Investing in biotech stocks often comes with huge risks and rewards, as a company is dependent on its pipeline and royalty payments. It can also take years to develop a treatment or drug, which can burn through cashflow until approved by the Food and Drug Administration.

One such company that remains unprofitable but has a bright future could be BioCryst (BCRX). In short, the company develops novel, oral small-molecule medicines that inhibit enzymes that play a key role in the biological pathways of rare diseases.

The company has two products on the market and has built a world-class sales team to launch and market them. The first is Orladeyo, a treatment for hereditary angioedema (HAE) that is available in the United States and Europe. Hereditary angioedema is a rare genetic disorder that can cause attacks of painful, disabling swelling throughout the body.

BCRX’s other treatment, Rapivab, that has been approved and is used for the treatment of acute uncomplicated influenza in patients six months and older who have been symptomatic for no more than two days.

Another drug, Galidesivir, is in clinical trials for the treatment of viruses that pose a threat to health and national security that include COVID-19, Ebola, Marburg, Yellow Fever, and Zika.

BCRX is also working on REDEEM-1 and REDEEM-2 for the treatment of patients with paroxysmal nocturnal hemoglobinuria (PNH). PNH is a rare, life-threatening blood disease characterized by the destruction of red blood cells, as well as the development of blood clots and impaired bone marrow function.

If all of these collaborations come to fruition, BCRX could become the next rare disease giant in the industry.

Wall Street analysts believe the company could post a loss of $0.30 to $2.08 per share for 2022, with the average estimate at a loss of $1.28.

Wall Street analysts believe the company could post a loss of $0.30 to $2.08 per share for 2022, with the average estimate at a loss of $1.28.

However, revenue estimates range from $260 million to $324 million, with 2023 revenue possibly clearing $400 million.

Of the 10 analysts who cover the stock, two have given strong buy recommendations, five buys, two holds, and one has given BCRX an underperform rating.

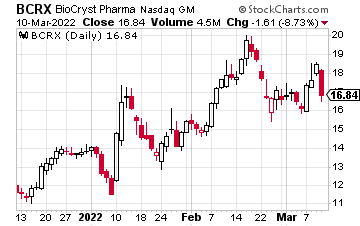

On a technical basis, the chart below shows near-term resistance at $18.50-$19 with the current 52-week peak at $19.99. Support is at $17.50-$17.

BCRX’s all-time high, reached in August 2000, is north of $31.94. If shares can clear and hold $20 there could be little resistance in making a run towards $25-$30. Of course, if there is any negative news from clinical trials in some of the treatments under development, shares could easily fall back to the mid- to low-teens.

— Rick Rouse

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley