One of my favorite Warren Buffett quotes goes like this:

“Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

It comes down to price versus value. Price is what you pay, but value is what you get.

Prices of stocks move up and down every day. But the actual value of businesses? Not so much.

Outside of some major event, a business isn’t going to suddenly be worth a lot more or a lot less on Tuesday than it was on Monday. And so if the price of equity in a great business drops significantly, even while the value of that equity hasn’t dropped significantly, that could be a fantastic opportunity to jump in for the long term.

This is especially true when dealing with dividend growth stocks. Why?

Because, all else equal, price and yield are inversely correlated. When the price drops, the yield rises. And this gets you that much closer to living off of the dividends your investments provide for you.

Plus, you’re usually looking at better long-term total return when starting from a lower valuation.

It’s more for less.

Today, I want to tell you about five dividend growth stocks that are down 20% or more from their recent highs. Ready? Let’s dig in.

The first dividend growth stock I want to highlight is A. O. Smith Corp.(AOS).

A.O. Smith is a water heating and water treatment company with a market cap of $9 billion. I’m a big fan of anything having to do with water moving forward. I think water will be the “liquid gold” of this century, much like how oil was the “liquid gold” of the last century.

Companies that touch water in some way should do really, really well. And that’s kind of an easy bet to make, since these companies have already been doing really, really well for years now. That’s certainly been true for A. O. Smith, which has been increasing its revenue, profit, and dividend for a very long time.

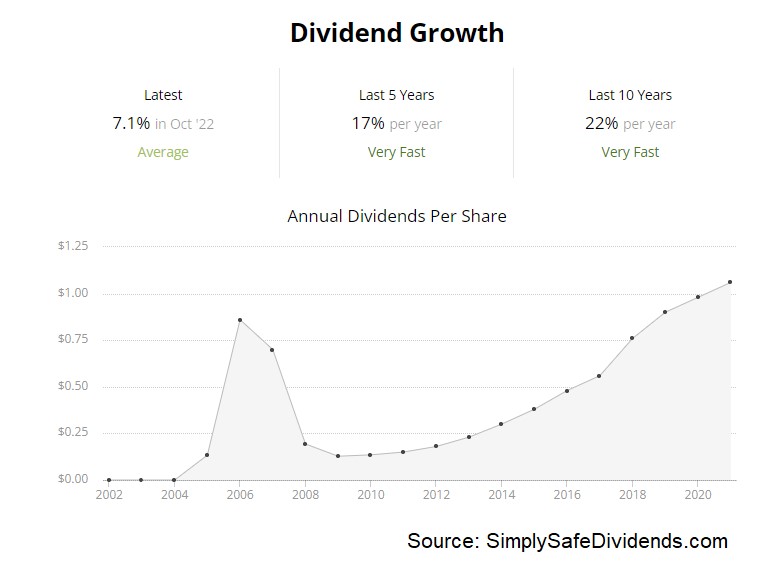

The company has increased its dividend for 29 consecutive years. This is an esteemed Dividend Aristocrat, which is a status reserved for stocks with at least 25 consecutive years of dividend increases. These are the crème de la crème of dividend growth stocks, showing a rare level of consistency over the course of decades.

The company’s 10-year DGR is an astounding 20.8%, although more recent dividend increases have been in the high-single-digit range. In fact, A. O. Smith just increased its dividend by 7.1% only weeks ago, which we went over in another video. The stock now yields 2.1%, which easily beats the broader market. And a payout ratio of 38.7%, based on midpoint adjusted EPS guidance for this fiscal year, shows us a well-covered dividend poised for much more growth ahead.

The company’s 10-year DGR is an astounding 20.8%, although more recent dividend increases have been in the high-single-digit range. In fact, A. O. Smith just increased its dividend by 7.1% only weeks ago, which we went over in another video. The stock now yields 2.1%, which easily beats the broader market. And a payout ratio of 38.7%, based on midpoint adjusted EPS guidance for this fiscal year, shows us a well-covered dividend poised for much more growth ahead.

This stock has nosedived, now down 35% from its 52-week high. It’s highly unusual to see a Dividend Aristocrat perform in this way. But we’re in a highly unusual period for the world and the market. It’s a bummer for those that bought the stock at its 52-week high of $86.74. But down here, around the $56/share area? I think this business is extremely undervalued.

Based on that guidance, the forward P/E ratio is 18.1. The stock’s five-year average P/E ratio is 24.9. You could almost drive a truck through that gap. We can see a similar disconnect in the P/S ratio. At 2.3, it’s way off of its own five-year average of 3.

I’m surprised to see this Dividend Aristocrat down here. It just doesn’t make sense to me. But that’s a bear market for you. I don’t have to make sense of it. I just have to take advantage. You should consider doing the same.

The second dividend growth stock I have to tell you about is Black Hills Corp. (BKH).

Black Hills is an electric and gas utility based out of South Dakota with a market cap of $4 billion. There’s money in these hills, guys.

Black Hills might fly under the radar, but it’s been a steady performer for decades upon decades. And why wouldn’t it be? It’s providing a necessary service to captive customers. We literally can’t live without electric and gas in a modern-day society.

Just look at what’s happening over in Europe when you question this basic fact. While regulators do cap the kind of profit a company like Black Hills can make, and rightly so, that hasn’t prevented Black Hills from putting up an extremely impressive resume when it comes to revenue, profit, and dividend growth.

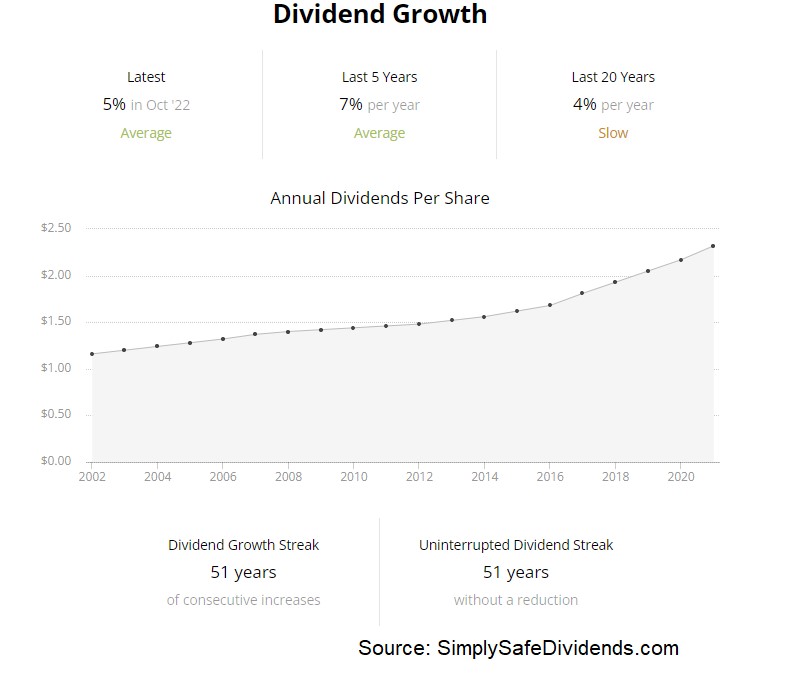

The utility has increased its dividend for 52 consecutive years. How about that? There aren’t many companies out there that have been able to muster 50+ straight years of dividend increases. Not even in the utility space.

That’s what makes Black Hills such a great idea for long-term dividend growth investors. The 10-year DGR of 4.9% won’t knock your socks off. But it’s really more about consistency… and income.

That’s what makes Black Hills such a great idea for long-term dividend growth investors. The 10-year DGR of 4.9% won’t knock your socks off. But it’s really more about consistency… and income.

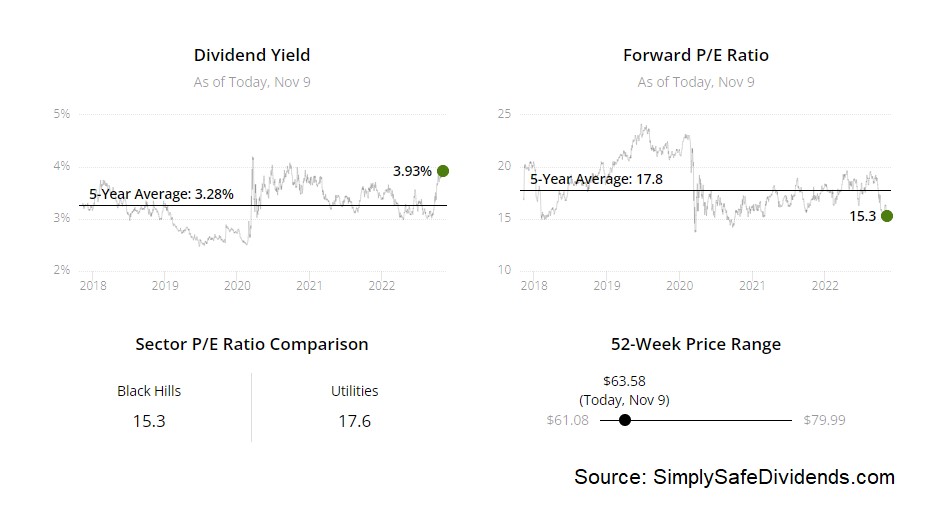

Regarding that latter point, the stock does yield a rather juicy 3.9%. That yield doesn’t just blow away what the broader market offers but it’s also 70 basis points higher than its own five-year average. So this higher-than-usual level of consistency also now comes with a higher-than-usual level of income. Good stuff.

The payout ratio is 61.7%, which is very reasonable. And that’s probably why Black Hills decided to increase its dividend, yet again, by 5% only weeks ago… marking their 52nd consecutive year of doing so.

This stock is down 20% from its recent high, and it now looks much more reasonable. At the 52-week high of $80.95, the stock looked overpriced to me. Just not a good value up there.

But, like Buffett, I like quality merchandise when it’s been marked down. And this name has been marked down, now around $65/share. After the markdown, the valuation has become reasonable once again. The P/E ratio of 16.3 is undemanding.

For perspective, the stock’s own five-year average P/E ratio is 17.7. So we’ve gone from above average to below average with the earnings multiple here. And that’s how the market works. The sentiment pendulum can swing too far in either direction.

I think the pendulum swung too far in the direction of optimism before, but it’s now swinging in the direction of pessimism. If you’re looking for one of the most consistent dividend growers in the world, and you want it marked down, Black Hills ought to be on your mind.

I think the pendulum swung too far in the direction of optimism before, but it’s now swinging in the direction of pessimism. If you’re looking for one of the most consistent dividend growers in the world, and you want it marked down, Black Hills ought to be on your mind.

The third dividend growth stock we need to cover today is LyondellBasell Industries (LYB).

LyondellBasell is a multinational chemical company with a market cap of $27 billion. Another under-the-radar name that doesn’t get a lot of press. No matter.

LyondellBasell continues to provide the various chemical products that go into the manufacturing of all kinds of everyday products – think packaging, pipes, fluids, adhesives, cosmetics, etc. Many of the products we all use, and can’t imagine living without, can be traced back to LyondellBasell, which is what bodes well for their revenue, profit, and dividend growth.

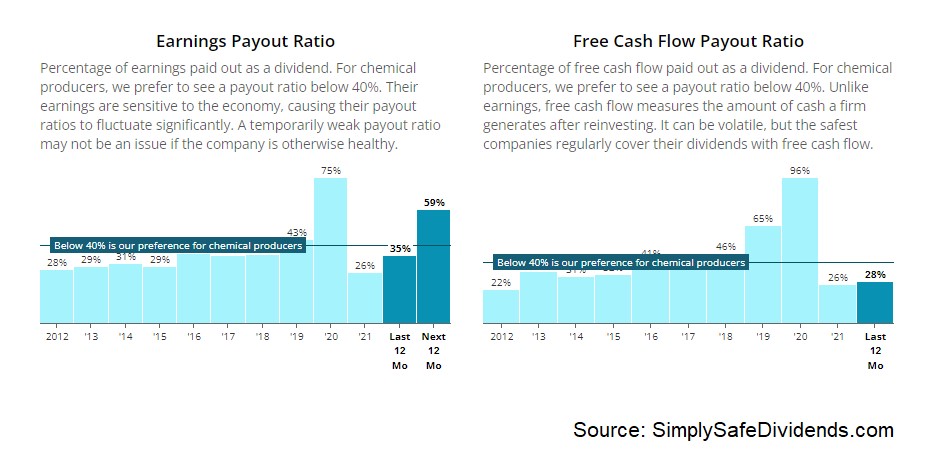

The company has increased its dividend for 11 consecutive years. The 10-year DGR of 13.6% is really strong, but more recent dividend increases have been in the mid-single-digit range. And I think that’s what you’re gonna get out of the company moving forward.

However, where the stock really shines is on the income front: The 5.7% yield is extremely high, and it’s actually higher than where a lot of utilities and REITs – your usual high-yield suspects – are at. So that’s notable. And the payout ratio of just 32.2%, based on TTM adjusted EPS, indicates no issues with the safety of the dividend.

This stock’s 29% drop from its recent high has provided a nice entry point, in my view. When the stock was at its 52-week high of $117.22, it might have been getting ahead of itself. But now, at about $84/share, the business looks attractively valued to me.

This stock’s 29% drop from its recent high has provided a nice entry point, in my view. When the stock was at its 52-week high of $117.22, it might have been getting ahead of itself. But now, at about $84/share, the business looks attractively valued to me.

Every single basic valuation metric I look at is lower than its respective recent historical average. The P/E ratio of 6.5 is noticeably lower than its own five-year average of 9.6. The P/S ratio is showing something similar – at 0.5, it’s nearly half of its own five-year average of 0.9.

Now, this is a stock that usually gets undemanding multiples. It’s a cyclical chemical company. So that’s fair. But it seems to be especially undemanding right now. Take a look at this one.

The fourth dividend growth stock we have to cover today is Norfolk Southern Corp. (NSC).

Norfolk Southern is a major US freight railroad with a market cap of $55 billion. When I would pretend to be an investor and play the board game Monopoly as a kid, I loved the railroads. As a real adult investor, I still love the railroads. Might love them even more, actually.

After all, we’re talking about an entrenched oligopoly with, arguably, the highest barriers to entry in all of business. The railroads that exist now in the US are almost certainly going to be the only railroads to ever exist. It would be nearly impossible to build a new railroad nowadays.

Add in a number of other durable competitive advantages, like cost superiority, and you have a clear path to growth across the revenue, profit, and dividend.

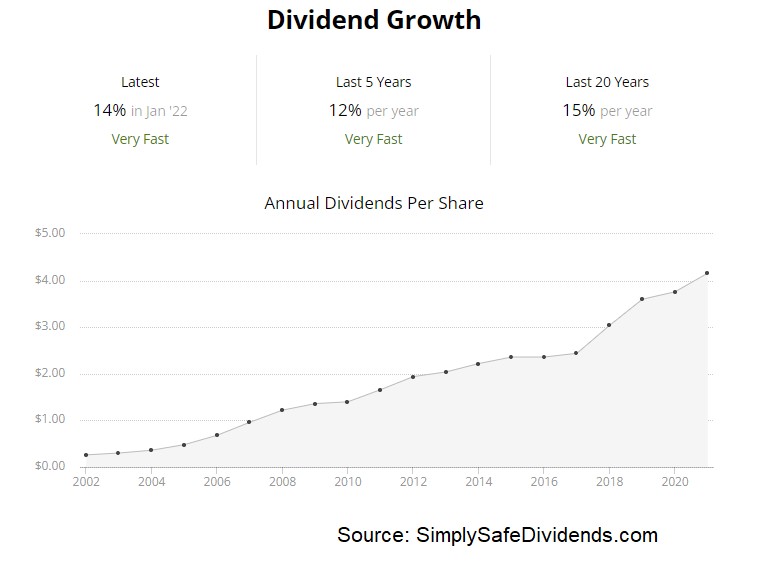

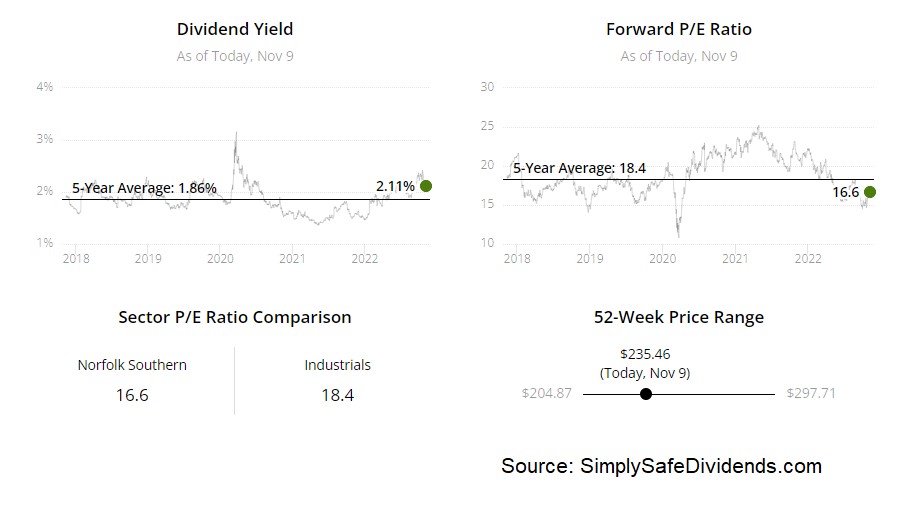

The railroad has increased its dividend for six consecutive years. And I believe they’re really just getting started with this. The five-year DGR is 14.7%. And, amazingly, there’s actually been a recent acceleration in dividend growth off of that already-high rate.

Plus, you get a market-beating 2.1% yield here. So you get a yield that beats the market, and you get dividend growth that easily beats inflation – even in this inflationary environment. And with the payout ratio sitting at 36.5%, the dividend is in a position to head a lot higher.

Plus, you get a market-beating 2.1% yield here. So you get a yield that beats the market, and you get dividend growth that easily beats inflation – even in this inflationary environment. And with the payout ratio sitting at 36.5%, the dividend is in a position to head a lot higher.

This stock’s 21% drop could be offering a rare chance to buy into a great railroad. Railroads are almost never marked down. But every once in a while, you get a sale. And when a sale comes, you have to be willing to jump on the train before it leaves the station again.

This stock’s fall from its 52-week high of $299.20 to the current level of about $236 looks like one of those rare windows of opportunity. I see the P/E ratio of 17.3 as being very acceptable for a business like this. Its five-year average P/E ratio, for context, is 19.5.

You know, I don’t find that to be super demanding for a premier asset. But I’d much rather pay 17.3 times earnings than 19.5 times earnings. By the way, any onshoring of industry back to the USA would likely benefit a major railroad like Norfolk Southern. Consider jumping aboard this one here.

You know, I don’t find that to be super demanding for a premier asset. But I’d much rather pay 17.3 times earnings than 19.5 times earnings. By the way, any onshoring of industry back to the USA would likely benefit a major railroad like Norfolk Southern. Consider jumping aboard this one here.

The fifth dividend growth stock we have to talk about today is Williams-Sonoma, Inc. (WSM).

Williams-Sonoma is a multi-channel home products and furnishings retailer with a market cap of $8 billion. With its $8 billion market cap, this is a pretty small retailer. But don’t underestimate Williams-Sonoma. This company has taken on its niche head-on and dominated it.

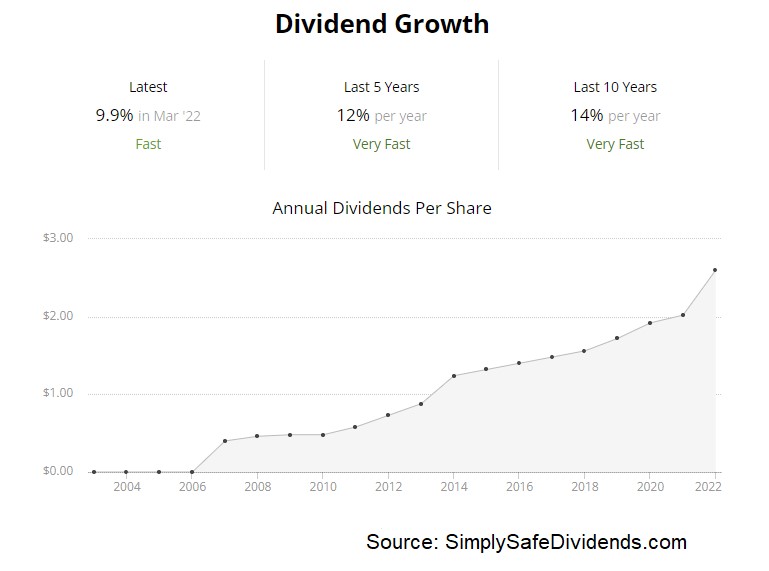

How? By meeting the customer where the customer is. Whereas some legacy retailers have missed the boat on e-commerce, Williams-Sonoma led the charge. More than half of their sales come from their e-commerce business. And this has been true for years and years. What’s also been true for years? That this company has been providing outsized revenue, profit, and dividend growth.

The retailer has increased its dividend for 16 consecutive years. There’s almost nothing to dislike with the dividend. The 10-year DGR is 13.6%. Great. The yield is 2.5%. Very nice. And the payout ratio is a low, low 19.5%.

What I see here is a market-beating dividend likely to continue growing at a double-digit rate for the foreseeable future. I’m not sure what you could possibly complain about.

What I see here is a market-beating dividend likely to continue growing at a double-digit rate for the foreseeable future. I’m not sure what you could possibly complain about.

This stock has fallen a stunning 45% from its 52-week high, and I think this is way overdone. It’s pretty rare for a high-quality dividend growth stock to fall this much. You tend to see this kind of action in speculative areas of the market, like the no-profit, all-hype tech.

You know, your “innovation” stuff. So what happened here? Well, Williams-Sonoma saw its stock get bid up way too high – all the way to its 52-week high of $223.32. And it was just irrational exuberance on the back of the work-from-home trend.

But irrational exuberance has turned into irrational apathy, with the stock now trading hands at the $124 level. We recently put together a full analysis and valuation video on this high-quality niche retailer, estimating fair value for the business at just under $178/share. Don’t be guilty of underestimating Williams-Sonoma, like so many others.

— Jason Fieber

Source: Dividends & Income