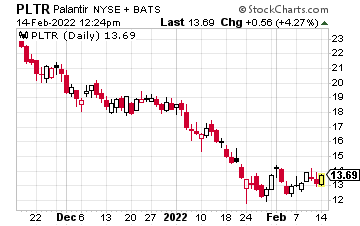

Shares of Palantir (PLTR) are down 65% from the January 2021 high of $39, bottoming bottomed at $11.75 on January 24 of this year. It is an interesting company and many investors think could make for a good buying opportunity.

Palantir was co-founded in 2003 and went public in late September 2020. As a private company, it routinely posted yearly losses, but now it has become profitable.

PLTR mainly involves three software products, Gotham, Foundry, and Apollo, which are used by the government and businesses. Gotham is used for counter-terrorism analysts by the United States government, Foundry is used by commercial clients, and Apollo is an operating system that manages and deploys both Gotham and Foundry.

The company will announce earnings in mid-February, with analysts expecting a profit of $0.04 per share on revenue of $414 million. PLTR’s own high estimate is at $0.04 and its low estimate is at $0.03. with revenue forecasts at $418 million and $396 million for the same scenario.

This means an earnings or revenue surprise hasn’t been factored in too far above or below current estimates. In fact, over the past three quarters the company has matched forecasts twice, and in the other quarter beat them by a penny. However, in the year-ago quarter they topped Wall Street’s forecasts by $0.04 per share.

For the current fiscal year, the average forecast is at $0.20 per share on revenue just under $2 billion. This would represent year-over-year growth of roughly 30% on the revenue side, if achieved.

As for the 11 analysts that cover the stock, one has issued a strong buy rating, and six have issued holds. There are also two underperform ratings and two sell recommendations.

The chart shows near-term resistance at $14–$14.25, with a close above $15 signaling a possible near-term bottom. Support is at $13.50–$13.25, with a close below $13 signaling a possible retest toward a 52-week low.

Given the uncertainty on how analysts have mixed reviews on the stock, it is hard to say if PLTR is a value play at current levels.

Given the uncertainty on how analysts have mixed reviews on the stock, it is hard to say if PLTR is a value play at current levels.

With that said, given its revenue growth, starting a small position at current levels might be a solid long-term investment.

To further offset some risk, instead of buying the stock, options allow an investor to risk less capital to control 100 shares.

At current levels, buying 100 shares would cost roughly $1,400; however, to control the right to buy 100 shares by next January at $15 would only cost $300 per contract.

The PLTR January 15 calls are currently trading for $3 and would allow an investor to buy 100 shares of the stock at $15, no matter where the stock is by January 20th, 2023, for each aforementioned call option purchased. If shares are at $20, then the investor would still have the right to buy the stock at $15. It is important to note, however, the cost would actually be $18 after factoring in the premium paid for the option.

The option would also be $5 in the money and would be worth $500. Instead of exercising the option, you could sell to close the position for a gain of 67%. The risk would be if shares fail to clear $15 by next January, which would make the call option worthless. Given this risk/ reward setup, buying an option that gives you the right to control shares for the next 10 months might be more appealing than buying PLTR stock at current levels.

— Rick Rouse

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley