I want to tell you about a high-quality stock that pays big, growing, reliable dividends. These growing dividends are funded by growing profit, because this business is a leading marketing company.

The Internet and social media have totally upended traditional advertising. But it hasn’t made it less important. Actually, properly marketing and managing a message is now more critical than ever before.

In an age in which information can be instantly disseminated, controlling the narrative is very valuable. That puts this company, which does that, in the driver’s seat. And it positions them to continue growing its revenue, profit, and dividend for years to come.

I’ve personally invested in stocks just like this one on my way to going from below broke at age 27 to financially free at 33.

By the way, I explain exactly how I achieved financial freedom in just six years in my Early Retirement Blueprint.

By the way, I explain exactly how I achieved financial freedom in just six years in my Early Retirement Blueprint.

If you’re interested, you can download a free copy of my Early Retirement Blueprint.

Getting back to the stock I’ll tell you about today though, perhaps best of all, it looks undervalued right now.

Price is what you pay. But value is what you get.

Why’s that important? Because buying a dividend growth stock when it’s undervalued should provide a higher yield, greater long-term total return potential, and reduced risk. With this in mind, I want to tell you about an opportunity I recently came across with a stock that appears to be trading at a significant discount today…

Omnicom Group Inc. (OMC)

Omnicom Group Inc. (OMC)

Omnicom Group Inc. (OMC) is an advertising, marketing, and corporate communications company.

Founded in 1944, Omnicom is now a $15 billion (by market cap) marketing powerhouse employing 71,000 people.

Through more than 1,500 subsidiaries and over 200 brands, Omnicom serves 5,000+ clients across 70+ countries.

The company operates across the following fundamental business disciplines: Advertising, 56% of FY 2021 revenue; Public Relations, 10%; Healthcare, 9%; Precision Marketing, 8%; Execution & Support, 7%; Commerce & Brand Consulting, 6%; and Experiential, 4%.

The United States is their largest market by region, comprising slightly over half of the company’s revenue.

One might assume that Omnicom is some outdated advertising business. That would be a mistake.

Omnicom is an incredibly diversified marketing machine that manages corporate messaging in a world where communication is more important than ever.

Why is it more important than ever? The Internet, especially through social media, allows for rapid dissemination of information. If messaging can’t be managed, a company can lose control of its image, which could destroy a ton of value.

Omnicom steps up to the plate in a holistic way, using their experience and breadth to manage that messaging from top to bottom. This is an under-the-radar business that can, essentially, offer an investor exposure to the entire global economy all in one go.

The diversification is otherworldly.

CFRA puts it like this: “The company’s clients operate in nearly every sector of the global economy and no industry makes up more than 16% of the company’s revenue, with its largest client representing 3.2% of total revenue and 100 of its largest clients representing 54% of revenue.”

But what might be the most compelling feature of the business model is the “stickiness” of its client base. Once one of Omnicom’s agencies become attached to a client’s marketing department, it’s difficult to make a change. Inertia shouldn’t be underestimated.

Moreover, since Omnicom controls the likes of acclaimed agencies BBDO and DDB, the company can just move a client from one network to another.

Putting it all together, Omnicom is positioned for continued growth across its revenue, profit, and dividend for years to come.

Dividend Growth, Growth Rate, Payout Ratio and Yield

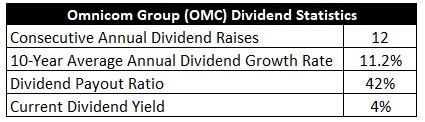

To date, the company has increased its dividend for 12 consecutive years.

The 10-year dividend growth rate is 11.2%, which is strong, but the last few years have shown a slowdown in dividend growth.

For instance, the company’s most recent dividend increase came in at 7.7%.

For instance, the company’s most recent dividend increase came in at 7.7%.

It’s also worth noting that they’re technically overdue for a dividend increase, although Omnicom has a history of increasing their dividend at odd intervals (not every four quarters).

On the other hand, the stock yields a very appealing 4%. That yield handily beats the market, and it’s 40 basis points higher than its own five-year average. And with a payout ratio of 42%, this is a secure and healthy dividend.

For investors who tilt toward yield over dividend growth, these dividend metrics look really good.

Revenue and Earnings Growth

Looking at business growth, Omnicom only slightly increased its revenue from $14.2 billion in FY 2012 to $14.3 billion in FY 2021.

We’re basically looking at flat revenue here. I’d like to see mid-single-digit top-line growth here, but Omnicom was still able to grow the bottom line at a very decent clip.

Indeed, earnings per share increased from $3.61 to $6.53 over this period, which is a compound annual growth rate of 6.8%.

A combination of margin expansion and share buybacks helped to drive this excess bottom-line growth. This just goes to show how many levers a company can pull.

For perspective on the buybacks, the company’s outstanding share count is down by 20% over the last decade. That’s substantial.

Looking forward, CFRA believes that Omnicom will compound its EPS at an annual rate of 16% over the next three years.

This would be a material acceleration in EPS growth for the firm. Is CFRA way off base here?

Not necessarily. But I do think this is a rather optimistic take. That said, this kind of growth rate is at least realistic largely because of the somewhat low base we’re starting from.

We have to keep in mind that FY 2020 was abnormally difficult for the company, yet FY 2021 epitomized Omnicom’s resiliency and ability to bounce back – EPS for FY 2021 grew 49.4% YOY.

In an alternate reality in which the pandemic never occurred, Omnicom’s 10-year picture would almost certainly look better than it does, but the go-forward picture would probably be less exciting.

CFRA does highlight Omnicom’s strategic investments in advertising and marketing technologies, and high-growth industries. This should help to mitigate some of the macroeconomic challenges.

All in all, I see it as possible that Omnicom can grow its EPS at a double-digit clip like this over the next few years, but I also see it as unnecessary.

In order for this to be a satisfactory investment, based on that 4% starting yield, you’d only really need to see high-single-digit EPS and dividend growth from here.

Omnicom doesn’t have to clear a high bar.

But if the company is able to put up numbers like CFRA is expecting, we could be looking at extraordinary dividend raises and total return over the foreseeable future.

Financial Position

Moving over to the balance sheet, Omnicom has a rock-solid financial position.

The long-term debt/equity ratio is 1.5, while the interest coverage ratio is nearly 11. The company’s debt is not at all unmanageable, and it’s only low common equity that makes the former number look somewhat high.

Profitability is very good. Over the last five years, the firm has averaged annual net margin of 8.3% and annual return on equity of 46.2%.

Circling back around to the net margin expansion story that I touched on earlier, Omnicom was routinely printing net margin in the 7% range a decade ago.

Moreover, net margin actually came in at nearly 10% for last fiscal year.

Omnicom flies under the radar, but it has all the makings of a great business.

And with agency brand power, global scale, “sticky” client relationships, incredible breadth, and decades of accrued data and expertise, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Litigation, regulation, and competition are omnipresent risks in every industry.

Competition in this industry is fierce but also limited – five major players make up an estimated 30% of global ad revenue.

It remains to be seen what a post-pandemic marketing world looks like.

The digital marketing landscape continues to quickly evolve. Any missteps by the company’s various agencies in this regard would likely have consequences.

There’s technological risk, as the Internet continues to open up the flow of information.

I also see the very business model as a risk. If large companies ever decide to internally control their marketing, this would adversely affect Omnicom.

Stock Price Valuation

Investors should carefully contemplate these risks, but I think the quality of the business shines through. And with the stock down nearly 25% from its recent high, the valuation also shines very brightly.

The stock is currently sporting a P/E ratio of 11.4. That’s extremely low by any measure, and it compares favorably to its own five-year average of 13.4. Even for a stock that’s typically pretty cheap, it looks especially cheap right now.

The P/S ratio of 1 is also slightly below its own five-year average of 1.1. And the yield, as noted earlier, is significantly higher than its own five-year average.

I valued shares using a dividend discount model analysis. I factored in a 10% discount rate and a long-term dividend growth rate of 6.5%. That dividend growth rate looks awfully conservative when you look at this company’s long-term demonstrated dividend growth of over 10%. And the near-term expectation for EPS growth is well into the double digits.

Plus, the payout ratio is fairly low.

However, my mark is fairly close to Omnicom’s 10-year EPS growth rate, and I’m also weighing Omnicom’s more recent dividend growth track record that has been erratic and slower.

It’s quite possible that Omnicom clears this hurdle with ease, but I’d rather err on the side of caution. The DDM analysis gives me a fair value of $85.20.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks. Morningstar rates OMC as a 4-star stock, with a fair value estimate of $90.00. CFRA rates OMC as a 4-star “BUY”, with a 12-month target price of $86.00.

I came in very close to where CFRA is at, and we all agree that the stock looks inexpensive. Averaging the three numbers out gives us a final valuation of $87.07, which would indicate the stock is possibly 25% undervalued.

Bottom line: Omnicom Group Inc. (OMC) is an under-the-radar business that has surprisingly good fundamentals. In a world in which marketing is more complex and important than ever, Omnicom is in the driver’s seat. With a market-beating yield, double-digit long-term dividend growth, a low payout ratio, more than 10 consecutive years of dividend increases, and the potential that shares are 25% undervalued, this is a compelling idea for long-term dividend growth investors.

Bottom line: Omnicom Group Inc. (OMC) is an under-the-radar business that has surprisingly good fundamentals. In a world in which marketing is more complex and important than ever, Omnicom is in the driver’s seat. With a market-beating yield, double-digit long-term dividend growth, a low payout ratio, more than 10 consecutive years of dividend increases, and the potential that shares are 25% undervalued, this is a compelling idea for long-term dividend growth investors.

— Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is OMC’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 70. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, OMC’s dividend appears Safe with an unlikely risk of being cut. Learn more about Dividend Safety Scores here.

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Source: Dividends & Income