There’s a group of dividend payers out there whose businesses are doing better than they were before the COVID mess, but their stocks are still ridiculously cheap today.

Best of all, we contrarian income seekers can get these stocks at an even deeper discount than regular folks can—while collecting a healthy 6.6% dividend.

The trick? Buy them through a closed-end fund (CEF) like the one we’ll discuss below.

But let’s not get ahead of ourselves. The investments we’re going to buy through this CEF are real estate investment trusts (REITs), which own and rent out various types of properties, from shopping malls to warehouses and cellphone towers.

The beauty of REITs from a dividend perspective is that they’re essentially “pass-through” entities, collecting rents (which are rising fast these days) from their tenants and handing them over to us as dividends. In fact, REITs have a powerful incentive to do so: they pay no corporate tax as long as they hand out 90% of their earnings to us as dividends.

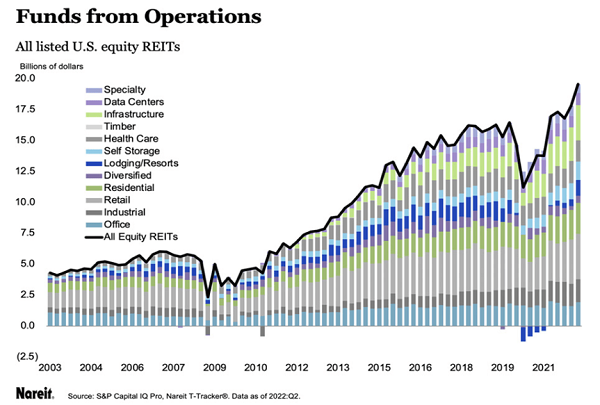

Take a look at this data from NAREIT, the National Association of Real Estate Investment Trusts. It’s pretty convincing evidence that REITs are once again on a roll—something I like to call the “silent real estate boom.”

Almost all types of REITs are reporting higher funds from operations (FFO, the main REIT cash-flow metric) than they were pre-pandemic:

If you’re a follower of REITs (and as a dividend investor, I’m betting you are), you know that they took a particularly hard hit during the pandemic, especially office REITs, as it appeared that the shift to working from home would make their business models obsolete.

If you’re a follower of REITs (and as a dividend investor, I’m betting you are), you know that they took a particularly hard hit during the pandemic, especially office REITs, as it appeared that the shift to working from home would make their business models obsolete.

Except that’s not how things actually turned out, as we can see from the chart above. But the market is overlooking this. That’s where our buying opportunity comes in.

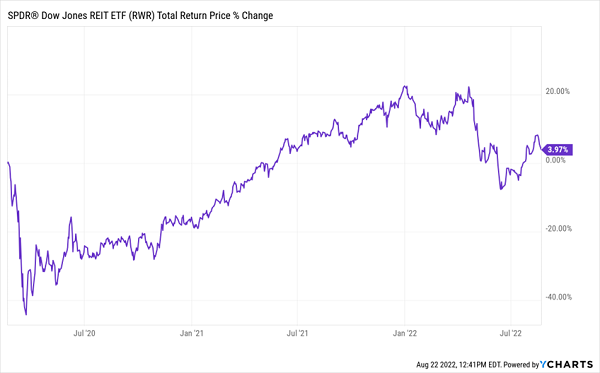

No thanks to the bear market of 2022, many of the gains from the REIT recovery of 2020/’21 have been wiped out, and the sector is up a measly 4% on a total-return basis from the February 2020 market peak, just before the start of lockdowns.

Rising Income, Flat Prices

Since the rental income that REITs are getting has risen sharply and the price of actual REITs is flat, the price we’re paying for REIT rental income is now at a low. That’s despite the fact that the causes of the current market dip (the Federal Reserve, inflation) aren’t that bad for REITs. People still need real estate, no matter where interest rates are, and inflation is causing rents to go up, benefiting REITs even further.

Since the rental income that REITs are getting has risen sharply and the price of actual REITs is flat, the price we’re paying for REIT rental income is now at a low. That’s despite the fact that the causes of the current market dip (the Federal Reserve, inflation) aren’t that bad for REITs. People still need real estate, no matter where interest rates are, and inflation is causing rents to go up, benefiting REITs even further.

A Solid CEF Play for a “Double Discount,” 6.6% Income, From REITs

As CEF investors, we can get top REITs for even cheaper than the market price when we buy through a fund the Cohen & Steers Quality Realty Fund (RQI).

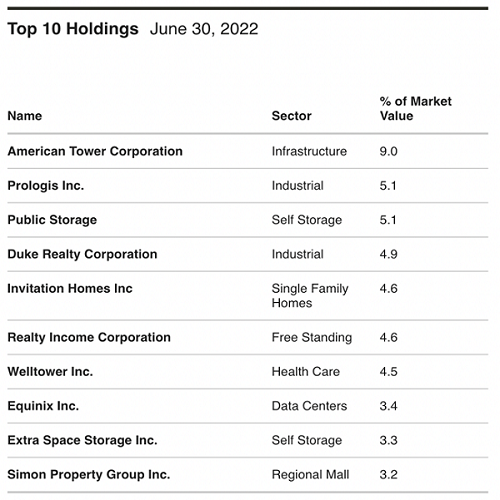

Note the word “quality” in the name—and that’s not marketing. RQI’s portfolio focuses specifically on REITs that have seen rising free cash flow, like American Tower (AMT), Prologis (PLD) and Public Storage (PSA).

Source: Cohen & Steers

Source: Cohen & Steers

These are all companies that have delivered strong total returns for years, and through all market weather. Take a look at the performance of its top-five holdings in the last five years.

Rising Income, and Gains, for RQI Investors

That portfolio of cash-boosting real estate companies is why RQI has clocked in an 11.4% average annualized total return over the last decade, more than double that of the broader REIT market, shown below by the performance of the SPDR Dow Jones REIT ETF (RWR).

Savvy Picks Power RQI Past the REIT Market

Does this outperforming, high-quality, high-income-producing fund trade at the premium it deserves? Hardly. Thanks to market fears, it’s dipped to a 3.3% discount, giving us some nice “bonus” savings on top of the deals we’re getting in the already-cheap REIT market.

— Michael Foster

Don’t Buy RQI Just Yet—These CEFs Are Cheaper, and Pay Way More, Too! [sponsor]

You really couldn’t go wrong with going out and buying RQI now. It’s a well-run fund backed by Cohen & Steers, which boasts one of the strongest teams of real estate pros there are, not only in CEFs but in the real estate business as a whole.

I’ve looked at the fund for my CEF Insider service many times, and there are only two things that have kept me from recommending it: the dividend and the discount.

Sure, the payout seems high, at 6.6%, but that’s actually on the low end for CEFs, many of which yield 7%, 8% and more.

And the discount is decent, but here again, we’ve got plenty of even better deals in the CEF space now.

For those reasons, I recommend keeping RQI on your watch list, at least for now, and looking to the 5 other CEFs I have for you right here.

They yield a lot more—an average payout of 7.9% today—and trade at deeper discounts, too. In fact, their discounts are so deep that I see these funds’ share prices popping 20%+ in the next year, even if the summer market rebound takes a breather.

And because these 5 funds pay dividends monthly, you’ll get your first payout soon after you buy.

Now is the time to make your move. Click here and I’ll give you a special report that reveals the names, tickers, yields and my complete research on these 5 high-income, bargain-priced CEFs.

Source: Contrarian Outlook