the other hand, I’m not selling ADM or any of the names I’m going over today. Like the great Peter Lynch said, “Selling your winners and holding your losers is like cutting the flowers and watering the weeds.”

The second dividend growth stock I want to go over today is Chevron (CVX).

Chevron is a multinational energy corporation. I’ve been a Chevron shareholder for many years. And, to be totally honest, it hasn’t been all sunshine. There were long stretches that were downright tough.

Parts of society were starting to sour on hydrocarbon companies a while back, which kinda left me scratching my head. But I never lost faith. After all, our modern-day society doesn’t work without reliable access to energy. And while I applaud humanity’s moves into more sustainable forms of energy, as we have to think about the viability of our species thousands of years into the future, these other forms of energy simply aren’t ready for primetime yet.

Well, an energy crisis in Europe has caused a rude awakening. The world’s been reminded of the importance of hydrocarbons. And Chevron’s business has come roaring back, which caused the stock to reawaken.

Chevron’s stock returned right about 51% in 2022. Wow. And that’s before the large dividend is factored in. This kind of extreme relative outperformance certainly makes up for some disappointing years in the past. Since Chevron is actually an overweight position for the Fund, Chevron definitely helped with overall performance in 2022. But I’m not here to chase short-term outperformance.

Chevron’s stock returned right about 51% in 2022. Wow. And that’s before the large dividend is factored in. This kind of extreme relative outperformance certainly makes up for some disappointing years in the past. Since Chevron is actually an overweight position for the Fund, Chevron definitely helped with overall performance in 2022. But I’m not here to chase short-term outperformance.

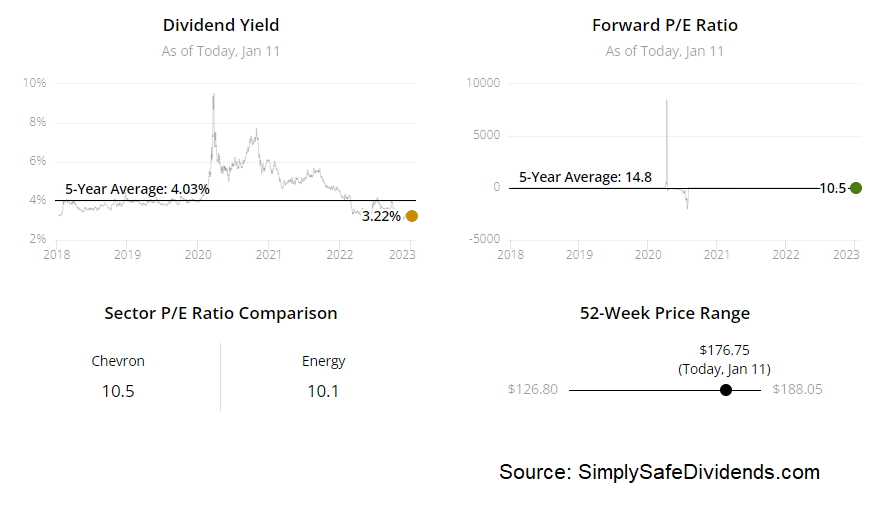

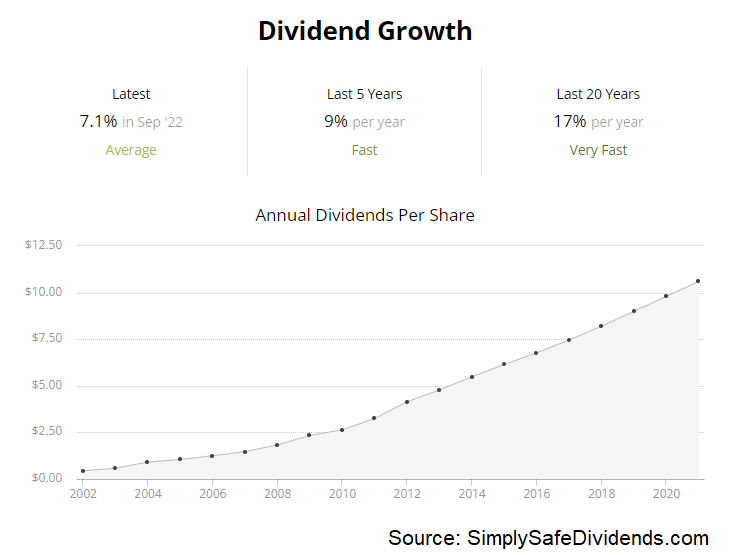

I’m here for safe, growing dividends that I can count on through thick and thin. Well, Chevron shines here. This is a Dividend Aristocrat, with 35 consecutive years of dividend increases. The 10-year DGR of 5.1% pairs decently with the yield of 3.2%, although I’d prefer either a higher yield or higher dividend growth rate here. Nonetheless, the payout ratio is an extremely low 32.3%, thanks to a great year for earnings. This dividend is headed higher.

Despite the massive run, the stock still doesn’t look expensive. But I’d be cautious here. Most of the multiples are either at, or below, their respective recent historical averages. The P/E ratio is only 10. The P/CF ratio of 7.4 compares favorably to its own five-year average of 9.7.

However, Chevron had a banner year in 2022. Their recent Q3 report for FY 2022 showed $5.78 in EPS. That’s more than the business did in the entire year of 2019. We did put out favorable coverage of Chevron multiple times over the last year or so, highlighting the appeal of the business.

However, Chevron had a banner year in 2022. Their recent Q3 report for FY 2022 showed $5.78 in EPS. That’s more than the business did in the entire year of 2019. We did put out favorable coverage of Chevron multiple times over the last year or so, highlighting the appeal of the business.

We even discussed how Warren Buffett had been loading up on this name. Personally, I’m a bit less enthusiastic at these higher levels, but, due to imbalances between supply and demand, geopolitics, and a warmer societal attitude toward the business model, Chevron finally has some tailwinds at its back. The balance sheet has been cleaned up. And the profit picture looks better than it has in many years. I still like Chevron very much. But a 10% or so drop would make me like it even more.

The third dividend growth stock that has to be highlighted is Lockheed Martin (LMT).

Lockheed Martin is the world’s largest defense contractor. Lockheed Martin was one of my top five stock ideas for 2022. It’s also a large position for the Fund.

What can I say? I like to put my money where my mouth is. In the case of Lockheed Martin, I’ve put my money to work with one of the best companies on the planet. This company practically prints money, because its largest customer – the US government – literally prints money. With geopolitics heating up in a big way recently, that can only mean more demand for Lockheed Martin’s products and services. And that’s why there’s been more demand for Lockheed Martin’s shares.

This stock rose by approximately 37% in 2022. You’re basically looking at a 40% one-year return, after factoring in the dividend. That’d be incredible in any year. But it’s especially incredible in a year in which the S&P 500 dropped by almost 20%. But a long-term dividend growth investor like myself sees capital gain like this as a byproduct of investing in great businesses.

The focus, however, is always on that safe, growing dividend income that one can live off of. In this regard, Lockheed Martin is a lock. The company has increased its dividend for 20 consecutive years, with a 10-year DGR of 10.9%. The stock offers a compelling 2.6% yield to start off with. And the payout ratio of 55.7%, based on EPS guidance for FY 2022, shows what a long growth runway the dividend still has.

The stock had a great 2022. But I see no reason why it won’t have a great 2023, 2024, 2025, etc. The business is currently going for almost $460/share. Would a buyer prefer $450/share? Or $400/share? Absolutely. We always want to pay less. But I think this is one of the best businesses a long-term dividend growth investor can get their hands on, and being too myopic about trying to get the absolute best deal today could leave you missing out on decades of growth.

The stock had a great 2022. But I see no reason why it won’t have a great 2023, 2024, 2025, etc. The business is currently going for almost $460/share. Would a buyer prefer $450/share? Or $400/share? Absolutely. We always want to pay less. But I think this is one of the best businesses a long-term dividend growth investor can get their hands on, and being too myopic about trying to get the absolute best deal today could leave you missing out on decades of growth.

We analyzed and valued Lockheed Martin a few months ago, estimating the intrinsic value of the business at nearly $450/share. I basically see the business as fairly valued here. And you could do a lot worse than buy a wonderful business for a fair price. In my view, Lockheed Martin is buyable right here, right now.

The fourth dividend growth stock I have to tell you about is Merck (MRK).

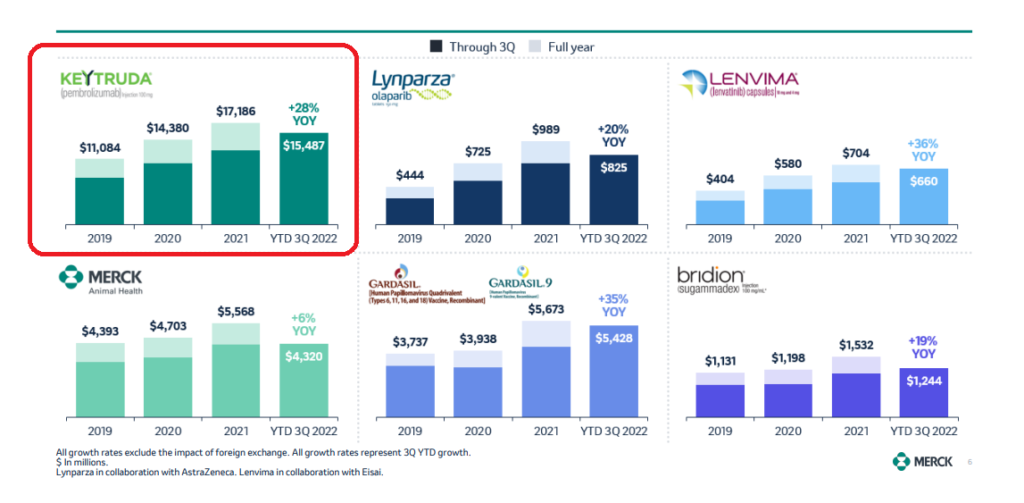

Merck is a multinational pharmaceutical company. When you think of Merck, you should immediately think of Keytruda – the company’s blockbuster cancer drug that brought in over $5 billion in sales for the most recent quarter and is poised to become the best-selling drug in the world.

The success of Keytruda is the tide lifting the entire Merck boat, as the business and stock had a fantastic 2022. By the way, that’s one of the underlying points throughout this whole video. If you want great stocks, you have to invest in great businesses. Stocks are slices of real businesses. If you invest in a terrible business, you’re buying a terrible stock. Don’t do that. And if you decide to do this anyway, don’t complain when you perform poorly.

The success of Keytruda is the tide lifting the entire Merck boat, as the business and stock had a fantastic 2022. By the way, that’s one of the underlying points throughout this whole video. If you want great stocks, you have to invest in great businesses. Stocks are slices of real businesses. If you invest in a terrible business, you’re buying a terrible stock. Don’t do that. And if you decide to do this anyway, don’t complain when you perform poorly.

Merck shares jumped by about 44% in 2022. Market down 20%? No problem. A great business like Merck to the rescue. When you add the dividend, you get to almost 50% on the year. Very impressive. Also impressive is the dividend, which is likely to go down as one of the best in all of Big Pharma, when all is said and done.

Merck has increased its dividend for 12 consecutive years, with a 10-year DGR of 5.1%. The dividend raises have been a bit lumpy, but I see future dividend raises as being larger as a result of Keytruda’s success. The stock also yields 2.5%, which isn’t bad at all in this environment. The payout ratio, which is 48.6%, gives Merck plenty of leeway for future dividend raises.

Merck isn’t a steal anymore. But I don’t see the valuation as egregious. Merck was another one of my top five stock ideas for 2022. That also turned out well. Now, it’s not the no-brainer investment that it was when we made that video, but it’s also not necessarily something that I’d outright avoid in early 2023. The P/E ratio of 19.1 isn’t unreasonable, especially when considering that Keytruda is just getting warmed up.

I was buying Merck when Warren Buffett was selling it, and we put out videos where I openly disagreed with my hero, the Oracle of Omaha, on this one. Also, we highlighted this name as being undervalued as recently as March 2022. That last video showed why the estimate for Merck’s fair value is right about $100/share.

Merck is currently selling for about $115/share. If you need more exposure to Big Pharma in your portfolio, Merck is still worth considering – especially if you’re in it for the next 10+ years. But seeing as how a big discount has, perhaps, turned into a modest premium, a 10% correction from here would make Merck very interesting again.

The fifth dividend growth stock we have to quickly discuss is Exxon Mobil (XOM).

Exxon Mobil is a multinational oil and gas corporation. Not a surprise to see a second oil & gas supermajor on today’s list, alongside Chevron. Oil companies dominated 2022. Exxon Mobil’s Q3 FY 2022 quarterly report – their most recent – showed $112.1 billion in revenue.

Many of the companies in the S&P 500 don’t have annual sales at that level. That same report showed $4.68 in EPS, which beats the earnings per share that Exxon Mobil recorded for the entirety of FY 2019. When the business skyrockets like this, it shouldn’t be a surprise to see its stock skyrocket – particularly when the stock had low expectations baked in from the start.

Many of the companies in the S&P 500 don’t have annual sales at that level. That same report showed $4.68 in EPS, which beats the earnings per share that Exxon Mobil recorded for the entirety of FY 2019. When the business skyrockets like this, it shouldn’t be a surprise to see its stock skyrocket – particularly when the stock had low expectations baked in from the start.

This stock skyrocketed higher by about 74% in 2022. After you factor in the outsized dividend, Exxon Mobil came in with a total return of almost 80% on the year. That’s a jaw-dropping number, and it does make up for quite a few poor years leading up to 2022.

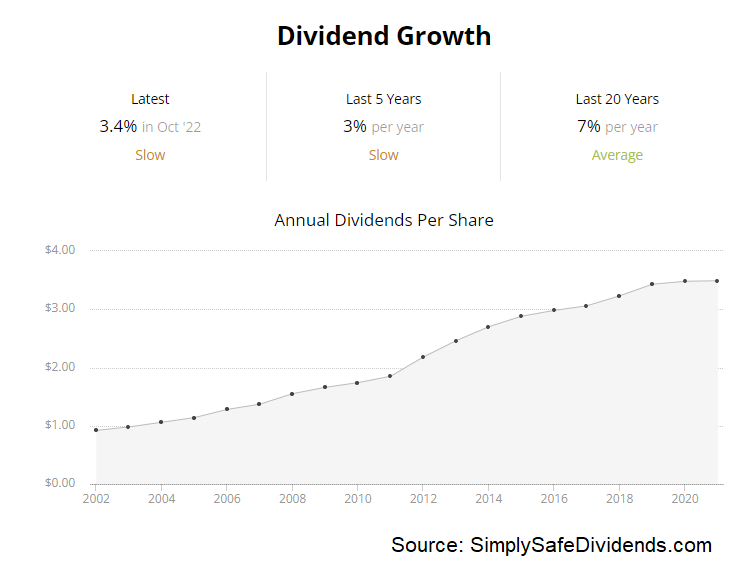

What’s helped longtime shareholders like myself to hold on through those tough years has been Exxon Mobil’s dividend. The stock has typically offered a high yield. And it’s a dividend that shareholders have been able to count on, no matter what happens with the price of oil. Indeed, Exxon Mobil has raised its dividend for 40 consecutive years, easily qualifying it for its esteemed Dividend Aristocrat status.

The 10-year DGR is 5.4%. Not outstanding. But respectable. The 3.4% yield here is also respectable. And the payout ratio is 29.7%, which is about as low as I’ve ever seen it.

The 10-year DGR is 5.4%. Not outstanding. But respectable. The 3.4% yield here is also respectable. And the payout ratio is 29.7%, which is about as low as I’ve ever seen it.

A lot of the recent performance has been the result of a coiled spring viciously uncoiling, but it’s not overdone.

A lot of what I said about Chevron can also be applied here, but Exxon Mobil does look cheaper right across the board. Indeed, this stock, right now, is basically priced the same as it was back in late 2007 – 15 years ago. Exxon Mobil’s business kept plodding along, the stock went nowhere, earnings moved way up recently, and the spring just couldn’t coil any longer.

Pretty much every multiple here is lower than Chevron’s respective comparison, and they all indicate that Exxon Mobil still looks cheap – its P/E ratio is only 8.8, for instance.

However, it really does come down to the longevity and durability of recent results. It is, after all, a cyclical industry. As with Chevron, I do think the paradigm for Exxon Mobil has shifted – in a positive way. And that bodes well. But there’s been some greed around this name, which makes me a bit fearful. The stock is currently priced at about $108. Personally, I become enthusiastic again below $100.

— Jason Fieber

P.S. Would you like to see my entire stock portfolio — the portfolio that’s generating enough safe and growing passive dividend income to fund my financial freedom? Want to get an alert every time I make a new stock purchase or sale? Get EXCLUSIVE access here.

Source: Dividends & Income