The tech-heavy Nasdaq Composite, took a beating last night as Meta Platforms Inc led the entire tech sector and its shares lower into a dip that, according to some skittish investors, is looking more like a trench every day.

After a nearly 20% dip triggered by an inflation-anxiety-based selloff, the Nasdaq couldn’t return to its previous highs – making up only 50% of the ground lost.

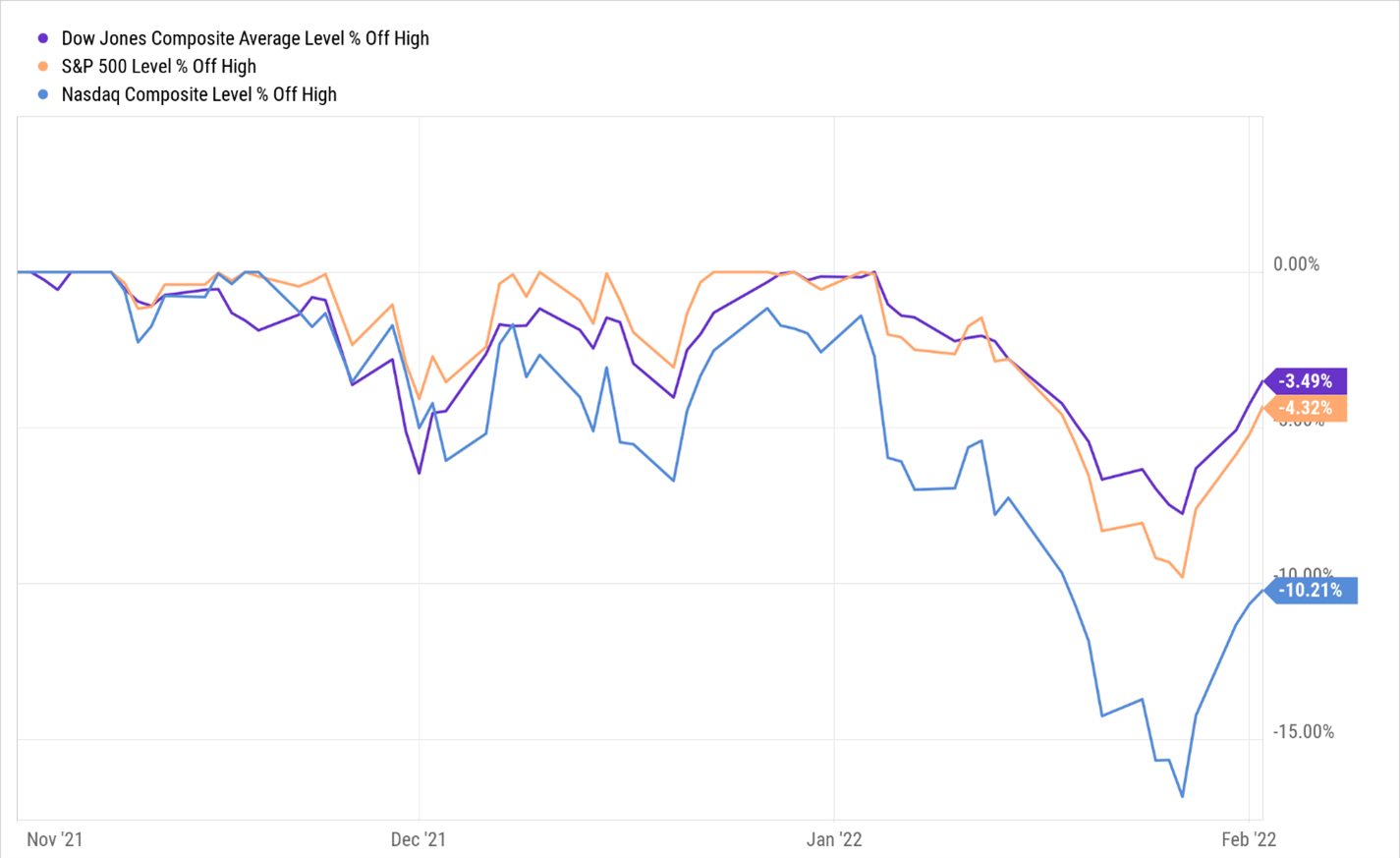

Meanwhile, the other indexes have bushed themselves off. The S&P 500 is currently down 4% off its last high, and the Dow is only down 3%.

Below, you’ll see just how far the Nasdaq Composite has fallen from its three-month highs.

Source: YCharts

But, as my mantra goes, “you need to buy the dip. Every dip.”

The tech industry’s rally isn’t over yet. For the best stocks on the Nasdaq Composite, this is just a brief pause on their journey even higher – and it’s an opportunity for you to jump on one of the most lucrative industries of the modern era.

Predicting the Tech Stock Pile-Up

If you’re a buy-the-dip buyer (and if you’re not, you should be), you need to be looking within the underperforming Nasdaq Composite for the beaten, bloodied, but otherwise perfectly profitable companies that will bounce back when this latest round of selling subsides.

After a hard tumble like this, traders and investors start piling onto the downtrodden stocks of the best companies, anticipating they’ll be brought up again by big ETFs. Coincidentally, the most targeted stocks in these situations are tech stocks – the very same that propelled markets higher for years.

The first trick to making this strategy work is determining when the tumble is over. The second trick is figuring out which Nasdaq stocks you should buy.

While there’s no surefire way to know exactly when any selloff or correction is over, I’ve got a couple of good metrics and measures for you to watch.

The selloff-

Actually, let’s call it what it is: a correction. The Nasdaq not only sold off more than 10%, it almost tumbled into “bear market” territory – or a 20% or more drop.

The correction isn’t necessarily over. The 50% the Nasdaq Composite has retraced takes it to 14,654. That leaves it 79 points below its all-important 200-day moving average (MA) of 14,733. Even if it gets there, it’s still 348 points (2.5%) from its even more important 50-day MA.

The S&P 500 is already above its 200-day MA and a short hop away from getting back to its 50-day MA. While the Dow’s way above its 200-day and already flirting with overtaking its 50-day MA.

MAs are critical to watch. I’d want to see the Composite get above its 200-day MA and well on its way to piercing above its 50-day – but that doesn’t mean you shouldn’t buy this dip.

You just need to be cautious and invest only in the best tech stocks in the Composite. Ones with stellar financials and guaranteed future profits. And, of course, you should use tight stops just in case we’re not out of the woods and the markets slide backward.

Then there are rising rates.

The biggest worry the market’s facing, especially tech stocks, is the prospect of rapidly rising rates.

With the Nasdaq Composite more prone to being “devalued” on account of rising rates, it’s essential to watch what’s happening with rates and what the Fed’s doing to determine if the coast is really clear.

But, we’re not going to get an all-clear until we see a meaningful drop in inflation numbers and expectations. And that’s unlikely in the weeks and next couple of months ahead.

Buy the Dip… Cautiously

The header says it all. Buy the best stocks, meaning solid companies with great balance sheets and great earnings and the ability to potentially improve their profit margins in an inflationary environment.

In the tech world, those companies are the ones that won’t get overly “devalued” when rising rates impact discount cash flow models because they’re way past being dependent on barely generating enough cash flow to support their growth potential, and they’re on sale.

Here are my recommendations…

- Microsoft Co (Nasdaq: MSFT): This company definitely fits that bill. I’ve spoken about it many times, and it’s on sale.

- Amazon.com Inc (Nasdaq: AMZN): The eCommerce giant is on sale and a super solid company with fantastic cash flow.

- Zoom Video Communications Inc (Nasdaq: ZM): This company is greatly discounted down here and one of my favorite stocks for 2022.

- And PayPal Holdings Inc (Nasdaq: PYPL): After trading down in bargain-basement land, this company is still worth bottom-fishing for down here.

Buy these on-sale stocks and use a 10% stop to preserve your capital if the market’s not done trying to find a new bottom.

That’s how you buy this dip.

Cheers,

— Shah

Source: Total Wealth