FIRE – financial independence/retire early – is a popular concept nowadays. But I actually started chasing after this idea way back in early 2010.

I was fired from my car dealership day job in 2009, during the depths of the Great Recession. I was working in the auto industry in Metro Detroit during the Great Recession.

This was back when the major domestic auto manufacturers were going bankrupt. You almost couldn’t have picked a worse industry in a worse place at a worse time.

I had no job and no money. Actually, I was in debt. It was a scary time. But I used that experience as, well, fuel for my FIRE, you might say.

Because I knew I could never again be so reliant on an employer, where I wasn’t able to pay my bills without a job.

So I picked myself up, devised a plan, and achieved FIRE in early 2016 – just six years after starting out. A huge part of my success was the investment strategy I used… and still use.

Today, I want to tell you about the ultimate investment strategy for FIRE. Ready? Let’s dig in.

Today, I want to tell you about the ultimate investment strategy for FIRE. Ready? Let’s dig in.

I’m going to tell you all about dividend growth investing and why it’s the ultimate investment strategy for FIRE. I’ll give you five reasons why dividend growth investing is basically a perfect match for achieving and maintaining FIRE.

The first reason is because dividends are incredibly reliable.

If you’re going to quit your job in favor of living off of investment income, you need to know that the income is going to be reliable.

Quitting a job can be almost as scary as getting fired. Because in both cases, you’re losing the paycheck. But here’s the truth of the matter: A paycheck isn’t as reliable as you might think. I found that out the hard way. And a lot of other people have found this out the hard way for themselves over the years. A paycheck can be fairly reliable when times are good. When times aren’t so good? Yeah, not so reliable. The days of starting out at the local company straight out of school and retiring there with your gold watch in your 60s are long gone.

On the other hand, dividends are way, way more reliable than a paycheck.

I know. Sounds crazy. But it’s true. A paycheck is fickle. Dividends are anything but fickle. I mean, companies are constantly right-sizing their workforces, based on a myriad of continuously-evolving factors. Dividends, however, are almost always viewed as being sacrosanct. When you look at a lot of companies out there, management often owns a lot of shares. And trust me, they don’t want to see their own income cut.

And compared to just buying an index fund during your working years and then slowly selling off shares once you achieve FIRE in order to produce cash flow, dividends are way more reliable. Not only do you not need to worry about potentially running out of money but the act of selling off shares of index funds is not even all that reliable. Who wants to worry about selling during a big market downturn, like we’re now experiencing?

The market is extremely volatile and definitely not reliable, so relying on the market is the complete opposite of relying on non-volatile dividends. By the way, selling off more shares to produce the same amount of income during periods of heightened volatility is concerning and endangers the long-term viability of FIRE. See, you need reliable income, which is why dividends are so great. This reliability is so important because… well… guess what else in life is reliable?

Bills. Bills are very reliable.

Yep. Bills are relentless. Housing, transportation, food, etc. It never ends. Well, you want to match relentlessly reliable bills with relentlessly reliable income. And that’s why dividends are so great. Want irrefutable evidence of relentless reliability?

Okay. Here you go. Companies like Coca-Cola (KO), Procter & Gamble (PG), and Exxon Mobil (XOM) have all been reliably paying dividends for more than a century. We’re talking about more than an entire average human lifetime here. If that’s not reliable, I don’t know what is.

Okay. Here you go. Companies like Coca-Cola (KO), Procter & Gamble (PG), and Exxon Mobil (XOM) have all been reliably paying dividends for more than a century. We’re talking about more than an entire average human lifetime here. If that’s not reliable, I don’t know what is.

The second reason why dividend growth investing is the ultimate investing strategy for FIRE is because of the passivity of dividends.

Dividends are as passive as income can possibly get.

There’s nothing else out there that has the passivity of dividends. Once you own stock in a company that pays a dividend, there’s literally nothing you have to do in order to collect your passive dividend income. You wake up and get paid. It’s that easy. It’s a one-and-done that you won’t find anywhere else.

No phone number to call, email to write, or form to fill out. No action to take, whatsoever. If we go back and compare it to slowly selling off shares of funds that you built up during your working years, that requires action on your part. Even that isn’t as passive as just straight up collecting dividends.

The dividends just show up in your brokerage account while you go about your life.

It’s a beautiful thing. I own shares in more than 100 different businesses. And because US-based companies usually pay a dividend every quarter – or every three months – I’m collecting around 400 dividends per year. It’s a dividend a day. And as the old saying goes – a dividend a day keeps the unwanted job away.

Or is the old saying about an apple and a doctor? Anyway, a paycheck certainly can’t compete with this level of passivity. A job requires you to exchange your time for money. A dividend is 100% pure passive income. Nothing can compete.

Rental properties? Nope. An online business? Not even close.

Owning rental properties sounds like passive income. But from scouting properties to securing lending to managing tenants, it’s simply not all that passive. And I’ve run online businesses myself. It’s not passive at all. I really enjoy online projects, including helping to produce the very video you’re watching.

But any income I derive from this activity is not passive. Now, this isn’t to say that there aren’t a lot of great ways to make money in life. Certainly, I think many of these avenues are far superior to a job and a paycheck. But when it comes to pure passivity, nothing beats dividends.

The third reason why dividend growth investing is the ultimate investment strategy for FIRE is because it guides you into the best businesses on the planet.

Dividend growth investors are almost forced into investing in world-class businesses.

After all, what is dividend growth investing? Well, it’s a strategy that espouses investing in businesses that pay reliable, rising dividends to shareholders. In order for a stock to even be considered by a dividend growth investor, there has to be many consecutive years of dividend raises present. And how are reliable, rising dividends funded? By producing reliable, rising profits. And what kind of businesses can produce reliable, rising profits and pay out reliable, rising dividends… for years on end? World-class businesses.

Dividend growth investing acts like a filter.

That’s right. It filters out lower-quality businesses that can’t produce the reliable, rising profits necessary to fund reliable, rising dividends. It weeds out the poor business models that can’t compete and endure. Charlie Munger, billionaire investor and Warren Buffett’s right-hand man, likes to invert problems to find solutions.

Well, let’s say you want to be a successful investor who achieves and maintains FIRE. If you invert this and try to find the wrong answer, you would probably say the way to surely not be a successful investor who achieves and maintains FIRE is to invest in unsuccessful companies and poor business models.

Dividend growth investing also acts a litmus test for two things.

First, it shows you which businesses can afford to pay a growing dividend. Second, it shows you which companies value their shareholders enough to share with them their fair share of growing profit. It’s about both wherewithal and willingness. Let’s be honest here. Publicly-traded companies are owned by shareholders. When you buy shares in a company, you’re now a part-owner. And you should think like an owner.

Any profit that is generated is, technically, your profit. And you should collect a portion of it. If a company can’t afford to pay a growing dividend, or doesn’t value you enough to give you your rightful share of growing profit, why invest at all?

The fourth reason why dividend growth investing is the ultimate investment strategy for FIRE is because of growing dividends.

It’s right in the name. This is dividend growth investing.

Let me circle back around to a point I made earlier on bills. Bills are relentlessly reliable, right? Well, you know what else is relentlessly reliable? The way in which your bills go up, year after year. Everything gets more expensive over time. With hot inflation suddenly a global headline, this has never been a more obvious or more painful issue for people. Well, if you want to maintain FIRE – not just achieve it – you need to make sure your income can keep up with rising expenses.

Passive income is wonderful. But it isn’t so wonderful if it’s not growing.

And not just growing but growing at a rate that’s in line with, or faster than, the rate of inflation. That’s because you need to make sure your purchasing power stays intact, or even grows. Achieving FIRE is awesome. It’s an applaudable attainment. Achieving FIRE happens when your passive income meets or exceeds expenses. But achieving FIRE is only the start. You need to maintain FIRE. Because the last thing you want to do is head back to the day job after leaving. And that would require your passive income to relentlessly rise in the same way your expenses will. But have no fear. I have good news for you.

Many high-quality dividend growth stocks increase their dividends at rates that exceed the rate of inflation.

Inflation is a hot-button issue right now. We’re talking about 8%+ YOY inflation in the US right now. That’s as high as I’ve ever seen it. However, many high-quality dividend growth stocks are increasing their dividends at rates far higher than this. In fact, double-digit annual dividend growth is not an uncommon feature among some of the best businesses in the world, which speaks on my earlier point about investing in great businesses in the first place.

What do American Tower (AMT), Lockheed Martin (LMT), and Nike (NKE) all have in common? All three companies have increased their dividends at compound annual rates exceeding 10% over the last 10 years. Even better? These raises have the same passivity as the dividends themselves. You do nothing to get “pay raises”. Compare that to a day job, where you have to work really hard in order to get pay raises. This really can’t be beat.

The fifth reason why dividend growth investing is the ultimate investment strategy for FIRE is because it tends to beat the market over the long run.

This is icing on top of an already delicious cake.

I’ll be honest. I never had a big goal to outperform the market. My goal was to achieve FIRE ASAP. I wanted to make sure I could live without a job, productivity, or active income of any kind at a very young age. I needed that kind of freedom and autonomy in my life. So outperforming a particular index or some other investor out there wasn’t important, because it didn’t have any impact on my goal. That said, I’ll never turn down outperformance if it comes my way.

Well, outperformance is exactly what dividend growth investing can offer you.

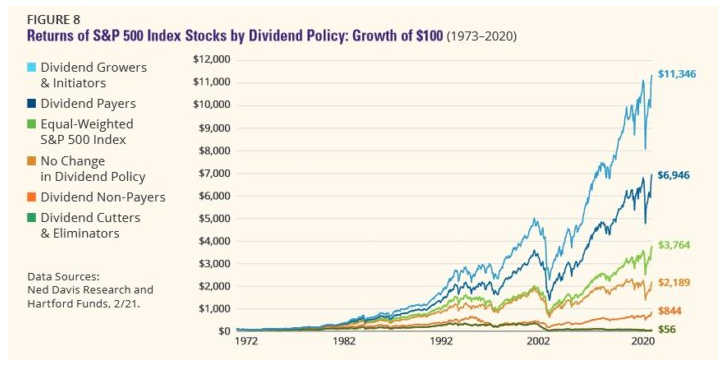

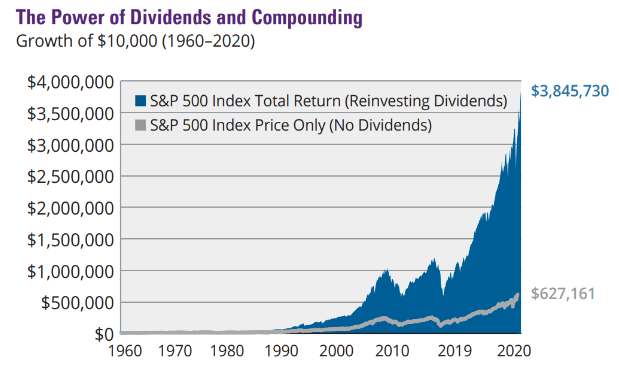

Per Ned Davis Research, Dividend Growers & Initiators provided returns that trounced the returns of Dividend Non-Payers, as well as the S&P 500 equally weighted, between 1973 and 2020. It’s not a surprise. Reinvested dividends account for the vast majority of the S&P 500’s total return over the last five decades. And that’s not a surprise, because of the filter and litmus test I touched on earlier. All of this is complementary and interrelated. FIRE is the cake. Outperformance is the icing. But here’s the thing. Dividend growth investing is so perfect for FIRE because of the way high-quality dividend growth stocks work.

High-quality dividend growth stocks are like the golden geese that lay ever-more golden eggs.

High-quality dividend growth stocks are like the golden geese that lay ever-more golden eggs.

You simply collect your ever-larger pile of dividends from the golden geese that are world-class businesses. You don’t kill the golden geese by selling shares, which would risk eventually running out of money. No. You go out and live your life and pay for ever-higher expenses with this ever-larger pile of dividends. It’s so intuitive and simple. It’s almost nonsensical to consider alternatives. After achieving FIRE six years ago and living off of growing dividends from high-quality dividend growth stocks, I must say that dividend growth investing is the ultimate investment strategy for achieving and maintaining FIRE.

— Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

The goal? To build a reliable, growing income stream by making regular investments in high-quality dividend-paying companies. Click here to access our Income Builder Portfolio and see what we’re buying this month.

Source: DividendsAndIncome.com