Most initial public offerings in 2021 seemed to be created through SPACs (special purpose acquisition company), a popular and more cost-effective way to get a faster listing. While the jury remains out on many of these SPAC-originated IPOs, there is one company that went public the traditional way. That way involves regulatory filings and several months of negotiations with underwriters and brokerage firms.

Dutch Bros (BROS) is an up-and-coming coffee chain that began trading last September after completing its IPO process. The company offers specialty coffee, smoothies, cold brew, teas, and energy drinks, with most locations setup as strictly drive-thru models, and some featuring walk-up windows and outdoor seating.

The company sold more than 21 million shares at $23, above an anticipated range of $18-$20. The proceeds netted Dutch Bros nearly $485 million, with Wall Street giving them a $3.8 billion valuation.

Not too shabby, considering the company had fewer than 500 stores at the time of the IPO, and closed out 2021 with 538 stores. The company’s footprint is limited to just 11 states, with more than half of the current locations primarily in Oregon, California, and Washington.

There are another 100-115 BROS locations planned for 2022. Success in new markets isn’t always guaranteed where consumer tastes might be different along with competition from other chains. However, at a current price for a simple Dutch Bros blend coffee set at $1.50, consumers might prefer this much cheaper alternative in a high inflation economy, versus bigger chains such as Starbucks (SBUX).

Repeat customers also signal long-term success. Dutch Bros has seen its monthly visits skyrocket, increasing by as much as 160% during December 2021. This helps explain the company’s 14-year streak of growing same-store sales.

Analyst coverage is high for a recent IPO; nine brokerage firms cover the stock. There are currently five strong buy ratings, three buys, and one hold recommendation.

Estimates for the most recently ended quarter has the company earning a profit of $0.02 per share, on revenue of $135 million. This may be very conservative, as BROS’ first quarter as a publicly traded produced a profit of $0.23 per share, versus forecasts for a loss of $0.20.

Another solid quarter could have more analysts coming on board, as the analysts who currently follow BROS raise their price targets. For 2022, estimates are pegged at $0.46 per share, on average, with revenue near $700 million.

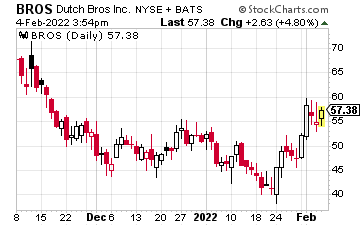

The chart below shows shares trading to a high of $81.40 at the start of November with the recent low hitting the $40 level. Current resistance is at $60 with continued closes above this level getting $65-$70 back in play. Support is at $55–$50 and the 50-day moving average.

Volatility is high for a newly publicly traded stock, so investors should average in at different price points for a possible long-term investment. Options are also available to trade, but they are expensive given the large price swings shares tend to make.

Volatility is high for a newly publicly traded stock, so investors should average in at different price points for a possible long-term investment. Options are also available to trade, but they are expensive given the large price swings shares tend to make.

For instance, the BROS December 70 calls are trading near the $8 level. Although these options have plenty of time premium built in, shares would need to clear $78 by mid-December, technically, to break even.

If shares managed to trade to $86 and a fresh 52-week peak, the aforementioned call options would double, at $16 in-the-money. If shares remain below $70, or are below this level by mid-December, the options would expire worthless.

— Rick Rouse

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley