Look, I know this inflation-panicked market is frustrating. But despite the endless doomsaying from the pundits, there is good news: if you’re investing for income and have a long time horizon, there are some big dividends (I’m talking 10%+ yields) waiting for us in closed-end funds (CEFs).

In a second, we’re going to dive into three such funds I’ve assembled into a low-drama “mini-portfolio” yielding north of 10%.

We can thank the selloff for this opportunity: when stock (and CEF) prices go down, yields go up. And our CEFs discounts to net asset value (NAV, or the per-share value of a CEF’s portfolio) fall to bargain levels.

There’s no shortage of oversold funds in this market. Today I want to show you three CEFs that get us a collection of high-yielding stocks, real estate and bonds at attractive prices.

These three funds yield 11.8%, on average, and have long histories of delivering profits to shareholders. Remember that an 11.8% yield means $1,180 in annual income for every $10,000 invested, while the 1.4%-yielding S&P 500 gets you just $140 per year on your $10k.

CEF #1: A Diversified Bond CEF With a Double-Digit Yield

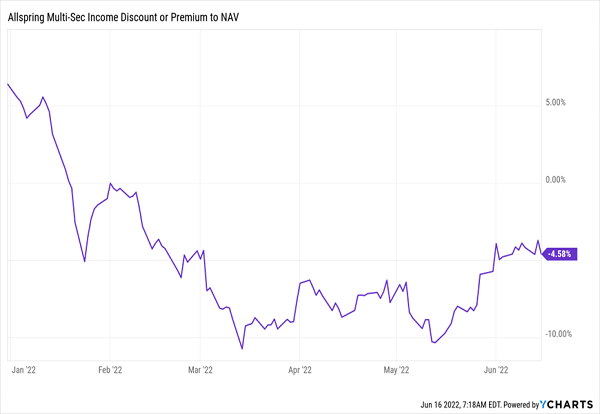

The Allspring Multi-Securities Income Fund (ERC) is an 11.5%-yielding CEF that’s nicely positioned for today’s market. The fund’s overdone drop this year (it’s down about 25% since January as of this writing) makes it worth a look now. This chart explains why.

Oversold Fundamentals

In the last six months, investors have sold ERC more than its fundamentals warrant, resulting in a rare discount for this income-focused bond fund.

Consider that ERC started the year at a 5.8% premium to NAV, and it now trades at a 4.6% discount, meaning you’re getting the fund’s bonds for about 95 cents on the dollar.

That means you can buy ERC now and collect its rich 11.5% dividend while you wait for that premium to return as the market retools for the Fed’s likely slowdown in rate hikes in late 2022 (and potential rate cuts in the next two years).

What does ERC hold? A diversified mix of government bonds from around the world, combined with some strong corporate bonds that have been oversold in this panic. Now that the market has priced in a more aggressive rate-hike path from the Fed, ERC’s big discount and yield look more attractive.

CEF #2: Be the Landlord and Pocket 13% Dividends

Next up is the Brookfield Real Assets Income Fund (RA), which is also worth a look now, both because it’s massively oversold and for its sky-high 13% yield. That payout is backed by RA’s portfolio of real estate, energy and infrastructure firms, which combined own thousands of real assets (hence the name) throughout the country. That means if one company or sector struggles, this fund’s portfolio is robust enough to handle it.

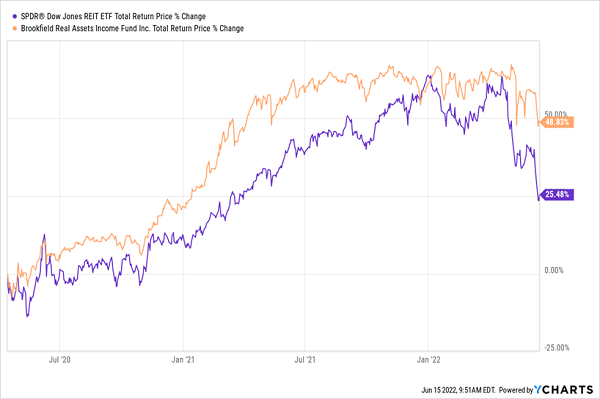

RA Shows “Relative Strength” This Year

Even though RA has fallen this year (along with pretty well everything else), it has held its value well overall throughout the pandemic and is well ahead of the S&P 500, particularly this year—a sign of “relative strength” I love to see when I buy CEFs.

RA has performed well because it holds energy assets, utilities and infrastructure firms that have been able to charge higher prices as inflation has risen. Top holdings include pipeline operators like Enbridge (ENB) and cell-phone-tower owners like Crown Castle International (CCI).

One thing we do need to keep in mind with RA is that it trades at a 10.9% premium to NAV now. That’s right around where its premium has been all year, so I don’t expect any major decline, as higher inflation continues to power RA’s share price higher. But you will want to keep this one on a shorter leash and be prepared to sell if the premium falls significantly.

Meantime, you’re well compensated for the risk by RA’s 13% dividend, which has been rock-solid since its launch in late 2016.

CEF #3: Big Dividends From Stout US Blue Chip Stocks

Finally, for blue chip stocks, let’s look to the Liberty All-Star Equity Fund (USA), which holds some of the most important companies in the US economy, like Amazon (AMZN), Alphabet (GOOG), Microsoft (MSFT) and Visa (V)—all of which have seen their cash flow soar over the last decade and are still generating strong results.

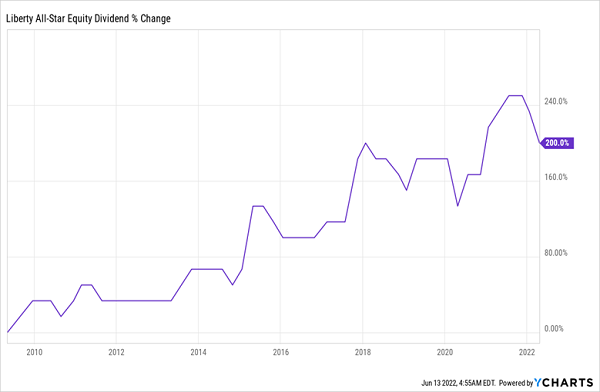

Plus we can get these firms with a 10.9% dividend that’s risen over the last decade.

Soaring Income From a High Yielder

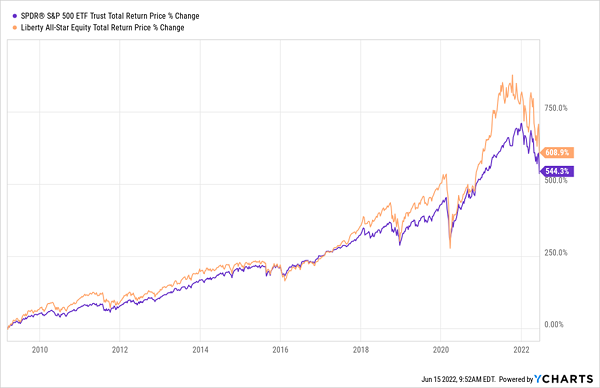

Moreover, USA has the long-term track record we demand when we buy a fund in a market like this, having demolished the S&P 500 since the subprime-mortgage crisis.

USA Delivers Strong Gains (and Dividends) in the Long Run

In terms of valuation, this one trades at something of a “discount in disguise,” at a 2.5% premium that’s actually below the 5% premium, on average, at which it has traded over the past year. And as recently as April, USA’s premium stood at 10%.

Put these three funds together and you’ve got a double-digit yielding portfolio that can help you survive market chaos, thanks to its high 11.8% average yield, while also positioning you for upside when the markets recover—as they always do.

— Michael Foster

URGENT: My Top 4 CEFs Crush Inflation, Trade at Incredible Discounts [sponsor]

Right now—this week—I’m urging investors to buy my top 4 CEF picks. I say that because I freshly updated this list of “battleship” dividend picks, which yield a reliable 8.5% today, pay dividends monthly and are much better deals than the three CEFs above.

Forget paying premiums, as you would with USA and RA: these 4 cash machines sport discounts that could easily send their prices flying 20%+ in the next 12 months if their discounts revert to more normal levels (which they almost always do!).

And even if the market continues to tank, these discounts help mitigate your downside, while you enjoy their rich 8.5% monthly payouts.

This is how dividend investing is supposed to work, especially in a crisis! And these 4 CEFs are the right buys to make it happen for you. The fact that they pay monthly, right alongside our bills, is a nice bonus.

Click here and I’ll give you my complete strategy on CEF investing and tell you more about my top 4 CEF buys for “recession-resistant” (and monthly!) 8.5% dividends and upside.

Source: Contrarian Outlook