Investor confidence suffered a big blow last month. As a result the indices fell into a deep pit and fast. The bearish technical lines triggered and almost instantaneously went to the worst case possible. This is the equivalent of ripping the bandage quickly to shorten the pain period. This left the door open for a fast rebound rally, but we can still find stocks to buy near support.

The bad earnings reactions from Facebook (NASDAQ:FB) and Spotify (NYSE:SPOT) caused new sympathy damage. This sometimes extends to anything that merely resembles the stocks falling. In this case, FB is so large that it causes a pretty wide ripple effect. Case in point Snapchat (NYSE:SNAP) and Pinterest (NYSE:PINS) fell 10% after hours, which clearly is an over-reaction.

Today we focus on three stocks to buy that are near support levels. It is also important that they have a healthy business. The idea is to eliminate the guesswork and just gauge the potential upside in the long run. None of these are for the short term, but we will take the rally if it comes.

I usually strive to eliminate events like an earnings release from the immediate future. One of the three today will be reporting soon enough. But I feel like there is enough time to get in and out beforehand. The other two have already delivered their earnings, so we can dissect the value at its own merit. I prefer it when there isn’t a binary event but sometimes it is unavoidable.

There are no experts in the stock markets these days. The main reason is the the short term headline risks that loom. The politicians are busy making the global situation a bit more edgy. Furthermore the central banks are likely to make the fundamental settings a bit more challenging. The Federal Reserve already committed to ending the quantitative easing and starting a quantitative tightening. The European Central Bank is likely to also follow suit soon enough.

I have relatively strong conviction in the thesis behind the stocks to buy today. However, I will infuse a bit of doubt on purpose to keep me humble. I would not suggest taking full positions all at once to leave room for error. Going all in right now is a bit presumptuous and leaves investors with little recourse under pressure. The three stocks to buy this week are:

- Intel (NASDAQ:INTC)

- Starbucks (NASDAQ:SBUX)

- eBay (NASDAQ:EBAY)

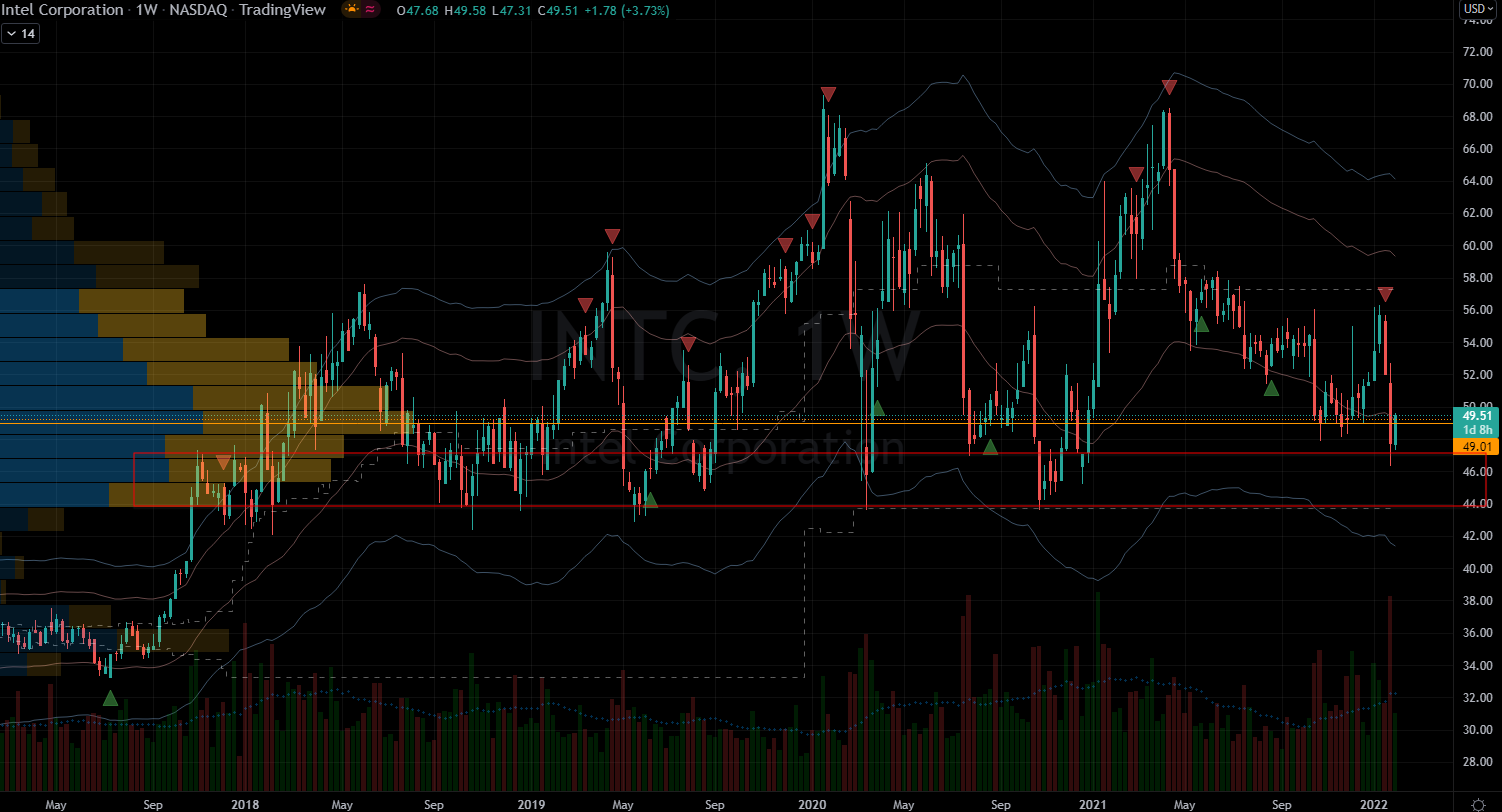

Stocks to Buy: Intel (INTC)

Source: Charts by TradingView

Source: Charts by TradingView

For the past few years I find myself defending this giant too often. While, AMD (NASDAQ:AMD) and Nvidia (NASDAQ:NVDA) hog the headlines, this is the monster in the field. Intel is twice bigger than the other two in total. Yet for now it can’t bribe investors to like it. Eventually it will come back in style and catch a bid. It reminds me of Ford (NYSE:F) in 2019. Back then it was struggling to hold $7 per share. My bullish thesis then was they were due more respect than they had. Now investors are chasing it even though its stock is three times more expensive.

I am not suggesting that INTC stock will be $150 soon. However, it doesn’t deserve to have a single-digit price-to-earnings (P/E) ratio either. It currently has a trailing P/E of 10 and still can’t find fans on Wall Street. The problem is its lack of pizazz. The evidence of this is the lackluster growth in sales, especially if you compare it to the other two. Eventually, management will figure out a way to recapture investor attention. At least, that is part of my thesis.

Intel has the money and the tech to make a splash. The world is hungry for more tech than ever before, so demand is not a problem. I remember the olden days when “Intel Inside” sticker mattered on my PC. Now I don’t need it for I am just as happy to own an AMD machine. Recently I started shopping for a new computer. And much to my surprise I found myself looking for the “EVO” badge from Intel. Although I do not need it to be there, I am noticing more often.

The bottom line is that Intel has all the tools and opportunities that AMD and NVDA have. Management needs to get off the bench and refocus investors’ attentions on what matters. Owning INTC stock here has very little downside risk. Below $48 per share has been support since 2017. Therefore, it has less froth to shed in case markets suffer another stent lower.

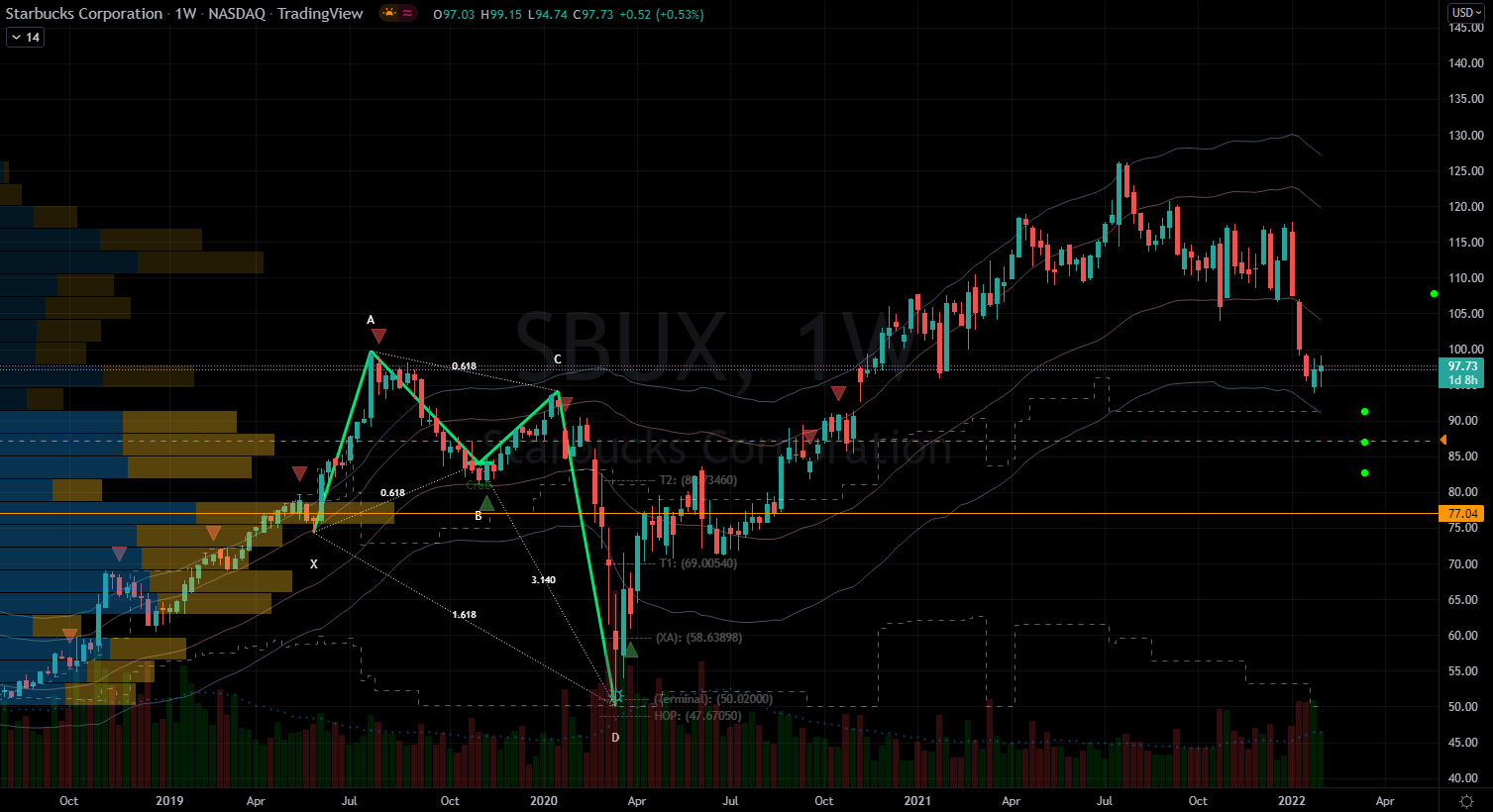

Starbucks (SBUX)

Source: Charts by TradingView

Source: Charts by TradingView

During the pandemic outbreak of 2020 when all business closed their doors, I expected SBUX to suffer much worse consequences. The way that management navigated the toughest conditions ever was impressive. They have earned kudos for a lifetime from me, so SBUX stock is a buy on dips.

It already corrected up to 25% from its summer highs. Most of it was through no fault of its own, just following the indices. The business has no flagrant issues nagging it. I remember days when the critics were selling it because of long lines. Having too many clients is a problem any manager would love to have.

The coffee habit is a way of life, so their clientele are not likely to give up on them. Part of Warren Buffett’s wisdom is to seek businesses with a strong recurring base. The competitive advantage partly comes from humans being creatures of habit. I have friends who will walk through snow to get their Starbucks cup. I am not that discerning so I am fine with my good ole drip at home.

Fundamentally, SBUX stock is as bulletproof as they make them. Revenues continue to grow except for a blip through a global shut down. The sales and net income now are 15% and 10% larger than in 2019. Clearly there is nothing wrong with the business, so it comes down to timing. Technically, if it loses $94 per share it could fall another 6% from there. That would place SBUX stock below pre-pan levels.

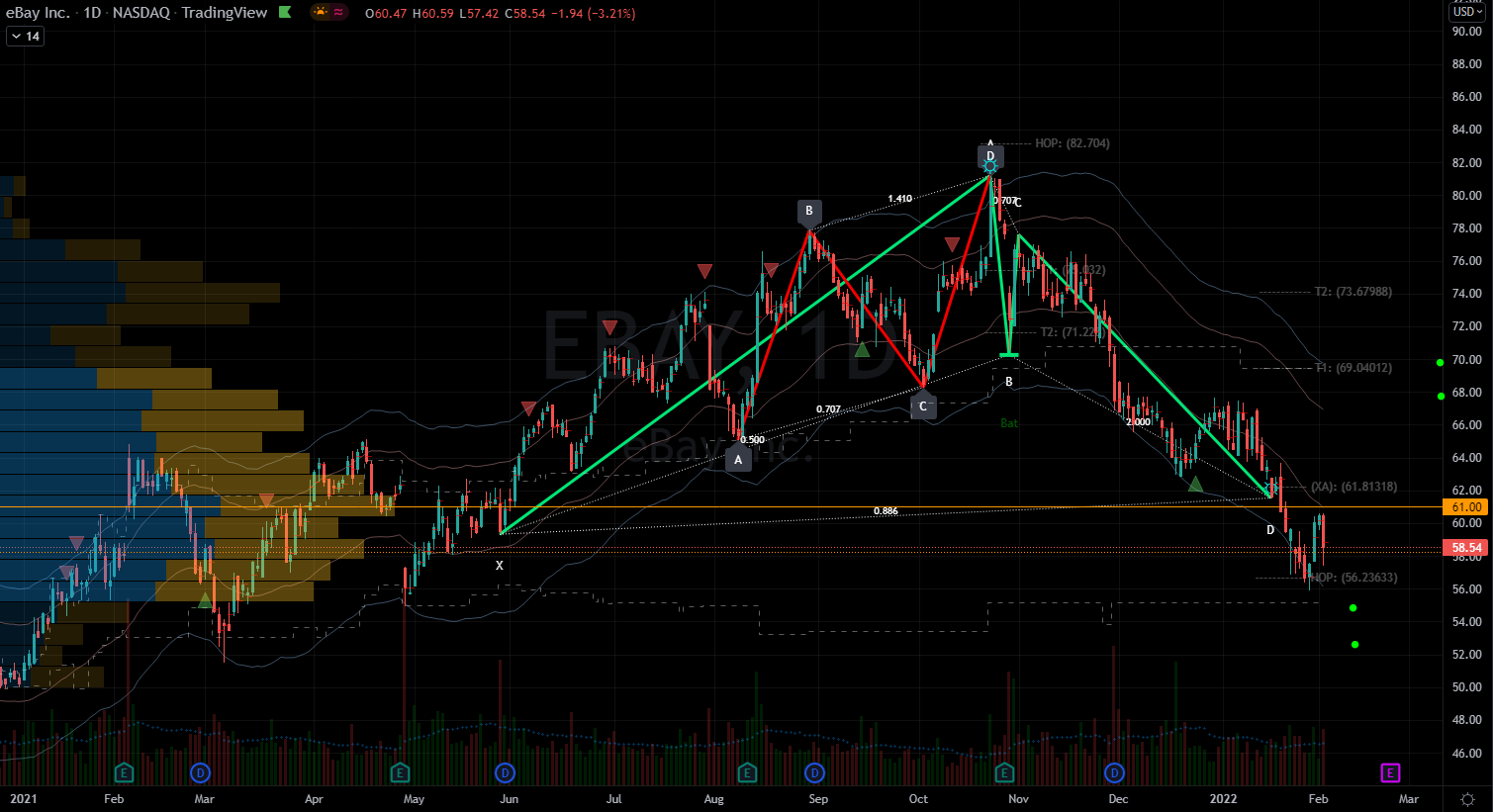

eBay (EBAY)

Source: Charts by TradingView

Source: Charts by TradingView

If EBAY stock can hold $55 per share, it can rally to $67 in the next few weeks. The upcoming earnings event may cause a temporary disruption to that, but it’s worth the risk. The short-term reaction to earnings is unpredictable. Let the Robinhood (NASDAQ:HOOD) spike on terrible results remind us of that.

This is more of a short-term technical opportunity than the other two. Nevertheless, the eBay business is doing just fine. The company generated $8.2 billion in gross profits last year. Moreover, it has a P/E of 3.5, which is low in absolute terms. This is hardly a scenario where we would be taking on bloat.

eBay lacks the extreme growth attraction, therefore I consider this an active trade. If it rebounds fast before the earnings I’d get out or reduce the risk. The technical setup is enticing enough and the downside risk should be manageable. These days markets are indecisive and they are quick with the flip. Sentiment if fickle and the smallest headline causes panic.

— Nicolas Chahine

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place