Wall Street investors have been on edge for a long while. There are faint signs this week that the volatility has already peaked. This is not to say that the threats have receded, but rather their effect on stocks is fizzling. Meanwhile, the pendulum swings are still large, but narrowing. Today the focus is on a relatively calmer bunch of stocks. The goal is to find three dividend stocks to buy to combat runaway inflation.

In spite of sentiment, the symptoms of the risks at hand are healing For instance, the CBOE Volatility Index was up slightly.

Under such conditions, it becomes easier to find bargain stocks. But for today, that is not as important as the dividends they pay. The task of finding fixed income has become much easier after the recent run-up in yields. The U.S. 10 Year Treasury, for example, now pays a 2.3% reward. Technically, yields have more room to run, but I would bet against a complete runaway. The effects of TINA will matter more the higher they go.

The TINA acronym stands for “there is no alternative.” It should remain in effect for as long as the differential between U.S and other bonds is so large. Besides, this is not nearly enough to offset the effects of inflation. Therefore, investors must pursue extra risk just to stay even. Luckily, there are stocks that yield a much higher percentage than even the highest U.S. bond.

Not All Dividend Stocks Are Foolproof

It is important to choose equities that have little downside risk in the short-term. This is because collecting a high premium can lose its effectiveness if we chase runaway stock prices. The oil sector, specifically Chevron (NYSE:CVX) and Exxon (NYSE:XOM) come to mind. You will not find me suggesting to buy such stocks for a bit of dividend income. The companies are excellent, but their runaway rallies leave large downside potential.

Conversely, I prefer high dividend stocks that are near support. It is even more important to pick companies that have strong financials and a long history on Wall Street. I would caution against buying stocks that yield double digits. Those rarely last and often end in tears.

The three dividend stocks to buy on my list today have almost nothing in common. Therefore, they would make for an excellent basket in the same portfolio. Earlier, I noted that volatility levels are falling. But I reemphasize that the geopolitical threats are still real and very high. The situation in Ukraine could be far from over, so investors need to make room for error.

The U.S. Federal Reserve (Fed) is also a threat because they will be aggressive in trying to cool the hot economy. Luckily, the macroeconomic conditions are still near record levels. Companies are reporting record sales even when their stock falls, like Adobe (NASDAQ:ADBE).

Without further ado, here are the three dividend stocks to buy for the next few months:

- AT&T (NYSE:T)

- ZIM Integrated (NYSE:ZIM)

- USD Coin (USDC-USD)

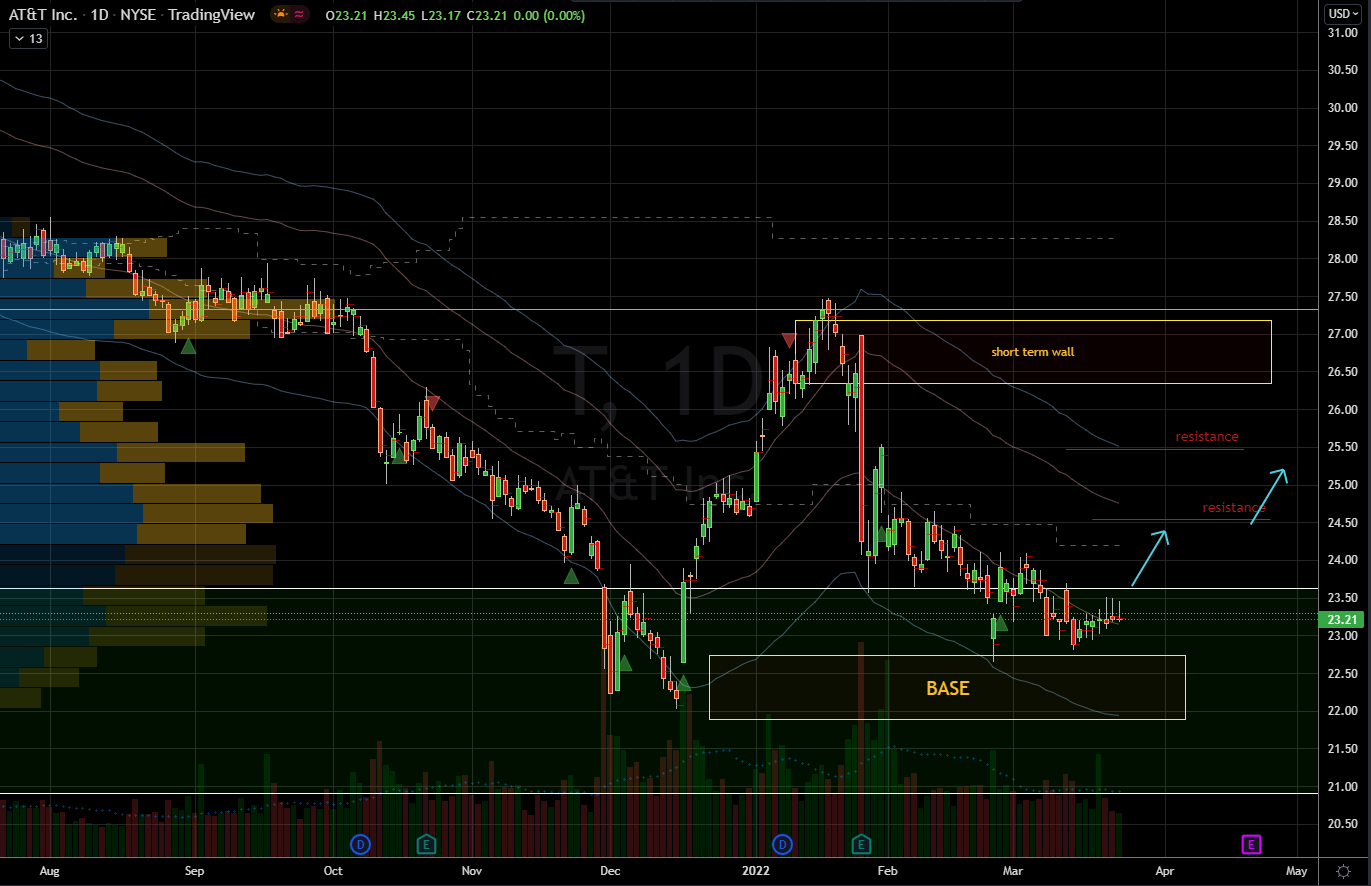

Dividend Stocks to Buy: AT&T (T)

Source: Charts by TradingView

Source: Charts by TradingView

AT&T has a long history of success under its belt. But for the last few years, they have had a few misses, so the stock has suffered. As a result and even after a dividend cut, T stock still offers a 9% reward for its owners. That is as high as I want from a major mega-cap company. Since they’ve already cut the dividend, there is no guarantee that they won’t do it again.

Unlike Chevron and Exxon who have vehemently defended theirs, investors in AT&T don’t have assurances. Nevertheless, there are signs that management is doing well in righting its ship. It is on track to regain investor confidence. Coming out of the pandemic, most companies were managing tight cash flow situations. Under current conditions, I don’t see the potential for a dividend cut without a severe deterioration in the business.

Currently, AT&T is still a financial beast generating $66 billion in gross profit and $42 billion in cash from their own operations. Even at high debt levels, this should be ample to service their commitment to the dividend. Moreover, T stock is in a multi-year swoon, so it has the opportunity for a long-term recovery from that. Its February lows were higher than December, which is better than the entire market. That relative performance bodes well for the future.

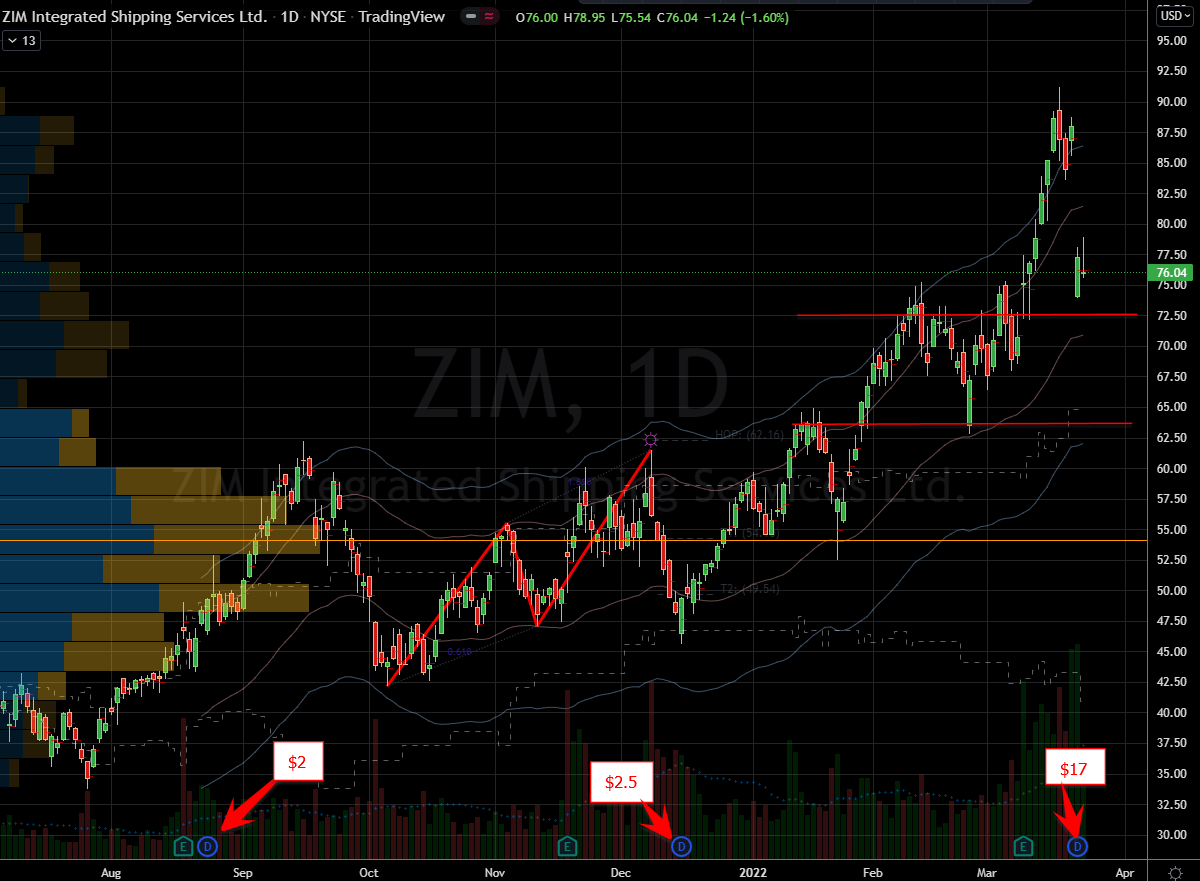

ZIM Integrated (ZIM)

Source: Charts By TradingView

Source: Charts By TradingView

ZIM stock made headlines this week because of its $17 dividend payout.

I was long the stock until two days ago. I closed my position just before the dividend payout. I know it sounds crazy, but my trade was with options. Had I not done that, it would have left me liable for paying the dividend.

Now that the stock has shed the special payout premium, investors can reconsider it long. The crash this week brought it into support and will soon start to make sense to own as an investment. While they may not pay another $17 for a long while, they still do pay a substantial dividend. The two prior payouts were over $2 each on a $50 stock base.

Usually, when companies pay a high dividend, I worry about the reason behind it. In this case, their financial statements show a solid footing. In 2021, they generated almost $6 billion in cash from operations. Business must be good, so they are likely to pay well again.

When a company is comfortable giving $17 back to its shareholders, it inspires investor confidence.

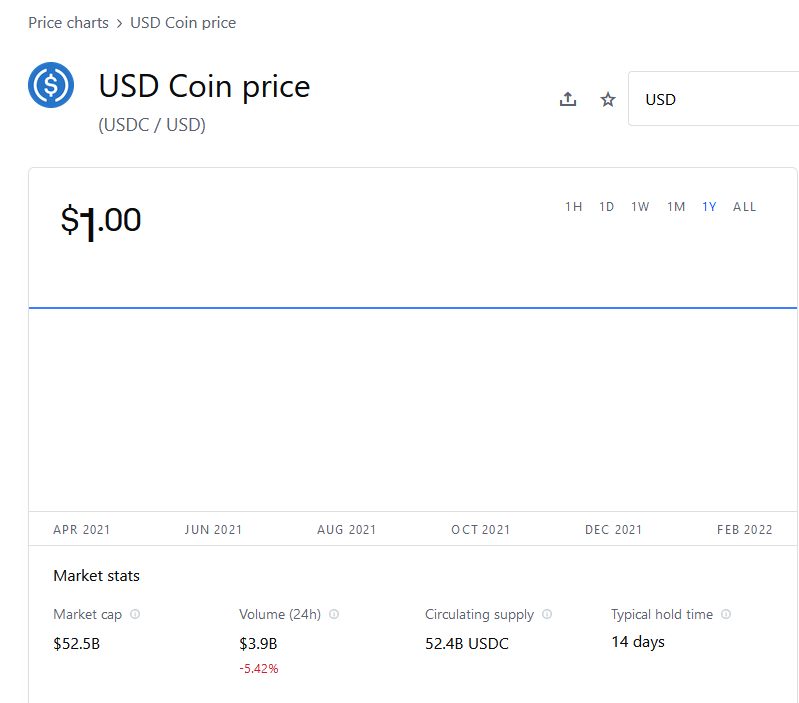

USD Coin (USDC)

Source: Charts by CoinBase

Source: Charts by CoinBase

My last pick today will surprise many because it is a crypto coin. Yes, I am a holder of USD Coin and it has been rewarding me extremely well. On the crypto.com platform, I can stake my USDC coin and collect a 10% annual reward. My commitment is only for three month lock periods. The process is painless and I can do it right from my phone in seconds.

I consider this a trade with sure 10% results unless the company goes bankrupt. This is a stable coin, so USDC value tracks one U.S. dollar. Therefore, I don’t have to worry about the wild price action in crypto. This is one way to fight inflation in this crazy environment.

So far, the Fed action has been brutal on fixed income investors. They recently restarted a rate hike cycle, which should revive some alternative dividend income for them. However, I find comfort in diversifying my portfolio with this non-central source of income. You just can’t get more decentralized than a decentralized currency.

The process of investing in crypto and staking has been rewarding financially and otherwise. The term “staking” is the part that earns the dividend. Think of it like the old school CD accounts, minus the Federal Deposit Insurance Corporation part. I encourage you to read up on the subject because eventually we will all be dealing with electronic currency. This is one that is setting the framework for what is to become the norm later.

— Nicolas Chahine

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place