McDonald’s (MCD) stock soared to fresh all-time highs to start May as investors dive into the safety and stability that the global fast-food power provides during an increasingly uncertain economy. Wall Street is also cheering on MCD’s corporate restructuring, Q1 earnings results, and more.

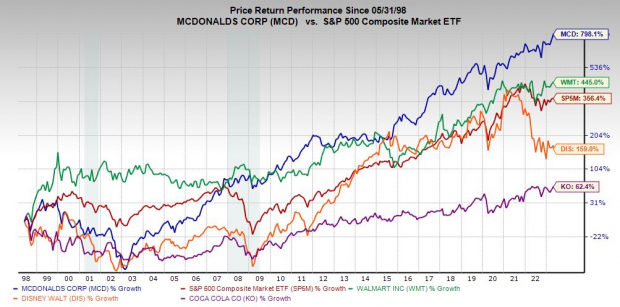

McDonald’s boasts an impressive track record that’s seen it power through multiple recessions and crush the market and many fellow historic corporate giants such as Walmart, Coca-Cola, and Disney over the last 25 years.

The Dividend Aristocrat is also prepared to shine as digital apps shake up the restaurant industry. In fact, the McDonald’s app was downloaded by more people globally in 2022 than Uber Eats and DoorDash combined—and it left all other restaurant chains in the dust.

A Beacon of Stability & Evolution

McDonald’s hasn’t needed an introduction almost anywhere on the planet in decades. MCD’s footprint includes around 40,000 locations in over 100 countries, with roughly 95% of its stores owned by franchisees.

The hamburger chain slowly tweaks its menu over the years, while keeping it remarkably consistent. Customers keep coming to McDonald’s, in large part, because they know exactly what they are going to get, which is something Wall Street loves about MCD stock too.

The McDonald’s brand consistently ranks in the top 10 to 15 globally alongside the likes of Apple, Disney, Coca-Cola (KO), and Nike. Rarely do you find any direct McDonald’s competitors near the top of these lists, which tells investors a ton. MCD has remained unwaveringly itself for decades while also slowly and subtly adapting and evolving.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

McDonald’s hasn’t lost a step with older generations, while catering to younger people by rolling out digital point-of-sale kiosks, adding new on-trend menu items, and completely embracing mobile ordering and delivery. The Chicago-based company said recently that its efforts to speed up ordering and improve the customer experience are helping MCD eat away market share from rivals.

Despite the supposed health-food craze, the fast-food pioneer remains at the forefront of brand building and even app development. The McDonald’s app was downloaded 127 million times worldwide in 2022, according to Apptopia to crush Uber Eats’ (UBER) 60 million, DoorDash’s 42 million, and Starbucks’ (SBUX) 34 million.

Recent Growth and Outlook

McDonald’s posted 10.9% global comparable sales growth in 2022, which came on top of 17% YoY expansion in the key metric in 2021. MCD’s adjusted earnings climbed roughly 9% and 50%, respectively during this same stretch. The restaurant juggernaut carried over this momentum into 2023, with its Q1 comps up 12.6% and adjusted EPS 15% higher.

McDonald’s topped our Q1 EPS by 14% on April 25 and it boosted its guidance in the face of lingering inflation and recession fears. MCD is classified as a Consumer Discretionary firm in terms of S&P 500 categories, alongside Amazon, Tesla, Home Depot, Nike, and others. McDonald’s is clearly much more of a consumer staples firm than any of these other names and it boasts the pricing power to prove it.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

McDonald’s has raised prices almost across the board at most locations to help it adapt to the new inflationary environment, with customers shaking off higher costs as they remain competitive. MCD attributed its strong first quarter performance to a “healthy balance of strategic menu price increases and positive traffic growth.”

Zacks estimates call for MCD’s adjusted FY23 earnings to climb 9% and then pop another 10% higher in 2024 to reach $12.04 per share. Some of the bottom-line expansion can be attributed to its corporate restructuring efforts and other initiatives aimed at streamlining high-level operations that McDonald’s executives admitted had become bloated, complex, and redundant over the years.

McDonald’s positive EPS revisions since its April release help it land a Zacks Rank #1 (Strong Buy). Zacks estimates call for another 4.7% global comparable sales growth in 2023, alongside 7% total revenue expansion both this year and next to see it pull in $26.59 billion in FY24.

Other Fundamentals

McDonald’s is one of around 70 S&P 500 Dividend Aristocrats. These are companies that have both paid and raised dividends for at least 25 straight years. MCD’s dividend currently yields 2.06% and it has boosted its payout by 7% annualized over the past five years.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

It takes a lot of work to become a Dividend Aristocrat and companies such as McDonald’s will do everything in their power to keep raising payouts no matter what the economy looks like. This is part of the reason why MCD is likely a staple in many balanced portfolios.

One of the nearby charts showcases that McDonald’s stock destroyed Walmart (WMT), Coca-Cola, and Disney (DIS) over the past 25 years. MCD’s roughly 800% surge more than doubled the S& 500’s 356% run and topped its Retail–Restaurants industry’s 665% climb. MCD continued to outshine the benchmark over the last five years and it has ripped 65% higher in the last three years vs. the S&P 500’s 43% and its industry’s 47%.

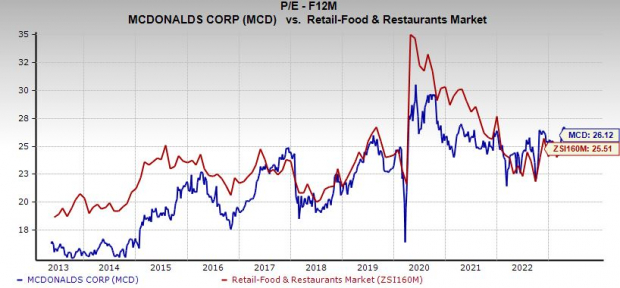

Investors have proven they are more than willing to pay up for the consistency McDonald’s provides. MCD trades at 26.1X forward 12-month earnings vs. the benchmark’s 18.2X. MCD crucially trades at a 14% discount to its own post-covid peaks and just slightly above the Retail– Restaurants’ 25.5X despite its historic outperformance. The Retail–Restaurants industry also currently ranks in the top 17% of over 250 Zacks industries as the space proves highly capable of adapting to inflation and a slowing economy.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

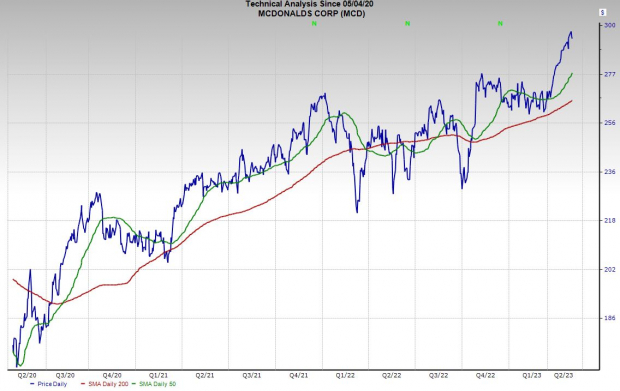

McDonald’s stock recently broke out of a trading range it had been stuck in for months to send MCD to fresh records to start May. MCD is up roughly 12% in 2023, including a 13% run since early March. And McDonald’s is trading well above its 50-day and 200-day moving averages again.

McDonald’s still trades roughly 6% below its average Zacks price target, and around 80% of the 24 brokerage recommendations Zacks has are “Strong Buys” or “Buys,” with no sells. Wall Street and customers know what to expect from MCD and they will keep coming back for more.

— Benjamin Rains

Want the latest recommendations from Zacks Investment Research? [sponsor]Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks