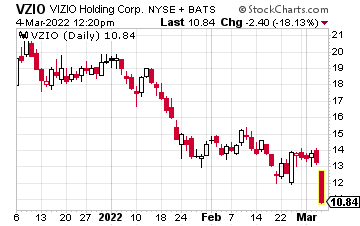

VIZIO Holdings (VZIO) shares are trading near their recent 52-week low—south of $12—following the company’s initial public offering (IPO) of $21 in March of last year. At the time, the company priced just over 12 million shares at $21-$23 in its debut; after the deal, the size was reduced from 15 million shares.

In its first day of trading, VZIO shares opened at $19.50 and traded to a high of $23 before settling at $20.75. For investors looking to take advantage of the shift of TV viewing and ad dollars from linear to streaming, shares could be at an attractive entry level.

Vizio’s Smart TV allows viewers to search, discover and access a broad array of content. The company is also the developer of an operating system for TVs called SmartCast. The platform gives content providers more ways to distribute their content and advertisers more options to target and dynamically show ads.

The SmartCast operating system also offers investors a way to get exposure to the connected TV ad market. This particular business sector is projected to grow from $9 billion in 2020 to roughly $28 billion in 2025.

In early November, the company reported a loss of $0.10 per share on revenue of $588 million. For the current quarter, Wall Street is expecting a loss of $0.18 per share on revenue near $700 million.

Eleven analysts currently follow VZIO, with four strong buy ratings, six buy ratings, and one hold rating. The price targets range from $16–$29 per share with the high end more than double current levels.

The chart below shows key support at $13 with a close below this level signaling another pullback towards the $12 area. Key resistance is at $14.

Near-term options are available to trade on VZIO, but it might be best to wait until after the company announces earnings, so you can to get a better outlook on what the company says about fiscal year 2022.

Near-term options are available to trade on VZIO, but it might be best to wait until after the company announces earnings, so you can to get a better outlook on what the company says about fiscal year 2022.

This type of price action can be typical for IPOs, but the company’s fundamentals should improve over time.

Analysts expect Vizio will post a full-year profit on revenue north of $2 billion. If the company reaffirms this outlook, shares could be a bargain at current levels.

— Rick Rouse

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley