Net lease REITs own stand-alone properties leased to tenants on long-term, triple net leases—meaning the tenant pays all the expenses for the property, including taxes, insurance, and maintenance, and the property owner does not have to deal with the rising costs associated with these expenses.

Typically, net lease contracts are long-term, with built-in rent escalators. Net lease REITs own properties with a wide range of uses, including grocery stores, drug stores, convenience stores, restaurants, fitness centers, and retailers such as home improvement centers and auto parts stores.

These REITs have become very popular with conservative investors. The popularity of these stocks tends to have them priced for low yields; however, the current market downturn provides a rare opportunity to buy into high-quality net-lease REITs at attractive starting yields.

Net lease REITs have stable, predictable revenues and are known for paying steadily growing dividends to investors. Broadly diversified property portfolios, plus the net lease contracts themselves, make this group of REITs a stock sector you can count on for the long term. Conservative investors know the benefits of these stocks, so they are usually priced to pay just-okay yields, often less than 4%. But now, with the bear market bringing down all stock prices, you can pick up shares of these companies with significantly higher starting yields.

Here are three net lease REITs to consider.

Realty Income Corporation (O) is the largest net lease REIT, with a $37 billion market cap. The company, which bills itself as The Monthly Dividend Company®, owns 11,400 properties with over 1,100 different clients. Companies in 72 various industries use Realty Income’s properties.

The company pays its investors monthly dividends, and the dividend has grown every quarter for 25 years. Dividend growth averaged 5.6% per year over the last decade. Historically, the shares carried an average yield of around 4%. Anytime the yield for O gets to 5%, it is a buying opportunity—and as of this writing, the shares yield 5.0%.

The second-largest net lease REIT, W.P. Carey, Inc. (WPC), has a market value of $14.4 billion. WPC owns 1,390 properties leased to 386 tenants. This REIT differentiates itself from others in the sector, with 33% of its properties in Europe and 50% of its square footage in industrial and warehouse properties.

W.P Carey converted to REIT status in September 2012, and its dividend has increased every quarter since the conversion. In recent years, annual dividend growth has been modest, at one to two percent per year. The shares currently yield 5.8%, compared to less than 5% a couple of months ago.

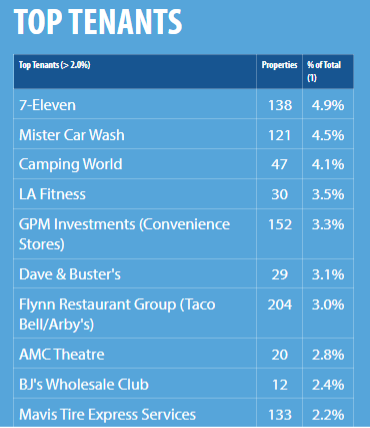

With a $7.2 billion market cap, National Retail Properties (NNN) is currently the fourth-largest net lease REIT. (After a recent buyout offer, the third-largest, STORE Capital Corp (STOR), will be going private soon.) National Retail owns 3,305 properties, with more 380 tenants. The below top-ten tenants table illustrates the diversified nature of the net lease REIT’s portfolio.

The National Retail Properties dividend has grown for 33 consecutive years, with a long-term annual growth rate of about 4%. (The company increases its quarterly dividend once a year, with its August payout.) The NNN yield has increased by 0.8% over the last month to a current 5.3%.

The National Retail Properties dividend has grown for 33 consecutive years, with a long-term annual growth rate of about 4%. (The company increases its quarterly dividend once a year, with its August payout.) The NNN yield has increased by 0.8% over the last month to a current 5.3%.

The combination of attractive yields, plus dividend growth, will generate low teens compounding annual total returns over the long term for all of the REITs above. You can count on these stocks through economic and stock market disruptions.

— Tim Plaehn

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley