I screened for 248 semiconductor stocks and semi-conductor equipment subsectors. Interestingly, long-term operating histories of most of the companies in these subsectors were very similar. One of the attributes commonly found was a high degree of cyclicality.

Additionally, as the role of technology has grown, so have the earnings and cash flows of semiconductor companies. However, over the last 10 years or so earnings growth was unsustainably high. Consequently, this abnormally high growth instigated irrational exuberance in the minds of many investors.

This drove the stock prices of many companies towards dangerous overvaluation levels. Nevertheless, now that growth rates are expected to be more normal and realistic, stock prices are beginning to correct to more reasonable levels.

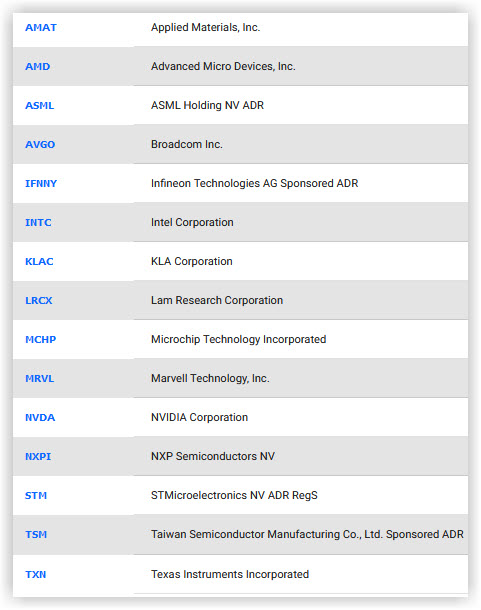

In this video, I covered 15 high profile semiconductor stocks. It is almost uncanny to see how they have mostly corrected in tandem. The moral of the story here is that we can learn a great deal from the past. On the other hand, it is only the future that we are capable of investing in. Therefore, as investors we need to be careful about how we assess the future potential of these companies and more importantly that we calibrate our valuations accordingly.

Applied Materials (AMAT), Advanced Micro Devices (AMD), ASML Holding (ASML), Broadcom (AVGO), Infineon Technologies (IFNNY), Intel Corp (INTC), KLA Corp (KLAC), Lam Research (LRCX), Microchip Technology (MCHP), Marvell Technology (MRVL), Nvidia Corp (NVDA), NXP Semiconductors (NXPI), STMicroelectronics (STM), Taiwan Semiconductor (TSM), Texas Instruments (TXN)

FAST Graphs Analyze Out Loud Video

— Chuck Carnevale

Source: FAST Graphs