Last week in these pages we sang the praises of bond god Jeffrey Gundlach. His DoubleLine Income Solutions Fund (DSL) looked poised to pop:

DSL investors have three ways to win here. First, the fund pays an electric 11.5% yield. Next, its NAV is likely to rise as both short and long rates decline. And finally, the fund trades today at a 4% discount, which means we are getting paid to ride shotgun with Gundlach.

DSL: 3 Ways to Win (Last Week’s View)

We also discussed that DSL dishes its dividend monthly. Which is almost 1% every 30 days! Unheard of.

We also discussed that DSL dishes its dividend monthly. Which is almost 1% every 30 days! Unheard of.

Well, this good story got even better. DSL just announced a special dividend of $0.196, payable at the end of this month. (The fund has dished out an extra dividend every December since 2019. What a fantastic holiday tradition.)

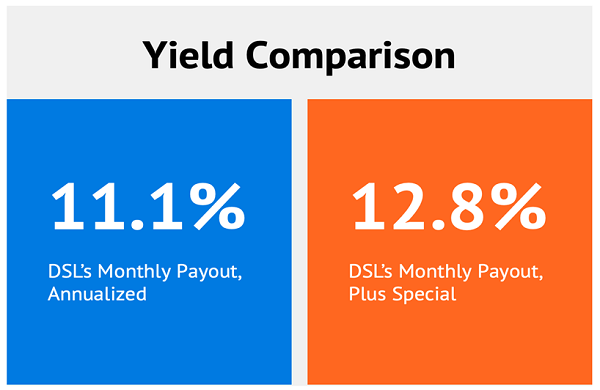

DSL’s yield “shrank” from 11.5% last week to 11.1% this week because income seekers snapped up a good dividend deal and boosted the share price. But apparently Gundlach won’t stand for a “mere” 11.1% yield!

DSL’s yield “shrank” from 11.5% last week to 11.1% this week because income seekers snapped up a good dividend deal and boosted the share price. But apparently Gundlach won’t stand for a “mere” 11.1% yield!

So he added a December special to our holiday stocking.

The fund is now on track to pay $1.516 in dividends in 2022. DSL trades a shade under $12 as I write. Which means its trailing yield is actually 12.8%.

Don’t be fooled by that 11.1% headline! It actually understates the payout.

When we reach rarified dividend air like this, are we nitpicking between 11.1% and 12.8%? No! It is the difference between $111,000 per year in dividend income and $128,000 for a million-dollar portfolio. I know inflation has been running hot, but these income streams are still legit.

When we reach rarified dividend air like this, are we nitpicking between 11.1% and 12.8%? No! It is the difference between $111,000 per year in dividend income and $128,000 for a million-dollar portfolio. I know inflation has been running hot, but these income streams are still legit.

(We needn’t worry too much about the semantics between “SEC yield” and “TTM yield” for a payer this generous.)

For those of you who have been wondering whether or not DSL’s dividend is safe, this answers the question: Yes.

If the monthly dividend weren’t safe, we wouldn’t see an extra payout. Management would simply stash the cash for next month.

Now sure, from a total return standpoint, DSL had a terrible 2022. Most bond funds have. We can blame the Federal Reserve but really it was the rise in long-term interest rates that weighed on bond prices. As they increase, income investors discard today’s fixed-rate coupons hoping for a better deal tomorrow.

Well, tomorrow is here. Bond bear markets eventually solve themselves by attracting buyers to the higher rates. (Hence the saying there are no bad bonds, only bad prices.)

And we contrarians don’t invest based on what we see in the rearview mirror. We consider the front window that is 2023. (I’m looking at you, Mr. Narwhal and Ms. Pterodactyl!)

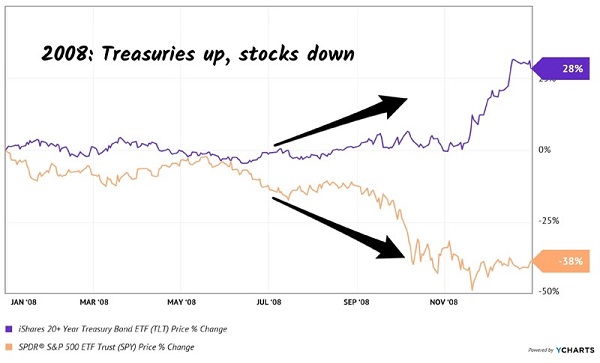

If there is indeed a recession on the way in 2023, then long-term rates are likely to stay under control. When the economy falters, bonds with long durations (time to maturity) are the place to be.

If there is indeed a recession on the way in 2023, then long-term rates are likely to stay under control. When the economy falters, bonds with long durations (time to maturity) are the place to be.

Consider the case of 2008. The S&P 500 sank 38% but long-dated US Treasuries rallied sharply. The iShares 20+ Year Treasury Bond ETF (TLT) delivered a 28% gain in calendar ’08.

In 2008, T-Bonds Did Great

(TLT, by the way, is up a tremendous 12% since we pounded the table on it in these pages just four weeks ago. That’s a 169% annualized gain. Merry Christmas, my fellow contrarians!)

(TLT, by the way, is up a tremendous 12% since we pounded the table on it in these pages just four weeks ago. That’s a 169% annualized gain. Merry Christmas, my fellow contrarians!)

DSL wasn’t “invented yet” back in 2008. But the fund, like TLT, should do well when long-term rates calm down.

High-quality bond funds like DSL and TLT see their prices gain when rates decline. It’s the opposite of what we saw this year. Which is why we’re focused on the front window.

And there’s more than price gains—like monthly dividends! Life for us income investors is pretty darn good when we are paid every month, banking 11.1% to 12.8% yields plus upside!

The income alternative for everyone else? Sweating out stocks that pay lame quarterly dividends. With a roll of the dice every three months for an earnings report. During a time in which we have serious economic headwinds.

No thanks, stock jocks. Give us the easy bond money.

Oh, and we’ll take an extra dividend payment for a baker’s dozen. Thank you very much, monthly paying bond god. We look forward to a prosperous 2023 together.

— Brett Owens

Sponsored Link: Most investors with $500,000 in their portfolios think they don’t have enough money to retire on.

They do. They just need to do two things with their “buy and hope” portfolios to turn them into $3,300+ monthly income streams:

- Sell everything. Including the 2%, 3% and even 4% payers that simply don’t yield enough to matter. And,

- Buy my favorite monthly dividend payers.

The result? More than $3,300 in monthly income (from an average annual yield just over 8%, paid about every 30 days). With upside on your initial $500,000 to boot!

Right now, three monthly payers are flashing BUY signals. And I’m talking annual yields above 12%. I’ve put all of my research into an exclusive monthly dividend report—please click here to read it now.

Source: Contrarian Outlook