Markets stumbled on Wednesday coinciding with the release of the Federal Reserve minutes. There should have been no surprises, since these were recounts of past events. Furthermore, Chairman Jerome Powell delivered their decision weeks ago. Nevertheless, investors freaked out and sold markets down 2%. Today we sift through the rubble to find potential stocks to buy on these dips.

Wall Street is acting more childish than ever, and they throw a fit at the drop of a hat. This is the byproduct of having a bull market in spite of walls of worry. Judging by how yields spiked yesterday, I’d say that investors were pricing in rate hikes.

The Fed started its taper last year, and that is step one of unwinding the QE program. First, they reduce the medicine amount until they get to zero asset purchases. Next, they tighten the availability of cash by way of monetary policy changes.

The two obvious methods are rate hikes and asset sales. By raising overnight lending rates, they make it more expensive for banks to lend us money. Also by selling assets, they collect cash from finance companies. The Fed can deploy either to combat inflation.

In reality, I doubt that Mr. Powell will go overboard with either of those two. He tried this in 2018, then Wall Street forced him to flip bullish again. After that Christmas crash, he restarted the QE program that he is trying to end now. I sure hope he learned his lesson from that debacle.

Tomorrow the government will release its December jobs data. If the report is too good, there is a chance stocks will fall again. Having an extremely low unemployment rate could signal wage inflation is coming. It is also important to pay attention to the participation number.

The combination of low unemployment and strong participation is the most troublesome for stocks. The irony is that those facts are great news for the economy. But temporarily and until investors come to term, good news is indeed bad news.

Those planning on finding stocks to buy should leave room for error. And this includes the three we are offering today. Regardless of how much I like my scenarios, they won’t trade in a vacuum. All stocks will fall if Wall Street is throwing a fit over headline data.

The three stocks to buy on these dips are:

- Salesforce.com (NYSE:CRM)

- Palantir (NYSE:PLTR)

- Roku (NASDAQ:ROKU)

Stocks to Buy: Salesforce.com (CRM)

Source: Charts by TradingView

Source: Charts by TradingView

My favorite falling knives to catch involve dissecting opinions. When a great company’s stock falls on a headline from an analyst downgrade, I look for opportunities. On Wednesday, UBS downgraded CRM stock and lowered its price target. Interestingly, their new target is still 17% above current prices.

As much as I’d like to take the other side of their downgrade, there are a few potential issues. The first is that technically the stock could have triggered a bearish pattern targeting lower prices still. But there are more support levels to lean on this week to help with that.

Second, we need to check on the fundamental metrics to see if there are obvious slowdown signs. According to TradingView, revenues continue to grow at a 25% average since 2014. The trailing 12 month rate is 2.4 times bigger than 2017. The least we can say is that there are no apparent signs of waning demand. The UBS note cited concerns over organic growth. I disagree.

Furthermore, annual net income has also ballooned to a running rate of $1.7 billion. CRM now generates $5.5 billion in cash from its own operations. This gives it freedom to execute on plans. There could be some noise from their Slack acquisition, but they deserve the benefit of the doubt. The dip is buyable especially if for new positions and not all in. I would leave room to add more after further market hiccups.

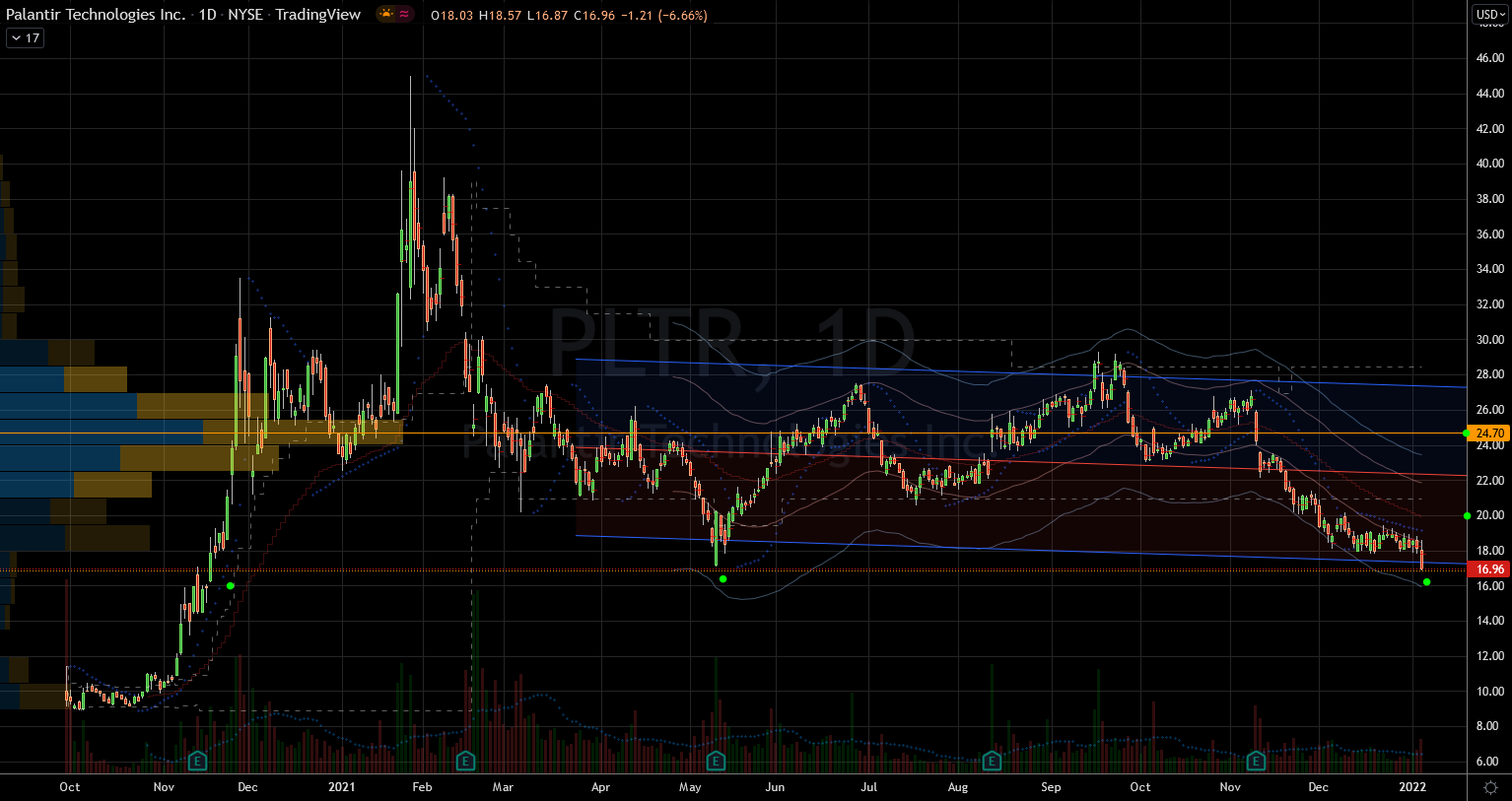

Palantir (PLTR)

Source: Charts by TradingView

Source: Charts by TradingView

Software analytics is a rising trend that is only likely to accelerate. After the pandemic, companies are chasing digitization frantically and on a global scale. There is no doubt that the world is collecting more data than ever. That’s where Palantir comes in with its uses of AI to help with that.

So far and judging by the results in the P&L, we can confidently state the obvious. The PLTR team is growing the business pretty quickly, so they are doing things right. Revenues and gross profits are now double than in 2019.

Palantir maintains two streams of income. One is from the commercial side, and the other from government contracts. The revenues are now over $1.4 billion and growing judging by recent headlines. Nevertheless, there is always room for improvement, so we recognize the frothiness potential. This is not a cheap stock, but its 24 price-to-sales is OK for now. This metric can normalize as the sales continue to grow.

My argument today is more technical than fundamental. While I like the long-term bullish thesis, I like more the support zone below. Wednesday, the stock fell into the May 2021 levels. Back then it bottomed violently and rallied 45% twice. Furthermore, this was also the level in contention in November 2020. Clearly, PLTR investors love fighting for it here. Taking longs even if small positions through options is worth the effort.

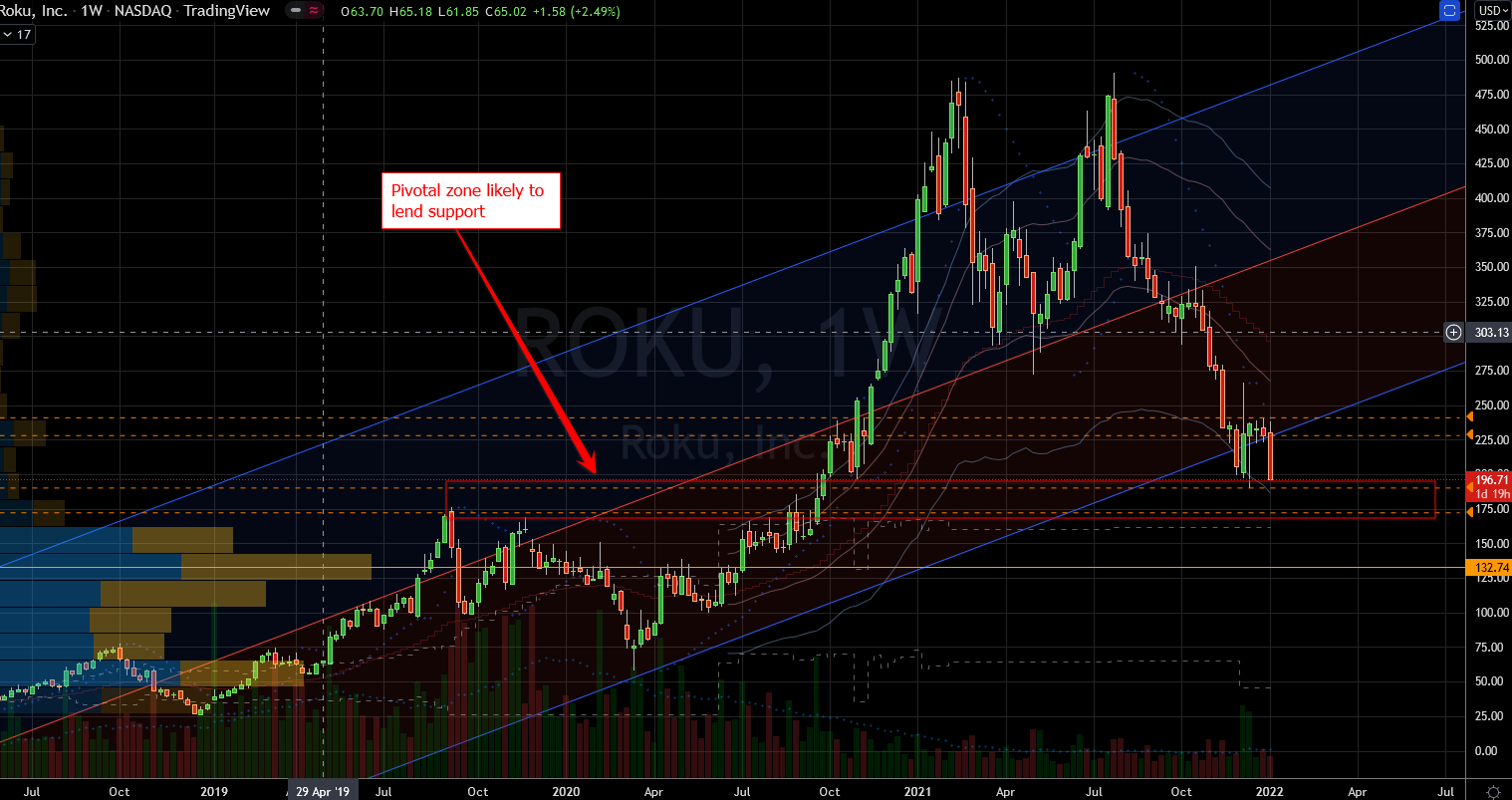

Roku (ROKU)

Source: Charts by TradingView

Source: Charts by TradingView

Roku stock also fell victim to an analyst’s headline. This time it was Atlantic Equities that initiated the stock as “underweight.” What is puzzling about this headline is that they set a $136 price target. This is significantly lower than current price. If that’s the case, they shouldn’t even have ROKU at any weight in a folio. I would expect them to post a sell sign on the ROKU ticker.

But I digress, and let’s pin the company facts versus the analyst opinion. ROKU has delivered a 41.5% average revenue growth since 2016. In the last 12 months their gross profits were $1.3 billion. They even eked out a $286 million net income from this. Clearly, the trend shows no signs of slowing down. The 12 month revenues are 2.3 times bigger than in 2019.

In spite of its successes, statistically ROKU stock remains reasonable. Its price-to-sales is under 13 and that is modest for a mega-grower. The price-to-earnings doesn’t matter as much now until it stops growing. Amazon (NASDAQ:AMZN) showed us that companies must spend to grow fast. Profitability is an easy tweak away later on when it matures. In all three stocks to buy I bet they would be higher if markets are higher.

— Nicolas Chahine

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place