Invest This Way – Proof That Value Investing Works

Why everyone should invest this way. With this video I have revisited previous videos going back as far as July 2017. The central idea is to illustrate how well valuation and value investing performs in the long run. This is true even when shorter-term performance based on a falling stock price tests the value investors’ mettle. The important point is that if fundamentals are doing well, holding up, and especially if they are growing, then stock price will inevitably follow – in the long run.

Value investing simultaneously reduces risk – long-term risk that is – and enhances total returns – once again long-term total returns. However, because of the fickle and unpredictable nature of short-term stock market action, value investing can appear to be failing but in truth it is performing beautifully. Investor psychology plays a major role.

Value investing simultaneously reduces risk – long-term risk that is – and enhances total returns – once again long-term total returns. However, because of the fickle and unpredictable nature of short-term stock market action, value investing can appear to be failing but in truth it is performing beautifully. Investor psychology plays a major role.

The experienced and accomplished value investor never let stock price movements ruin their confidence. Instead, their confidence is rooted in the realization that fundamentals matter, and that they matter a lot, and they matter much more than capricious short-term price movements. Stock prices lie whereas fundamentals speak the truth.

— Chuck Carnevale

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

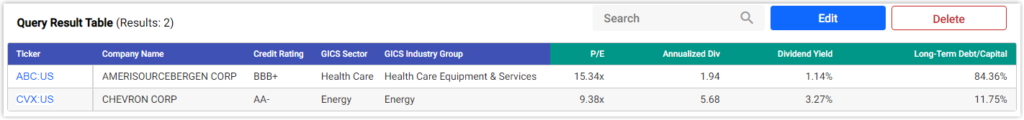

Source: FAST Graphs