Store Capital Corp. (STOR) – is going bye-bye.

The real estate investment trust agreed to be acquired for $32.25/share in an all-cash deal. Unless they get a better deal during a 30-day go-shop period, shareholders will have to accept the cash for shares.

Now, I am a bit surprised that the REIT didn’t get a higher price. But it is a down market. And this price does represent a decent 20% premium to the stock’s close prior to the deal announcement.

I decided to sell my shares in Store Capital for a price slightly higher than the deal value in the morning of September 15th. And I started to reallocate that capital almost immediately.

Today, I want to tell you about a high-quality REIT I recently bought for the FIRE Fund.

Today, I want to tell you about a high-quality REIT I recently bought for the FIRE Fund.

Ready? Let’s dig in.

I’ve been a Store Capital shareholder for a number of years. And I am a bit sad to see the shares leave the Fund. But I was able to sell out of the Fund’s entire stake in Store Capital for $32.26/share, which is actually slightly higher than the deal value. So that’s great.

What’s not so great?

Well, one of the big reasons to own Store Capital in the first place was the fact that it was a really great REIT that offered a super compelling mix of value and yield. The stock was yielding 5.8% before the deal announcement. And this was a safe, well-covered dividend here. STOR was not, and is not, some high-yield junk stock.

However, you’re just not going to find that kind of yield among many high-quality REITs with solid fundamentals. A lot of the REITs with yields of 6% or above are, quite frankly, troubled, or low quality, in some way or another. STOR was a bit of a gem. And I think this combination is what enticed GIC and Oak Street, the buyers of Store Capital, to swoop in.

One piece of advice I’ve repeated over and over again? Don’t chase yield.

It’d be easy to try to take the capital from Store Capital and try to match or better that yield elsewhere. But I think that’s a dangerous mentality.

If you see some unique opportunity there where the yield seems like a “gimme”, which is what we had with Store Capital, go for it. But when I scan the REIT landscape, I just don’t see 6% yields without severe drawbacks and big risks.

So what did I do with the proceeds from the sale of the Store Capital shares?

I went in a few different directions with it, because I actually see a number of really high-quality REITs that appear to be undervalued after significant drops in their pricing. But I want to highlight one REIT, in particular.

I bought Alexandria Real Estate Equities, Inc. (ARE).

This REIT is new to the FIRE Fund. And I’m super excited to finally own a slice of the business.

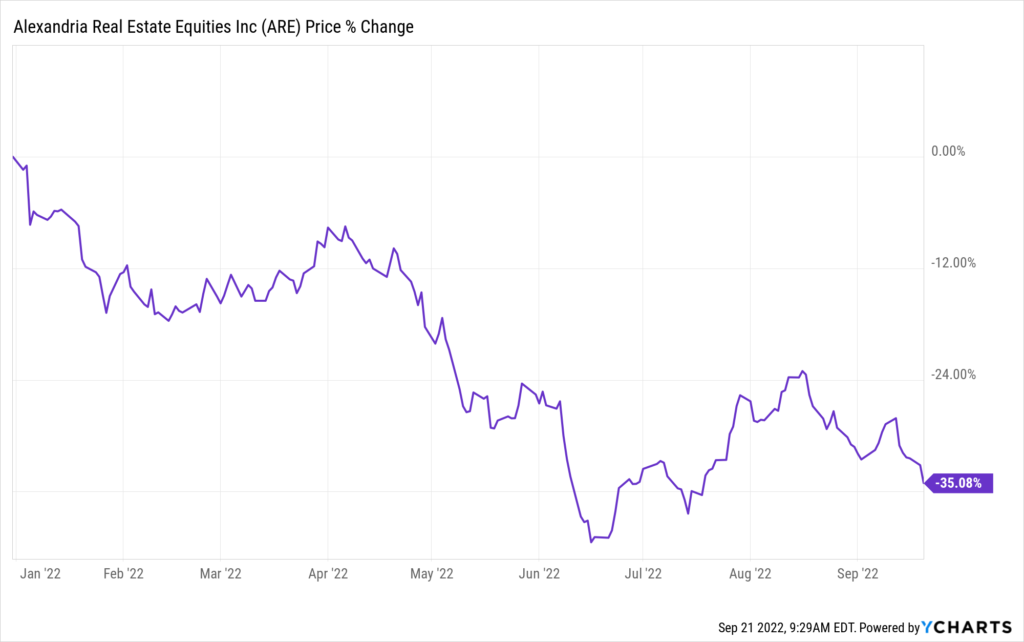

It’s a name I’ve had on my radar for a long time. I’ve been watching it and biding my time, waiting for the stars to align just right. Well, the stock is down more than 30% from its 52-week high and looking more attractively valued than it has in years. Yes, it’s cratered from nearly $225 late last year to below $150.

In fact, it’s currently below its pre-pandemic pricing right now. This was a $175 stock in early 2020.

In fact, it’s currently below its pre-pandemic pricing right now. This was a $175 stock in early 2020.

Let’s talk about what Alexandria Real Estate is all about. This real estate investment trust is an owner, operator, and developer that is focused on life science, AgTech, and technology campuses located in innovation clusters across key markets like San Diego and Boston. These markets are key because of the talent pool and university exposure. Like they always say in real estate: location, location, location.

Why is this stock down more than 30% from its recent high? I think a big reason why this stock has cratered recently is because a lot of investors naively misinterpret it as some kind of traditional office building REIT that’s under pressure from the work-from-home trend.

Think again.

The properties in Alexandria Real Estate’s portfolio are specialized, built-for-purpose, mission-critical buildings that are used for R&D. You cannot do this kind of work out of your extra bedroom at home in your pajamas. We’re talking about high-end laboratories here. That’s why rent collection and occupancy remains so high.

While some REITs in the traditional office building space are still struggling with occupancy rates, Alexandria Real Estate is not. For Q2 FY 2022, occupancy of operating properties in North America (excluding vacancy at recently acquired properties) was 98.4%. July tenant rent and receivables collected as of July 25, 2022 was 99.9%.

This should not be a surprise. Like I said earlier, these properties cannot be easily replicated or shifted to someone’s local co-working space. That’s not how it works. Some of their top tenants are the likes of Bristol-Myers Squibb (BMY) and Moderna (MRNA). And these tenants are committed to constant R&D in order to keep healthy product pipelines.

This should not be a surprise. Like I said earlier, these properties cannot be easily replicated or shifted to someone’s local co-working space. That’s not how it works. Some of their top tenants are the likes of Bristol-Myers Squibb (BMY) and Moderna (MRNA). And these tenants are committed to constant R&D in order to keep healthy product pipelines.

Plus, Alexandria Real Estate has great long-term visibility. The weighted-average remaining lease term for the top 20 tenants is 10.2 years. The top 20 tenants account for slightly more than 30% of annualized rental revenue.

These tenants, as I was just mentioning are great businesses in their own right, which fortifies Alexandria Real Estate. But the REIT is strong in its own right – its investment-grade credit ratings are BBB+ from S&P Global, and Baa1 from Moody’s.

This positions the REIT for continued high dividend growth for years to come.

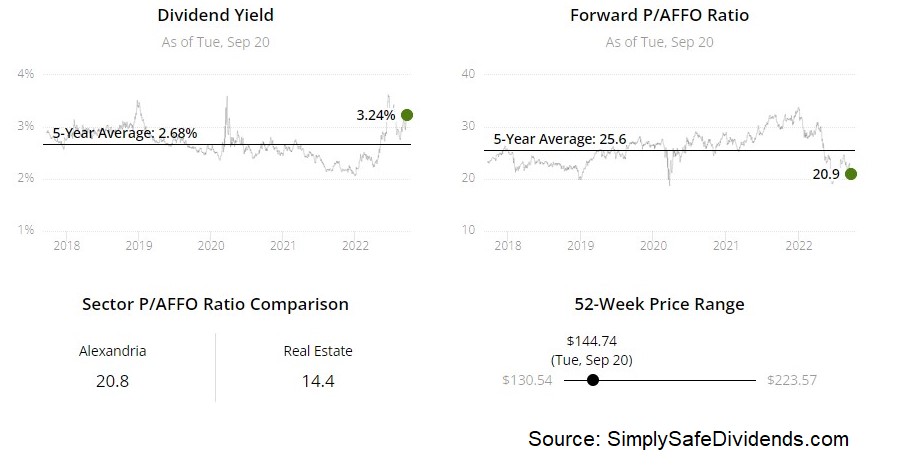

Already, Alexandria Real Estate has increased its dividend for 12 consecutive years. The 10-year DGR is 8.9%. And you get to pair that high-single-digit dividend growth with a yield of 3.3%, which is, notably, 70 basis points higher than its own five-year average.

Already, Alexandria Real Estate has increased its dividend for 12 consecutive years. The 10-year DGR is 8.9%. And you get to pair that high-single-digit dividend growth with a yield of 3.3%, which is, notably, 70 basis points higher than its own five-year average.

No, this yield isn’t as high as what Store Capital was offering. But Store Capital’s yield has dropped to 4.8% after the stock’s 20% post-deal-announcement pop. And I think Alexandria Real Estate will grow the dividend faster than what Store Capital would have been able to do.

That viewpoint is partially based on the fact that the payout ratio here is only 56.1%, based on midpoint guidance for this fiscal year’s AFFO/share. That’s a very low payout ratio for a REIT.

This dividend growth, of course, is powered by business growth.

Over just the last five years alone, the REIT has nearly doubled revenue. Funds from operations per share has a CAGR of 9% over that time frame. And this is an area of real estate that is in secular growth mode, with limited downside.

CFRA points this out, calling Alexandria Real Estate “…the dominant leader in life science real estate that we see high secular growth and more recession resistant than most other property types.”

Alexandria Real Estate actually increased its adjusted funds from operations per share guidance for FY 2022 in their most recent quarterly report, bucking the trend of many other companies out there decreasing guidance. The most recent guidance calls for 8.4% YOY growth here. For a REIT, that’s impressive. And all of this comes in what I think is an undervalued package.

Based on midpoint guidance for this fiscal year’s adjusted funds from operations per share, the forward P/FFO ratio is 17.7. That’s analogous to a P/E ratio on a normal stock. There’s nothing high about this.

We can also look at cash flow. The P/CF ratio is currently sitting at 21.4, which is significantly lower than its own five-year average of 25.7. This is a stock that typically commands premium multiples, and rightfully so. But those premiums have pretty much disappeared.

For another perspective on this, CFRA’s 12-month target price on the stock is $210.00. Simply put, the stock looks materially undervalued. And that’s why I’m aggressively buying this REIT.

For another perspective on this, CFRA’s 12-month target price on the stock is $210.00. Simply put, the stock looks materially undervalued. And that’s why I’m aggressively buying this REIT.

I initiated a position in Alexandria Real Estate for the FIRE Fund on September 15th for $153.00/share. This position was initiated almost immediately upon selling out of the Fund’s position in Store Capital.

I’ve been adding to the Alexandria Real Estate position since then, most recently (as of this writing) on September 20th for $145.10/share. I will be buying more, and I’ll be alerting my Patrons over at Patreon about those moves (and the many other moves I’m making).

Is Alexandria Real Estate right for your portfolio?

Well, that’s ultimately up to you. But I’m on the same page as CFRA with this one.

In my view, Alexandria Real Estate a high-quality, recession-resistant REIT in secular growth mode. After all, their world-class tenants are captive to these specialized facilities. It offers a market-beating yield, almost double-digit long-term dividend growth, a low payout ratio, more than 10 consecutive years of dividend increases, and the potential for material undervaluation.

If you’re a long-term dividend growth investor in the market for a REIT to invest in, especially if you’re flush with cash after selling out of Store Capital, Alexandria Real Estate should be on your radar.

— Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Your 12 income checks supercharged with 21% yields [sponsor]Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Dividends & Income