Not much has changed in the business outlook for Roku (NASDAQ:ROKU). The world is still transitioning right into its realm of operations. The streaming trend is only getting stronger, so ROKU stock should continue to have tailwinds for years. Based on this simple premise, dips in the stock should be opportunities for new investors.

However, the story is a bit more complex because of extrinsic wrinkles. The last time I discussed the value of the stock, I also warned about the Federal Reserve (Fed) variable. Back then, we didn’t know the extent of the harshness of the new monetary policy. Now we know, so it is clear where the selling pressure is coming from.

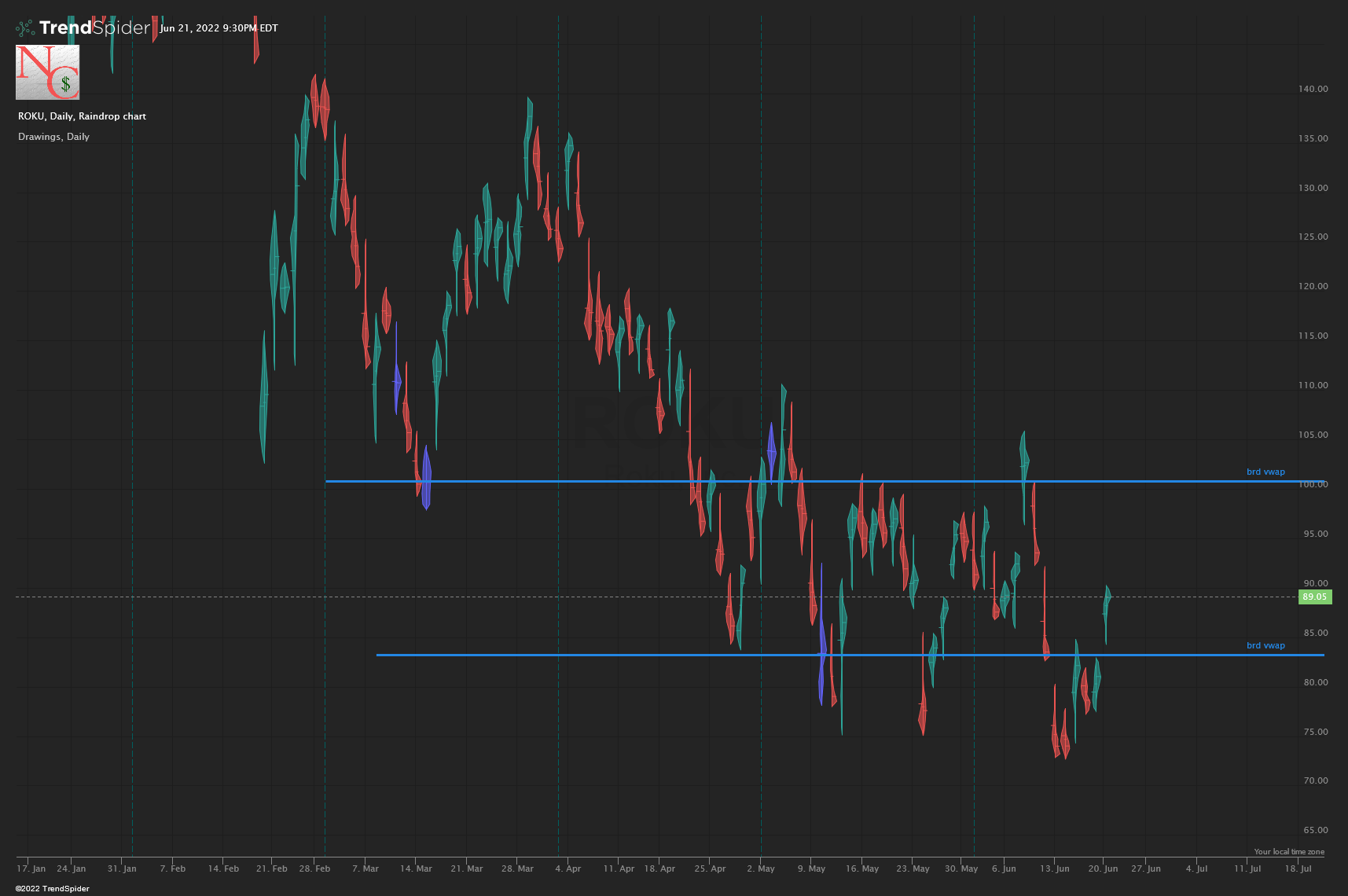

The threats that Fed Chair Jerome Powell poses are immense. They are out to destroy demand since they can’t fix the supply problems. If we can’t make more chips, the Fed wants to make sure that we can’t buy any either. That problem still lingers, but after an 80% correction, I’d say the worst has passed. ROKU stock is now leaner and perhaps meaner for it. Yesterday, it rallied 8% and I am not a fan of chasing. It would be best to buy it on weakness, like on a dip. But if the bulls can maintain above $83, they can have a shot at $105.

ROKU Stock Is Down in Sympathy

Source: Charts by TrendSpider

Source: Charts by TrendSpider

The problems plaguing ROKU stock are external. There is nothing wrong with its operations. Judging by the financial metrics, the company is executing flawlessly. According to Yahoo! Finance, management almost quadrupled the business. In my book, this earns them a pass and all the benefit of doubt they need. They are profitable now and generating $234 million in cash from operations.

Technically, the chart has seen better stints. This is a momentum stock, so I have seen it move violently before. But this unilateral direction without letup is extreme. All such situations eventually end, so investors need to be ready for that moment. The trick is that they don’t ring bells, especially not for fast movers like this one. So, investors must become creative or courageous.

In such cases, I usually resort to the options markets. Instead of buying shares, I can sell puts 30% below to be long ROKU. This way, the stock can fall by more than that and I can still profit. I won’t start losing money until the stock suffers two more recessions. While there are no guarantees of profit, having a buffer of this size affords me some peace of mind.

Get Ahead of the Herd

ROKU stock was a bargain in January, so I definitely still like its future prospects. The business has not yet shown many of the symptoms that the experts are fretting. The consensus is that the global chip shortages will severely disrupt the business. I contend that they have more than accounted for that in the stock price already.

The expert opinions tend to lag. Therefore, there is a good chance that in the next two earnings reports, the fears don’t materialize. If that happens, then analysts will go back to touting potential upside. Smart investors should get ahead of that scenario by taking starter positions. It would be wise not to go all in just in case they are right.

— Nicolas Chahine

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: Investor Place