The markets have bounced back once again, but we’re not out of the woods yet.

Since their latest highs, the DOW, the S&P 500, and the Nasdaq Composite have all dipped into correction territory – only to bounce back. But their bounces haven’t cleared enough hurdles to signal a resumption of the bull market.

In fact, the numbers and narratives investors hung their hats and hopes on are anything but positive. The stage is set for a quick and ugly selloff that could take markets even lower, but there’s a way to protect yourself.

I’ve dedicated today’s Total Wealth to exploring how we got here and what you can do about it.

From Record Highs to Frightening Lows

We’ve come a long way, the wrong way, from the market’s very recent record highs. Early in January, the three major indices, the Dow Jones Industrials Average, the S&P 500, and the Nasdaq Composite, all broke records…

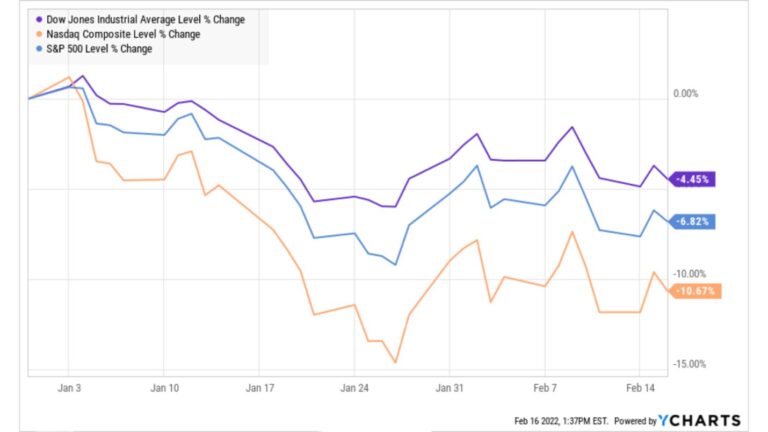

Then they dropped. And then, bounced back up again, but not quite high enough. Just look at the chart below. It follows the changes to these indices since January 1 as a percentage.

As you can see, each broke above its previous high around January 4, only to drop, bounce, then drop again several times since the year began. Now, the Dow is nearly equidistant from its all-time highs as it is to its January lows. As for the other two, the S&P 500 is 1.4 percentage points closer to its lows than its highs, and the Composite almost 5 percentage points closer to its lows than its highs.

The three measures of what we call “the stock market” look poised to weaken – not strengthen.

On the one hand, being closer to their lows means any and all “up-days” are going to have to be convincing in terms of breadth, volume, and which sectors lead indexes higher. On the other, it won’t take much for the benchmarks to drift lower or slide back to test support at their January 24 lows.

That’s because the narratives investors glom onto are increasingly negative, and those that were just positives are being recast as old news.

The Stories that Made the Markets

The markets sold off in anticipation of a possible Russian invasion of Ukraine – but news of de-escalation prospects seemed to bring buyers off the sidelines.

Consumer staples have been bid up on conflict fears. If global buyers of Russian oil boycott the country’s oil producers, well-positioned traders would make a neat profit off rising prices in the energy sector. Oil hit an 8-year high on Monday as a result.

Even if Russia pulls all its troops back and barracks them, removing any potential conflict from investors’ front burner issues, they have the Fed’s war on inflation to worry about.

Not only were the latest headline and core CPI and PCE numbers worse than expected – revealing inflation to be the highest it’s been in 40 years – retail sales on Wednesday showed an unexpectedly high 3.8% gain. And this got analysts talking about how consumers were stepping up purchases in anticipation of even higher prices in the future.

And last but not least, earnings numbers for the fourth quarter, with more than 85% of S&P 500 companies reporting, point to record earnings of close to $55.00 per share.

While that’s excellent news, it’s past tense already, and analysts are saying it’s as good as it’s going to get. In other words, we’re back to worrying about “peak earnings” and how corporate earnings are likely to slip in 2022.

It’s Going Down

If Russia isn’t done saber-rattling (or actually invades Ukraine), the market will go lower. If the Fed raises rates more than expected in March and more often throughout the year, the markets will go lower. If earnings going forward struggle to meet 2021’s lofty levels, the markets will go lower.

If investors start eyeing the January 24 lows as the next likely stop for benchmark indexes, we’ll get there sooner rather than later as they sell off.

And if we get to those lows, which everyone hopes will be support levels, and break through them, we’re going a lot lower, maybe 10%-20% lower.

To brace for that potential and increasingly probable outcome, investors need to make sure they have all their stop-loss orders in to protect their profits and stem losses on newly established positions.

To make money on any potential selloff investors should start buying puts or bear put spreads on index ETFs like SPDR A&P 500 ETF Trust (NYSE: SPY) and Invesco QQQ Trust (Nasdaq: QQQ).

I like buying puts or put spreads three to four months out ant strike prices 5%-7% below where SPY and QQQ are trading today.

And, as always, I’d be looking to buy quality stocks on any hard and fast shakeout.

Take care,

— Shah

Source: Total Wealth