Dividend growth stocks are one of the more favored classes of stocks that investors want to hear about. For this week’s subscriber request series, I was asked to cover over 60 stocks. 41 of the 60 were dividend growth stocks and the remainder non-dividend paying growth types.

Since there are so many companies to cover, I am only providing a cursory look or brief overview of each. There are some very intriguing companies that are attractively valued with good long-term histories and attractive dividend yields in the group.

There are also some that I would not consider for various reasons. It might be because of the poor historical record, significant current overvaluation or anything and everything in between. Throughout the video I will offer brief commentary on what I see and what I think about each selection I go over.

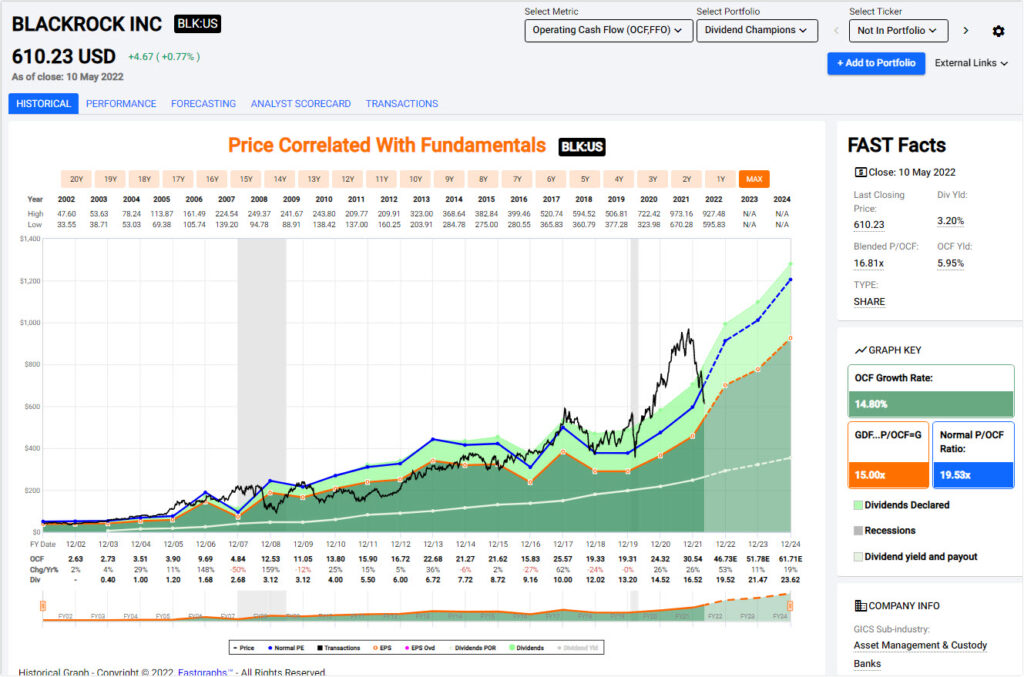

In this FAST Graphs analyze Out Loud Video I will go over Blackrock (BLK), ACCO Brands (ACCO), Amcor (AMCR), Bank of America (BAC), Bristol Myers Squibb (BMY), Blackstone (BX), Caterpillar (CAT), CME Group (CME), Capital Southwest (CSWC), Dicks Sporting Goods (DKS), Dow (DOW), EBAY (EBAY), Ford Motor (F), FedEx (FDX), Genpact (G), Graco (GGG), Goldman Sachs (GS), HDFC Bank (HDB), Honda Motor (HMC), Intercontinental Exchange (ICE), Infosys (INFY), JP Morgan Chase (JPM), Kraft Heinz (KHC), Manpower Group (MAN), Manulife Financial (MFC), Altria Group (MO), Morgan Stanley (MS), Potlatchdeltic (PCH), Primerica (PRI), Reinsurance Group of America (RGA), Riley B Financial (RILY), Snap On (SNA), S&P Global (SPGI), Strategic Education (STRA), AT&T (T), Truist Financial (TFC), T Rowe Price (TROW), Toro (TTC), United Parcel Service (UPS), Verizon (VZ)

FAST Graphs Analyze Out Loud Video

— Chuck Carnevale

Source: FAST Graphs