The stock market as measured by the S&P 500 has been correcting since the start of the new year. However, as I always contend, it is a market of stocks and not a stock market.

True that statement is the reality that most of the damage has come from the significantly overvalued constituents. The fairly valued or undervalued S&P 500 stocks are actually performing pretty well.

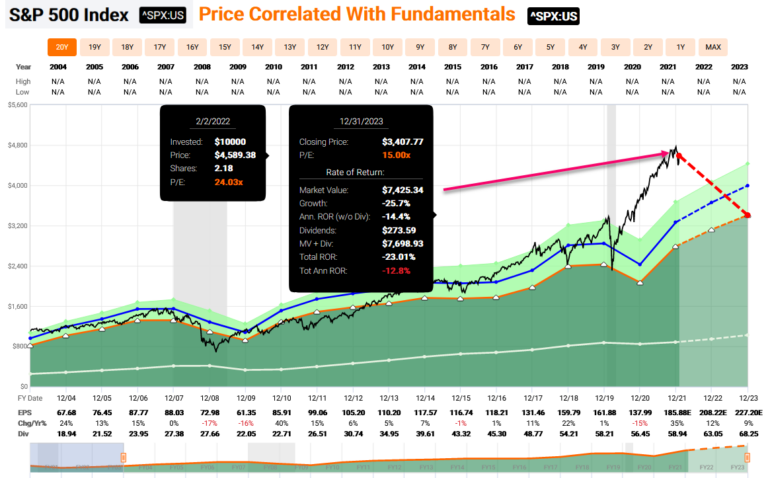

This is something that makes logical sense because some of the valuations on these overvalued stocks have been beyond excessive. In this video I am going to take a high level look at 20% of the S&P 500 constituents representing the majority of the overvalued companies and showing how excessive valuation is beginning to take its toll. My goal is to give you a perspective that you might not have had before watching this video.

FAST Graphs Analyze Out Loud Video

— Chuck Carnevale

Source: FAST Graphs