Picking a winning trade on a consistent basis is not simply a stroke of luck. It’s the result of calculated screening, planning, and deliberation.

With this in mind, we have started a new weekly series on our top 10 stocks to watch this week — stocks that look poised for a possible breakout in the coming days. Traders should add these stocks to their watchlist now.

The Top 10 Stocks to Watch This Week for Possible Breakouts

| Sl # | Name of the Stock | Stock Ticker | Last Close | Buy Level(s) | Reason |

| 1 | General Motors Company | NYSE: GM | $39.70 | $40.70 | Falling Wedge Pattern Breakout |

| 2 | Occidental Petroleum Corporation | NYSE: OXY | $71.29 | $73.00 | Symmetrical Triangle Pattern Breakout |

| 3 | Social Capital Suvretta Holdings Corp. I | NASDAQ: DNAA | $14.07 | $14.10 | Breakout From Consolidation Area |

| 4 | Upland Software, Inc. | NASDAQ: UPLD | $10.74 | $13.00 | Downtrend Channel |

| 5 | The Lovesac Company | NASDAQ: LOVE | $33.68 | $37.40 | Falling Wedge Pattern Breakout |

| 6 | Pinnacle West Capital Corporation | NYSE: PNW | $77.96 | $78.50 | Symmetrical Triangle Pattern Breakout |

| 7 | Wolfspeed, Inc. | NYSE: WOLF | $109.87 | $113.30 | Downtrend Channel Breakout |

| 8 | DCP Midstream, LP | NYSE: DCP | $38.18 | $39.50 | Ascending Triangle Pattern |

| 9 | Old Republic International Corporation | NYSE: ORI | $24.61 | $24.70 | Falling Wedge Pattern Breakout |

| 10 | Denbury Inc. | NYSE: DEN | $92.45 | $93.10 | Downtrend Channel Breakout |

Important: Typically, these trades offer a risk: reward ratio of 1:2 or 1:3 in the next 6 months, which implies 2x to 3x rewards when compared to risks. So, be sure to set your stop-loss levels and target prices accordingly to manage your risk. In addition, these trade ideas are triggered using daily closing prices, not intra-day pricing. So, if you participate in these trades, make sure that you only buy the stock once its daily close is above the recommended price level.

That said, here are the top 10 stocks to watch for a breakout, in no particular order.

#1 General Motors Company (NYSE: GM)

Sector: Consumer Cyclical | Auto Manufacturers

Reason: Falling Wedge Pattern Breakout

A falling wedge pattern is formed by joining two downward-sloping, converging trendlines having a contracting range. The pattern appears to be wide at the top and continues to contract as prices fall. A breakout from a falling wedge pattern can indicate either reversal or continuation depending on where the pattern appeared in the trend.

A stock that has broken out of a falling wedge pattern would have gained momentum and would have the potential to move higher.

Buy Level(s): The stock has currently broken out of a falling wedge pattern. However, the ideal buy level for GM is above the nearest resistance level of $40.70. This is marked in the chart below as a green color dotted line.

Daily chart – GM

#2 Occidental Petroleum Corporation (NYSE: OXY)

Sector: Energy | Oil & Gas E&P

Reason: Symmetrical Triangle Pattern Breakout

A symmetrical triangle is a chart pattern formed by two converging trend lines connecting a series of sequential peaks and troughs. These two lines result in the formation of a triangle that appears to be symmetrical.

A symmetrical triangle pattern is usually formed when there is indecision in the price movements and there is uncertainty among the buyers and sellers. This chart pattern represents a period of consolidation before the price breaks out or breaks down. In case a breakout occurs from the upper trend line, it is a strong bullish indication as it signifies the start of a new bullish trend.

Buy Level(s): The stock has currently broken out of a symmetrical triangle pattern. However, the ideal buy level for OXY is if the stock closes above the immediate resistance level of $73.00. This is marked in the chart below as a green color dotted line.

Daily chart – OXY

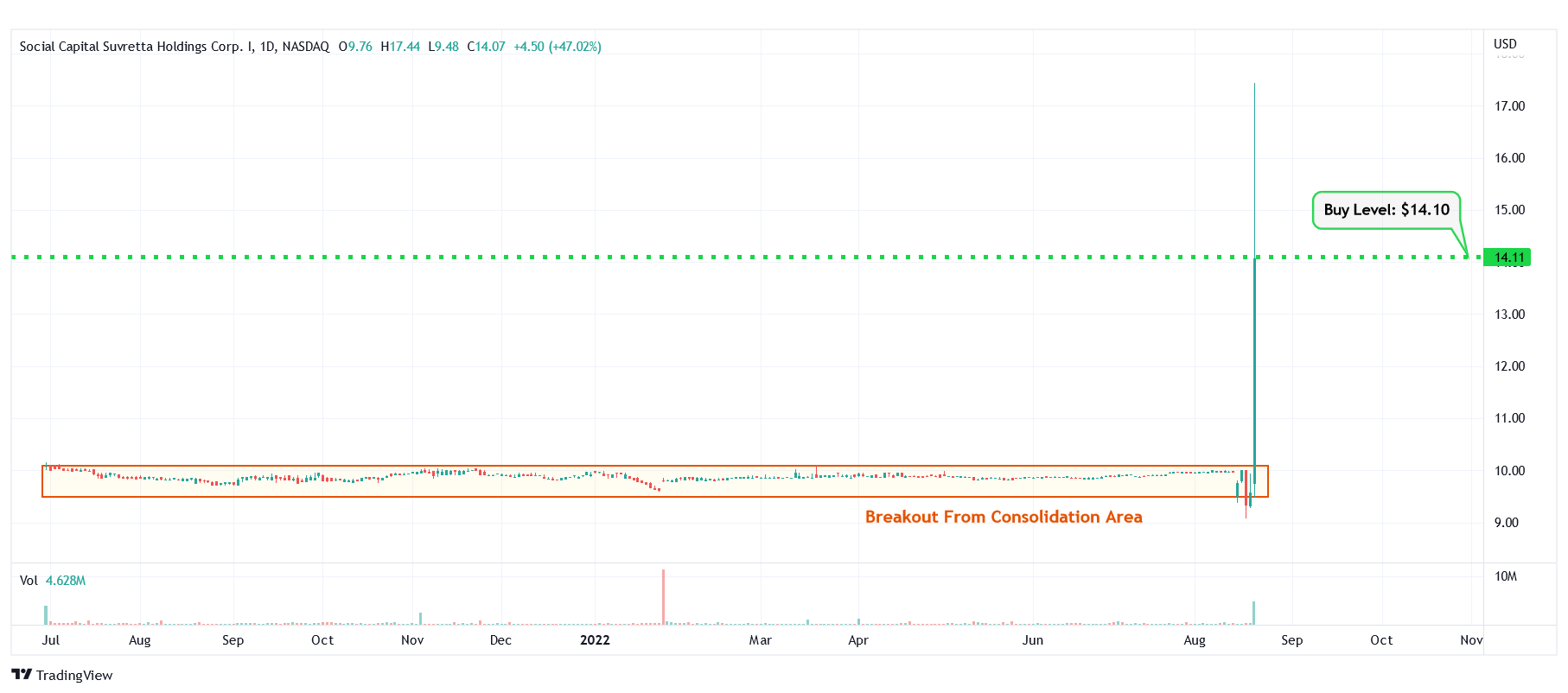

#3 Social Capital Suvretta Holdings Corp. I (NASDAQ: DNAA)

Sector: Financial | Shell Companies

Reason: Breakout From a Consolidation Area

A Consolidation Area is a price action contained between two parallel lines. It is formed by a lower line that connects the lows, and an upper line that joins the highs. A stock usually trades between the two lines of the consolidation area before finally breaking out from the upper rail.

Buy Level(s): Although the stock has currently broken out of a consolidation area, the ideal buy level for DNAA is above the near-term resistance area, which translates to a price of around $14.10. This is marked in the chart below as a green color dotted line.

Daily chart – DNAA

#4 Upland Software, Inc. (NASDAQ: UPLD)

Sector: Technology | Software – Application

Reason: Formation of a Downtrend Channel

A downtrend or descending channel is the price action contained between downward sloping parallel lines. It is formed by two lines that are drawn by connecting the lower highs and lower lows of a stock’s price. Even though this is typically a bearish pattern, a breakout from the upper rail of this pattern is considered a good bullish indication.

Buy Level(s): The daily chart shows that the stock is currently forming a downtrend channel. The ideal buy level for UPLD is if the stock breaks out of the downtrend channel and has a daily close above $13.00. This is marked in the chart below as a green color dotted line.

Daily chart – UPLD

#5 The Lovesac Company (NASDAQ: LOVE)

Sector: Consumer Cyclical | Furnishings, Fixtures & Appliances

Reason: Falling Wedge Pattern Breakout

A falling wedge pattern is formed by joining two downward-sloping, converging trendlines having a contracting range. The pattern appears to be wide at the top and continues to contract as prices fall. A breakout from a falling wedge pattern can indicate either reversal or continuation depending on where the pattern appeared in the trend.

A stock that has broken out of a falling wedge pattern would have gained momentum and would have the potential to move higher.

Buy Level(s): The stock has currently broken out of a falling wedge pattern. However, the ideal buy level for LOVE is above the nearest resistance level of $37.40. This is marked in the chart below as a green color dotted line.

Daily chart – LOVE

#6 Pinnacle West Capital Corporation (NYSE: PNW)

Sector: Utilities | Utilities – Regulated Electric

Reason: Symmetrical Triangle Pattern Breakout

A symmetrical triangle is a chart pattern formed by two converging trend lines connecting a series of sequential peaks and troughs. These two lines result in the formation of a triangle that appears to be symmetrical.

A symmetrical triangle pattern is usually formed when there is indecision in the price movements and there is uncertainty among the buyers and sellers. This chart pattern represents a period of consolidation before the price breaks out or breaks down. In case a breakout occurs from the upper trend line, it is a strong bullish indication as it signifies the start of a new bullish trend.

Buy Level(s): The stock has currently broken out of a symmetrical triangle pattern. However, the ideal buy level for PNW is if the stock closes above the immediate resistance level of $78.50. This is marked in the chart below as a green color dotted line.

Daily chart – PNW

#7 Wolfspeed, Inc. (NYSE: WOLF)

Sector: Technology | Semiconductors

Reason: Downtrend Channel Breakout

A downtrend or descending channel is the price action contained between downward sloping parallel lines. It is formed by two lines that are drawn by connecting the lower highs and lower lows of a stock’s price. Even though this is typically a bearish pattern, a breakout from the upper rail of this pattern is considered a good bullish indication.

Buy Level(s): The daily chart shows that the stock has currently broken out of a downtrend channel. However, there is a near-term resistance level for the stock. Hence, the ideal buy level for WOLF is if the stock has a daily close above $113.30. This is marked in the chart below as a green color dotted line.

Daily chart – WOLF

#8 DCP Midstream, LP (NYSE: DCP)

Sector: Energy | Oil & Gas Midstream

Reason: Formation of an Ascending Triangle Pattern

An ascending triangle pattern is a bullish pattern formed by drawing a horizontal line along the swing highs, and a rising trendline along the swing lows. These two lines result in the formation of a triangle. A breakout from this pattern is typically a strong bullish indication.

Buy Level(s): The ideal buy level for DCP is if the stock breaks out of the ascending triangle pattern and has a daily close above the near-term resistance level of $39.50. This is marked in the chart below as a green color dotted line.

Daily chart – DCP

#9 Old Republic International Corporation (NYSE: ORI)

Sector: Financial | Insurance – Diversified

Reason: Falling Wedge Pattern Breakout

A falling wedge pattern is formed by joining two downward-sloping, converging trendlines having a contracting range. The pattern appears to be wide at the top and continues to contract as prices fall. A breakout from a falling wedge pattern can indicate either reversal or continuation depending on where the pattern appeared in the trend.

A stock that has broken out of a falling wedge pattern would have gained momentum and would have the potential to move higher.

Buy Level(s): The stock has currently broken out of a falling wedge pattern. However, the ideal buy level for ORI is above the nearest resistance level of $24.70. This is marked in the chart below as a green color dotted line.

Daily chart – ORI

#10 Denbury Inc. (NYSE: DEN)

Sector: Energy | Oil & Gas E&P

Reason: Downtrend Channel Breakout

A downtrend or descending channel is the price action contained between downward sloping parallel lines. It is formed by two lines that are drawn by connecting the lower highs and lower lows of a stock’s price. Even though this is typically a bearish pattern, a breakout from the upper rail of this pattern is considered a good bullish indication.

Buy Level(s): The daily chart shows that the stock has currently broken out of a downtrend channel. However, there is a near-term resistance level for the stock. Hence, the ideal buy level for DEN is if the stock has a daily close above $93.10. This is marked in the chart below as a green color dotted line.

Daily chart – DEN

Happy Trading!

Trades of The Day Research Team

$3 billion+ in operating income. Market cap under $8 billion. 15% revenue growth. 20% dividend growth. No other American stock but ONE can meet these criteria... here's why Donald Trump publicly backed it on Truth Social. See His Breakdown of the Seven Stocks You Should Own Here.

Source: Trades of the Day