S&P 500 Introduction

2022 has been a bad year price-wise for the stock market as measured by the S&P 500. However, I contend that is not enough to simply know that the market is down, it is even more important to know why. Nevertheless, as you read this my guess would be that several thoughts automatically come to mind.

Examples might be, the market is down because inflation is rampant, the market is down because the Fed is raising interest rates, the market is down because of the huge issuance of stimulus checks, the market is down because of supply chain disruptions and on and on.

Now, I would agree that all those things mentioned above are known causes of negative stock market behavior. However, I would further stipulate that the biggest reason for such a large drop in prices is overvaluation. But overvaluation is rarely thought of or even mentioned by the pundits and financial media.

When stock price movements are strong, as they have been essentially since March 2009, investors see this bullish behavior as a good thing.

However, as a card-carrying value investor I tend to see things differently. Like everyone else, I was generally sanguine regarding market action from March 2009 through December 2012. Although the market was rising, valuation was within sound and prudent levels.

Then, stock prices continued to rise to levels that I as a value investor considered dangerously high. Therefore, while most investors basked in the glory of high stock prices, I began suffering the risk of the excess I was seeing. Consequently, as is often the plight of the value investor, I became agitated and concerned while the rest of the investment world danced with glee.

Then, stock prices continued to rise to levels that I as a value investor considered dangerously high. Therefore, while most investors basked in the glory of high stock prices, I began suffering the risk of the excess I was seeing. Consequently, as is often the plight of the value investor, I became agitated and concerned while the rest of the investment world danced with glee.

As a true value investor, I was despondent because I find it impossible to find good companies at good value. Perhaps worse yet, my favorite companies were trading at such high levels that I considered them unsuitable. Meanwhile, the rest of the investment world were, in my opinion, behaving as proverbial “geniuses in a bull market.” Instead of seeing great risk as I was saying, they only saw a great fortune.

In 2022, although the tables have turned from reckless optimism to panic and fear, the realities of fair value remain ignored. All the reasons cited in my first paragraph literally ignore the most relevant reason of all.

Since 2013 the S&P 500 was priced for perfection, and common sense would dictate that perfection is rarely possible. Therefore, as these catalysts (excuses) began to manifest, the market once dangerously overvalued began moving towards true worth values. As a value investor, I see this as a great opportunity unfolding, but once again, I find myself against the crowd. The crowd in contrast sees only bad things happening and consequently cannot see the incredible long-term opportunity unfolding before their very eyes.

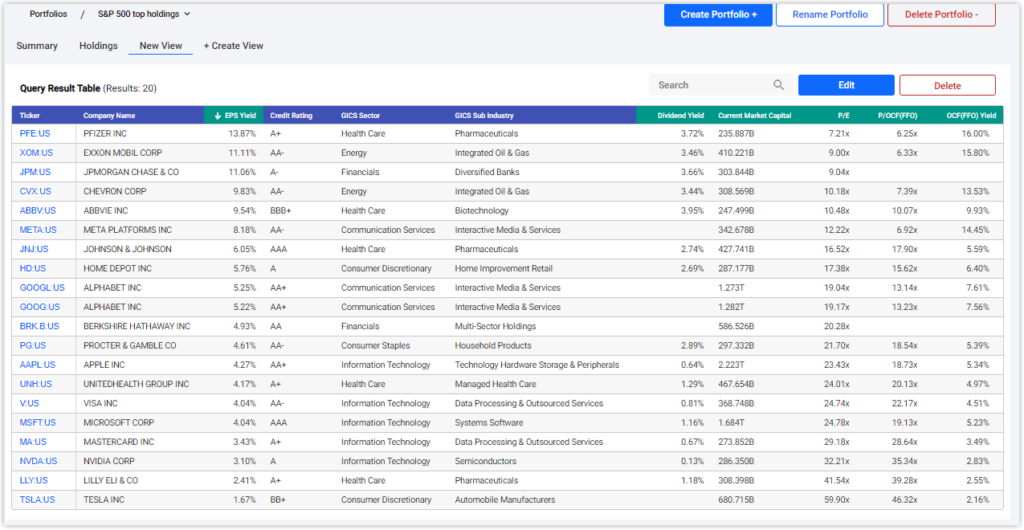

In this video I will review the top 20 holdings of the S&P 500 by dollar weight. Interestingly, these top 20 stocks also represent 20 of my most favored and admired companies on the planet. Unfortunately, based on excessive valuation I found it impossible to invest in any of these blue chips since 2013 until now. With that said, it is still a market of stocks and not a stock market.

Consequently, many of these top 20 are currently in what I consider prudent buying range – or at least close to it. Therefore, the tables are turning. Where once I find nothing to invest in, I am beginning to now see opportunity almost everywhere I look. It is true that they do not ring a bell at the top, or in this case at the bottom of the market.

However, since investing is never a game of perfect, I only take pleasure in the good values I am starting to see. Remember, sometimes the bulls win, and sometimes the bears win, but the pigs get slaughtered. Which is why I once posited that “the problem with running with the herd is that your ultimate destination is the slaughterhouse.”

In this video I will use FAST Graphs and review SPDR S&P 500 ETF Trust (SPY),Apple (AAPL), Abbvie (ABBV), Berkshire Hathaway (BRK.B), Chevron Corp (CVX), Alphabet Inc (GOOG) (GOOGL), Home Depot Inc (HD), JP Morgan Chase (JPM), Eli Lilly & Co (LLY), Mastercard Inc (MA), Meta Platforms (META), Microsoft (MSFT), Nvidia Corp (NVDA), Pfizer (PFE), Procter & Gamble (PG), Tesla (TSLA), UnitedHealth Group (UNH), Visa (V), Exxon Mobil (XOM)

FAST Graphs Analyze Out Loud

— Chuck Carnevale

Karim Rahemtulla, the trader behind a 400% gain in 24-months on Rolls-Royce, has uncovered another potential multi-bagger. This under-$20 stock gives you exposure to over 1-oz of gold with the lowest production costs in the industry. And an upcoming announcement could send this stock soaring. Get Karim's urgent briefing - click here now.

Source: FAST Graphs