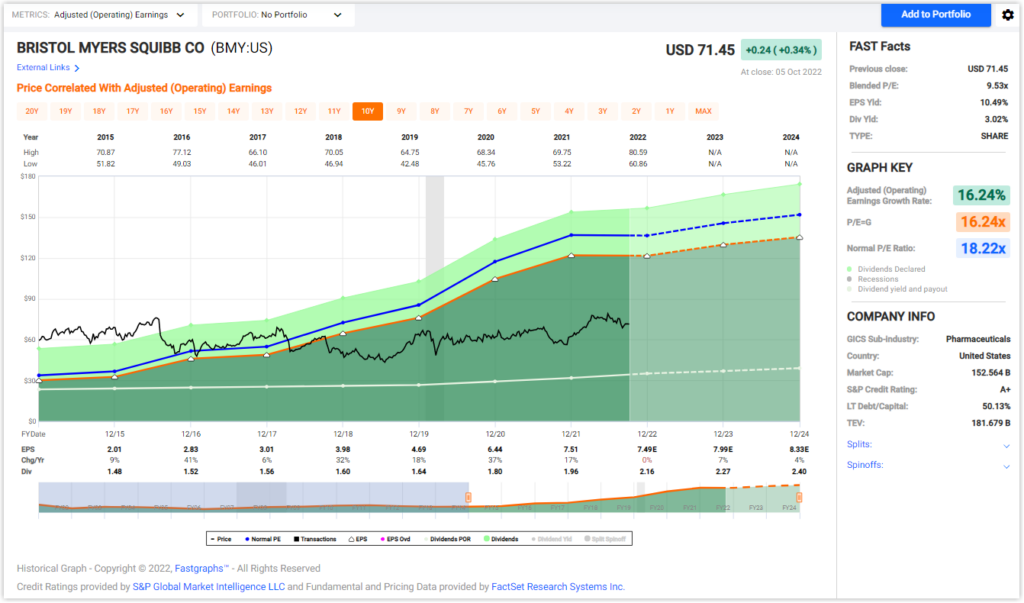

A+ rated Bristol Myers Squibb (BMY) is a blue-chip dividend growth stock offering a 3% and growing current yield. Historically, this stalwart pharmaceutical giant has commanded a premium valuation multiple by Mr. Market.

However, since November 2018 Bristol Myers has been selling at a discount to not only its historical norms but historical market norms as well. Despite this low valuation, the company has outperformed the S&P 500 on both dividend income and capital appreciation.

Furthermore, this low valuation also supports an opportunity for outsized future gains at below-average levels of risk. In addition to the company’s extremely high quality, the significant undervaluation provides a margin of safety as an additional layer of risk mitigation.

In this video, I will be running Bristol Myers Squibb by the numbers via the FAST Graphs fundamentals analyzer software tool. In addition to providing a fundamental analysis of the company, I will simultaneously be illustrating the power of the FAST Graphs research tool as well as how to use it to your maximum benefit.

In this video, I will be running Bristol Myers Squibb by the numbers via the FAST Graphs fundamentals analyzer software tool. In addition to providing a fundamental analysis of the company, I will simultaneously be illustrating the power of the FAST Graphs research tool as well as how to use it to your maximum benefit.

FAST Graphs Analyze Out Loud Video

— Chuck Carnevale

Karim Rahemtulla, the trader behind a 400% gain in 24-months on Rolls-Royce, has uncovered another potential multi-bagger. This under-$20 stock gives you exposure to over 1-oz of gold with the lowest production costs in the industry. And an upcoming announcement could send this stock soaring. Get Karim's urgent briefing - click here now.

Source: FAST Graphs