The new year is a good time for investors to reevaluate their portfolios to ensure they are on the best path toward financial well-being. A relevant quote worth revisiting is this one from Warren Buffett: “Price is what you pay, value is what you get.” I think it applies perfectly to the state of the stock market right now.

There are plenty of safe stocks that are excellent sources of passive income for 2023. Those like Coca-Cola, PepsiCo, and McDonald’s are likely to do well in a recession because demand for their products isn’t as sensitive to economic cycles. But just because these stocks are safe doesn’t mean they are compelling buys now. All three of those companies trade at a price-to-earnings (P/E) ratio above 25 — representing a premium to the S&P 500.

Meanwhile, Union Pacific (UNP) has equally strong fundamentals as those leading consumer staples companies but at a far less expensive valuation. Here’s why it’s a no-brainer buy for 2023.

The industry-leading railroad

The railroad industry of today is consolidated among a handful of players that each has close to a regional monopoly — giving railroads wide moats even if volumes fall in a recession. Not only is Union Pacific the largest North American railroad by market capitalization, but it is also arguably the best run.

A useful metric for determining the efficiency of a business relevant to its peers is the return on capital employed (ROCE). Union Pacific’s ROCE of 17.8% is near a 10-year high, and it’s the highest of its peer group.

What that metric tells us is that for every $1 of capital that Union Pacific employs, it expects to generate $1.18 in earnings before interest and taxes. Considering Union Pacific invested over $35 billion in improvements over the past decade, the high ROCE shows that those investments are paying off.

What that metric tells us is that for every $1 of capital that Union Pacific employs, it expects to generate $1.18 in earnings before interest and taxes. Considering Union Pacific invested over $35 billion in improvements over the past decade, the high ROCE shows that those investments are paying off.

A growing dividend

Union Pacific has raised its dividend every year for the past 15 years. Its dividend has increased by over 11-fold during that period to its current $1.30 per share per quarter — giving the stock a yield of 2.5%.

What’s particularly impressive about Union Pacific’s dividend is that it is fully supported by free cash flow (FCF). Here’s a look at the last 15 years of the company’s FCF yield and dividend yield.

Just as the dividend yield is simply the dividend per share divided by the stock price, the FCF yield is FCF per share divided by the stock price. The FCF yield tells you what the dividend yield could be if the company distributed all of its FCF to shareholders through the dividend. Despite 15 consecutive years of dividend raises, Union Pacific’s FCF yield has consistently exceeded its dividend yield since 2010, a sign that the company is supporting its dividend growth with FCF growth.

Just as the dividend yield is simply the dividend per share divided by the stock price, the FCF yield is FCF per share divided by the stock price. The FCF yield tells you what the dividend yield could be if the company distributed all of its FCF to shareholders through the dividend. Despite 15 consecutive years of dividend raises, Union Pacific’s FCF yield has consistently exceeded its dividend yield since 2010, a sign that the company is supporting its dividend growth with FCF growth.

A reasonable valuation

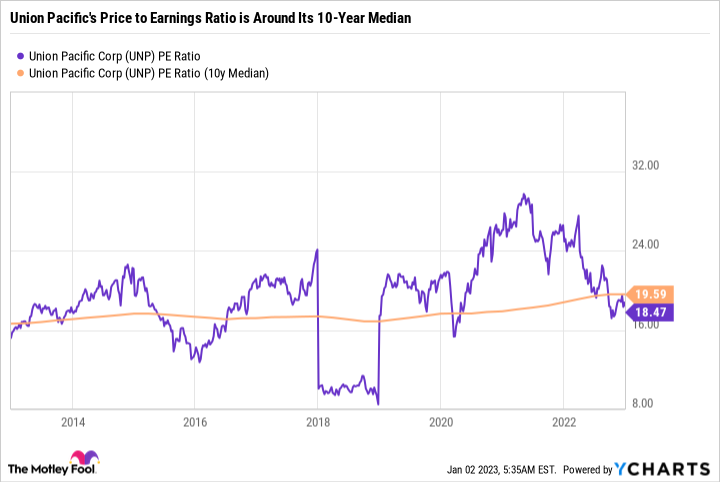

Union Pacific’s P/E ratio sits at 18.5 — which is slightly below its 10-year median of 19.6.

It’s a reasonable price for the railroad stock but not ideal, considering profits could come down in a recession. But given the consolidation of the railroad industry, there’s an argument that railroads are far less cyclical than many other parts of the economy and certainly less cyclical than other types of businesses in the industrial sector. And for that reason, Union Pacific at an 18.5 P/E and a 2.5% dividend yield looks much more attractive than McDonald’s at a 33 P/E and 2.2% dividend yield, Coca-Cola at a 28 P/E and 2.8% dividend yield, or PepsiCo at a 26 P/E and 2.5% dividend yield.

It’s a reasonable price for the railroad stock but not ideal, considering profits could come down in a recession. But given the consolidation of the railroad industry, there’s an argument that railroads are far less cyclical than many other parts of the economy and certainly less cyclical than other types of businesses in the industrial sector. And for that reason, Union Pacific at an 18.5 P/E and a 2.5% dividend yield looks much more attractive than McDonald’s at a 33 P/E and 2.2% dividend yield, Coca-Cola at a 28 P/E and 2.8% dividend yield, or PepsiCo at a 26 P/E and 2.5% dividend yield.

Given the large difference between Union Pacific’s FCF and dividend, I’d expect it to keep raising the dividend and supporting it with FCF even during a multi-year recession.

A glaring red flag

A glaring red flag

The biggest red flag for Union Pacific is its slowing growth. In the 20-year period from 1992 to 2012, revenue and profits grew at a torrid pace. But in the last 10 years, revenue is only up 17%, and the company has had to rely on efficiency improvements to squeeze more profit out of each dollar in sales.

What’s more, the company is only expected to grow earnings per share by 3% in 2023. The slow growth rate isn’t ideal, but Union Pacific’s reasonable valuation, solid dividend yield, and high FCF yield more than make up for it.

The case for Union Pacific as a staple

Union Pacific serves an essential role in the transportation of goods. Without it, the U.S. economy would be disrupted. And for that reason, I think investors can view Union Pacific as a far safer stock than its cyclical reputation. Down 25% from its all-time high set in the spring of 2022, Union Pacific is a well-rounded dividend stock that investors can count on to keep raising its payout for decades to come.

— Daniel Foelber

Where to Invest $99 [sponsor]Motley Fool Stock Advisor's average stock pick is up over 350%*, beating the market by an incredible 4-1 margin. Here’s what you get if you join up with us today: Two new stock recommendations each month. A short list of Best Buys Now. Stocks we feel present the most timely buying opportunity, so you know what to focus on today. There's so much more, including a membership-fee-back guarantee. New members can join today for only $99/year.

Source: The Motley Fool