Today we’ll show you how to make outsized income from Eastman Chemical (EMN) — a high-quality dividend growth stock we just picked up for our Income Builder Portfolio.

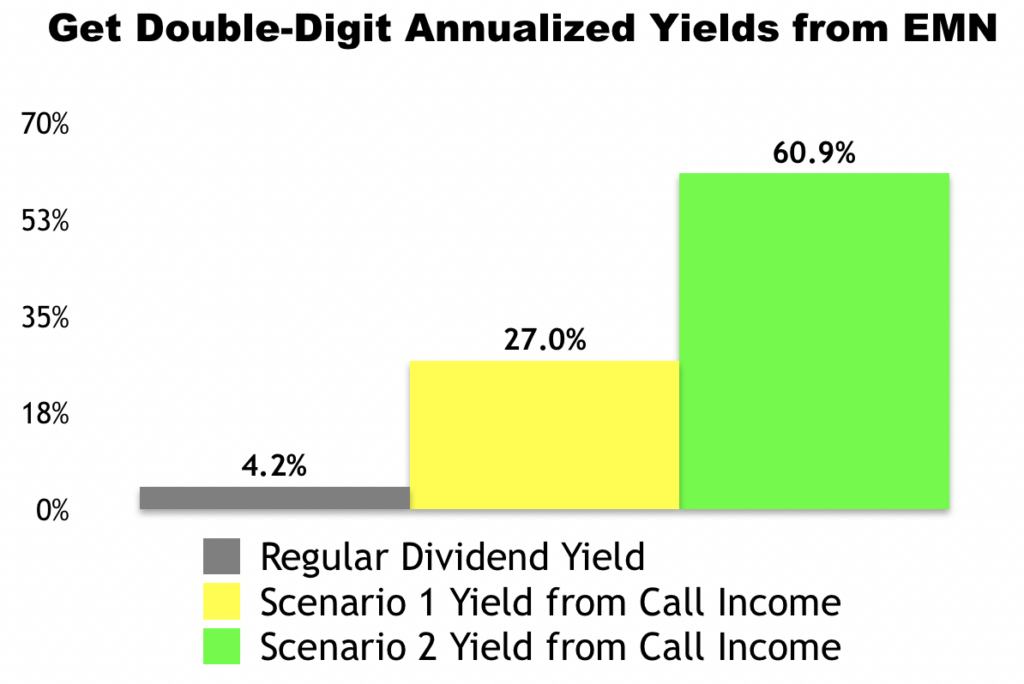

Shares of EMN already yield an attractive 4.2% right now, but by selling a covered call option we can create even higher income instantly — generating a quick $270-$609 (an annualized yield of 27% to 60.9%) in the process.

Here’s how…

As we go to press, EMN is selling for $71.61 per share and the November 18 $75 calls are going for about $2.70 per share.

Our income trade would involve buying 100 shares of EMN and simultaneously selling one of those calls.

By selling a call option, we would be giving the buyer of the option the right, but not the obligation, to purchase our 100 shares at $75 per share (the “strike” price) anytime before November 18 (the contract “expiration” date).

In exchange for that opportunity, the buyer of the option would be paying us $2.70 per share (the “premium”).

There are two likely ways this trade would work out, and they both offer significantly higher income than what we’d collect if we relied on the stock’s dividends alone.

To be conservative, we don’t include any dividends in our calculations for either of the following scenarios. The annualized yields are generated from options premium and applicable capital gains alone. So any dividends collected are just “bonus” that will boost our overall annualized yields even further.

Let’s take a closer look at each scenario…

Scenario #1: EMN stays under $75 by November 18

If EMN stays under $75 by November 18, our option contract would expire and we’d get to keep our 100 shares.

In the process, we’d receive $270 in premium ($2.70 x 100 shares).

That income would be collected instantly, when the trade opens.

Excluding any commissions, if “Scenario 1” plays out, we’d receive a 3.8% return in the form of income for selling the covered call ($2.70 / $71.61). Since we’d be in the trade for 51 days, this scenario would work out to a 27% annualized yield.

Scenario #2: EMN climbs over $75 by November 18

If EMN climbs over $75 by November 18, our 100 shares would get sold (“called away”) at $75 per share.

In “Scenario 2” — like “Scenario 1” — we’d collect an instant $270 in premium ($2.70 x 100 shares) when the trade opens. We’d also generate $339 in capital gains when the trade closes because we’d be buying 100 shares at $71.61 and selling them at $75.

In this scenario, excluding any commissions, we’d be looking at a $609 profit.

From a percentage standpoint, this scenario would deliver an instant 3.8% in income for selling the covered call ($2.70 / $71.61) and a 4.7% return from capital gains ($3.39 / $71.61).

At the end of the day, we’d be looking at a 60.9% annualized yield from EMN.

Here’s how we’d make the trade…

We’d place a “Buy-Write” options order with a Net Debit price of as close to $68.91 ($71.61 – $2.70) as we can get — the lower the better. Options contracts work in 100-share blocks, so we’d have to buy at least 100 shares of Eastman Chemical (EMN) for this trade. For every 100 shares we’d buy, we’d “Sell to Open” one options contract using a limit order. Accounting for the $270 in premium we’d collect, that would require a minimum investment of $6,891.

Hope this helps!

Phil Lamanna and Greg Patrick

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

P.S.. We’d only make this trade if: 1) we wanted to own the underlying stock anyways 2) we believed it was trading at a reasonable price 3) we were comfortable owning it for the long-haul in case the price drops significantly below our cost basis by expiration and 4) we were comfortable letting it go if shares get called away. To be mindful of position sizing, except in rare cases, the value of this trade wouldn’t exceed 5% of our total portfolio value. In addition, to minimize taxes and tax paperwork, we would most likely make this trade in a retirement account, such as an IRA or 401(k).

Please note: We’re not registered financial advisors and these aren’t specific recommendations for you as an individual. Each of our readers have different financial situations, risk tolerance, goals, time frames, etc. You should also be aware that some of the trade details (specifically stock prices and options premiums) are certain to change from the time we do our research, to the time we publish our article, to the time you’re alerted about it. So please don’t attempt to make this trade yourself without first doing your own due diligence and research.

Source: Trades of the Day