This bear market we currently find us in is bringing tremendous opportunity. In part 1, I talked about how bear markets were short-lived whereas bull markets tend to last a lot longer. Consequently, prudent dividend growth stock investors take advantage of bear markets to position ourselves for safe long-term growth of dividends and capital.

Although we are in this current bear market, I for one do not think it is quite over yet. Nevertheless, many opportunities to invest for dividend growth are presenting themselves. In this video I will feature 6 examples that are close, but not quite there yet. When you find yourselves in risky markets like today, I believe it is incumbent on investors to favor safety over profits.

Therefore, I think the best action is to identify the opportunities as they are unfolding. However, simultaneously exercising the patience to wait for the “fat pitch” that Warren Buffett often talked about. In part 3, I will feature several Dividend Kings that are already buyable in my opinion. Stay tuned, and I hope you enjoy today’s offering.

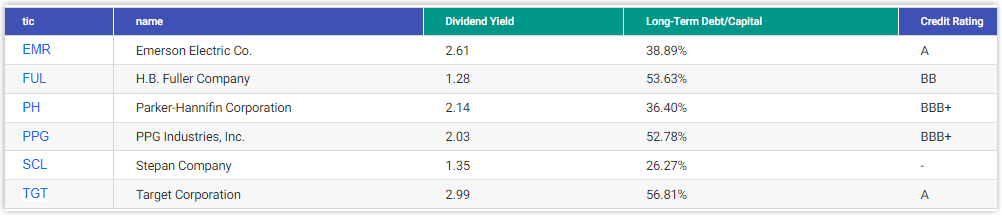

The companies I will go over in this video are: Emerson Electric (EMR), HB Fuller (FUL), Parker Hannifin (PH), PPG Industries (PPG), Stepan Co (SCL), Target (TGT).

FAST Graphs Analyze Out Loud Video

— Chuck Carnevale

Source: FAST Graphs