The world is going digital. Almost every aspect of our daily lives wants to migrate online, and financial institutions have been on the forefront of that idea. Visa (NYSE:V) was an early trendsetter within the credit card concept. In contrast, V stock has fallen 9% in June and 17% in 10 months.

Today we will identify where V stock can find footing inside this correction.

First, we must point out that Visa stock fans are still enjoying over 100% profits in five years. Those who stuck with it for 10 years have over 500% worth of cheering to do. This recent fall was not due to specific Visa-centric problems. Partly it’s the sector, since MasterCard (NYSE:MA) is also down. More so, it’s the indices that have been correcting. Block (NYSE:SQ) and PayPal (NASDAQ:PYPL) are almost down 80% from their highs.

V Stock Is Healthy Still

V stock is down from overall market sentiment — there aren’t any blatant problems with the company. Also, the runway for electronic payments is long, so the demand for its services will only increase. Next we will prove that the financial metrics are still sound.

According to Yahoo Finance, revenues are up more than 30% in five years. Last year Visa delivered $12 billion in net income and $15.2 billion in cash from operations. Management accomplished this while keeping a reasonable valuation. The price-to-earnings ratio is now below the five-year average. Growing fast without creating bloat is a testament to competence.

I may sound eagerly bullish about Visa, but let’s get real. We all know that “cheap” can get cheaper, especially if technical support fails. If V is a bargain now, it can slip another 12% and not change a thing in this writeup.

Investors Should Stay Patient

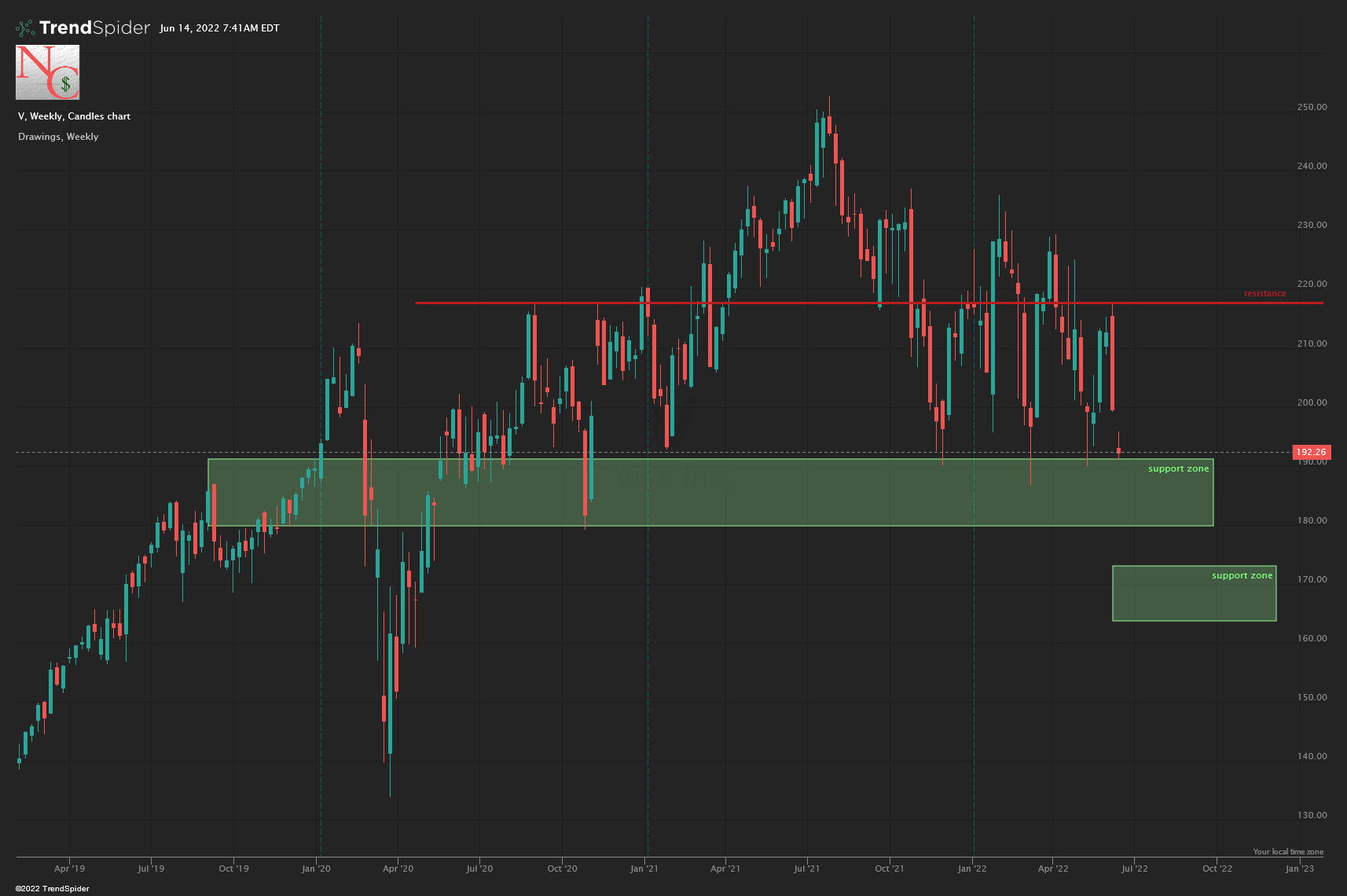

Source: Charts by TrendSpider

Source: Charts by TrendSpider

Support zones on the chart matter, so investors should not panic without just cause. I made this point last year, and it worked. Visa stock is now retesting that thesis under tougher conditions. So far it is holding, just like the last three bearish attacks in the last year.

After emerging from the pandemic bottom, V stock has defended the $185 level vigorously. While this is comforting, those looking for new positions should only consider partial entries for now. My concerns stem from the broader indices and the possibility of them collapsing this month. The old concerns over the taper turned into full blown panic over the Federal Reserve’s economic warfare.

The central bank turned off the free money faucets, and they are now in full quantitative tightening mode. During their last meeting they already raised the overnight lending rates 50 basis points. This week they are likely to raise rates again. Consensus had been for another 50 basis points but rumblings are that they will do more.

Conclusion

I bet that Fed Chairman Jerome Powell’s comments during the Q&A session will matter more. If the experts are correct about the Q/T, the Fed threats are going to crumble the S&P 500 another 600 points.

Judging by the speed of descent since Thursday, this could happen by early next week. Also the downfall of Bitcoin (BTC-USD) is likely contributing to the fintech woes. The two concepts are close relatives.

My simple conclusion for V stock is that it’s worth owning, but not at all costs. I don’t believe that investors would be missing much waiting a few days. At least delay action until Wednesday afternoon, or even better, midday on Friday.

This week is quadruple witching, so we are likely to see volatility persist into Friday. This is a volatile once every quarter event, where many large contracts expire. These are stock-index futures, stock-index options, stock options, and single-stock futures. In the olden days they were just volatile. Now investors believe they are bad, so they brace for impact.

–Nicolas Chahine

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place