If you want to spot potential opportunity, pay attention to insider buying.

After all, who knows a company better than an insider?

In fact, if an executive or board member at a company is buying a sizable number of shares, it’s often a good idea to start looking into why, and perhaps follow them into the stock. That’s because they’re typically privy to information on new products, competition, and the operating environment of the firm.

We also have to remember that insiders wouldn’t put up their own money unless they believed the move wouldn’t be profitable.

Of course, it’s not always wise to base your own buying decisions solely on the actions of insiders… but it could help guide your next investment decision.

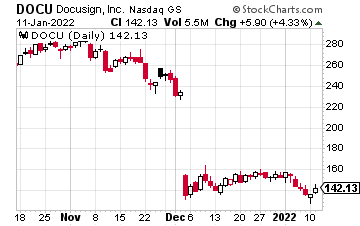

Take a look at DocuSign Inc. (DOCU), for example.

After gapping from $230 to $136 on earnings, the stock appears to have caught strong support, and could pivot higher, in the near term.

After gapping from $230 to $136 on earnings, the stock appears to have caught strong support, and could pivot higher, in the near term.

Sure, over the month, DocuSign slipped about $100 per share after the company said Q4 revenue would come in between $557 million and $564 million, which is below expectations for $573.8 million.

Several firms also lowered their ratings on the stock; however, at this point, the pullback may be overkill.

CEO Daniel Springer has been actively buying shares. In early December 2021, for example, Springer bought about $5 million worth of DOCU stock. Just [Tuesday], Springer bought another $2.4 million worth of DOCU shares at $128.89. With patience, we’d like to see DOCU refill its bearish gap around $136.

Or, look at MP Materials (MP), the rare earth company.

Over the last few weeks, the company signed a deal with General Motors (GM) to develop a supply chain of rare earth magnets for electric vehicles. If that wasn’t exciting enough for MP shareholders, Randall Weisenburger, who sits on the company’s board of directors, bought 86,901 shares of the MP stock for about $3.5 million.

Additionally, says chairman and CEO, James H. Litinsky in a recent press release: “The MP Materials team continues to deliver, with record quarterly production and shipments driving strong growth in revenue and Adjusted EBITDA… Our performance reflects continued execution and cost discipline at Mountain Pass coupled with strong global demand for rare earth materials.”

Again, while it’s not a good idea to base your investment decisions solely on the actions of insider buying, it could help guide you to your next big opportunity.

— Ian Cooper

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley