I’m proud to report that, for the first time in months, I “only” paid $100 for gas.

There was a catch. The pump had a $100 credit card limit!

Which begs the follow up question: Does your dividend strategist intentionally pump gas in the sketchiest neighborhoods he can find?

As a big guy in a Bills hat, who tends to traverse before the streetlights come on, perhaps I’m game for an adventure.

Fortunately for my wallet, my “soccer dad mobile” traverses a narrow grid. To the kids’ school. The gym. The park. Grocery store. One mile at a time.

A tank can last for weeks, which is helpful. A few fills ago a station in an, ahem, better neighborhood let me put a full $110 in there.

If this makes you think gee, we should buy stock in the companies charging these prices, we are on the same page. I can’t pump gas without fantasizing about refinery stocks—and (of course!) their rising dividends.

If this makes you think gee, we should buy stock in the companies charging these prices, we are on the same page. I can’t pump gas without fantasizing about refinery stocks—and (of course!) their rising dividends.

Most income investors forget about unglamorous oil refineries because they don’t understand them. They confuse them with energy producers, who drill for oil and natural gas and then sell the raw product. It’s their loss, because the best have quietly been growing profits and payouts like crazy.

These stocks form the unknown backdoor play on today’s energy bull market. Backdoor? Because you and I can’t use that raw product directly. We can’t dump a barrel of crude oil into our cars. We need “refined” gasoline.

Refineries buy oil from producers and turn it into gasoline, diesel fuel, heating oil and other end products. They are the perfect types of stocks to own with high energy prices.

And while it’s a bull market in oil, it is a bear market in the number of refineries here in America. We have fewer and fewer facilities to do the work of turning raw product into end product.

These are big sprawling facilities that nobody wants in their own backyards. There hasn’t been a major facility built on American soil since 1976, and more than half of all US refineries have been shut down in the last 25 years!

Woe to the refinery construction companies, but good for those already built. Either way, should we care? Why not outsource this business and simply rely on foreign refiners?

Maybe it didn’t matter when America was a net importer of crude oil. But with that all upside down and North America gushing oil and consuming such a large amount of the finished product, there are big economic advantages to refining here at home.

Plus, this isn’t the easiest stuff to transport across continents. And with the global supply chain a mess, and naval war games on the rise, why risk it?

Blue chip refiner Valero (VLO) is the big dog in the space. This is the stock we contrarians salivate over.

Regulators aren’t approving any more refinery real estate and Valero already owns the “beachfront properties.” If we close our eyes and buy VLO today, chances are high that shares will trade much higher in five or ten years.

But the path from here to there is likely to be greasy. If we buy Valero right, we can quickly double our money. Investors who swing too early, however, can be frustrated. Sure, VLO’s payout tends to act as a “dividend magnet” that eventually pulls its share price higher, every time. But there can be wild swings, too:

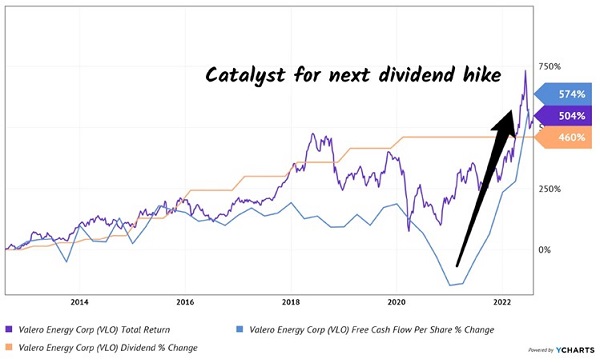

Valero’s “Dividend Magnet” Ebbs and Flows

VLO bounces around with crude prices. Day-to-day and even month-to-month can be stomach-churning.

VLO bounces around with crude prices. Day-to-day and even month-to-month can be stomach-churning.

But VLO is due for a dividend increase. We can see this reflected in the company’s recent cash flow “spike.” Talk about a catalyst! That plateaued payout should get moving again soon enough:

Cash Flow Gains: Catalyst for Next Dividend Hike

Why hasn’t management already boosted its dividend, given these cash flow gains? Probably for the same reason I haven’t formally recommended it (outside of a quick 44% spring fling in Dividend Swing Trader).

Why hasn’t management already boosted its dividend, given these cash flow gains? Probably for the same reason I haven’t formally recommended it (outside of a quick 44% spring fling in Dividend Swing Trader).

Because we’re waiting to see how severe this recession is going to be.

Yes, shares trade for just five times free cash flow. They are ridiculously cheap.

But the Federal Reserve is hiking rates and trimming its balance sheet as the economy slows down. A recession is a sure thing—a real one, not this “technical” recession in the headlines but one where people lose jobs and stop spending…

…And stop driving. This is already occurring as $100 tank fill-ups prompt some to change their ways–those that drive more than a mile at a time, that is!

Long-term I love VLO. It’s a dirt-cheap dividend that is likely to grow again in the years ahead. Its stock price should follow.

Between here and there I’d rather see us stake our position near a low. When that buy signal comes in, you’ll be the first to know.

— Brett Owens

Sponsored Link: In the meantime, I have seven other dividend growers that I do like today. I know that sounds crazy because I haven’t liked much of anything since last October. But these are recession-resistant dividend stocks with 100% upside.

These are exactly the types of stocks that we want to accumulate now. The rockier the markets are this fall, the better, because we’ll be able to build a bigger position with lower prices. Please click here for the details.

Source: Contrarian Outlook