Finding attractively valued and high-yielding investments is difficult in the current market and economic environment.

With this video I present two high-yielding master limited partnerships (MLPs) and 5 real estate investment trusts (REITs) offering yields averaging more than 5%. In addition to high yield, each of these REITs and MLPs can be purchased at attractive valuations today. That is rare and difficult under the current environment.

Importantly, I believe that investors should always be investing with their eyes wide open. Consequently, I want the viewer to recognize that investments offering these kinds of yields are riskier than best-of-breed blue chips.

However, that does not simultaneously mean they are of extremely high risk. Risk is relative and more importantly can be mitigated via research and prudent valuation. I believe the risks associated with these 7 high-yielding REITs and MLPs are greatly mitigated by the attractive valuations. Stated more commonly, the risks are in the price.

I offer these high-yielding securities as well-positioned research candidates. I further offer them to potentially be utilized to turbocharge an income portfolio.

In other words, they can be selectively included in a well diversified and well-constructed portfolio designed to meet specific income objectives.

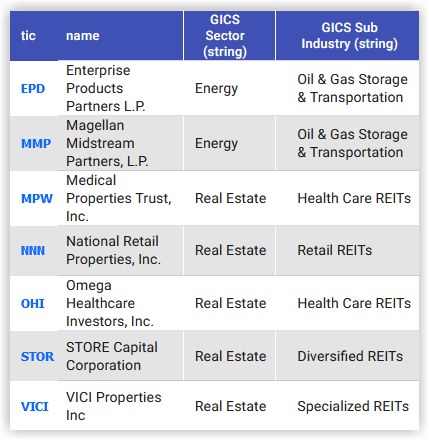

Enterprise Products Partners (EPD), Magellan Midstream Partners (MMP), Medical Properties Trust (MPW), National Retail Properties (NNN), Omega Healthcare Investors (OHI), Store Capital Corp (STOR), VICI Properties (VICI).

FAST Graphs Analyze Out Loud Video

— Chuck Carnevale

Source: FAST Graphs