One of the least well-known companies in the S&P 500 is Mettler Toledo (MTD), the global market leader in laboratory and industrial scales and balances.

Mettler Toledo also holds a leading position in product inspection. In its other segments, the company holds an average share of about 25% across most product lines.

The company’s laboratory instruments portfolio includes laboratory balances, liquid pipette solutions, and automated laboratory reactors, which cover a range of analytical instruments. The company also manufactures various industrial weighing instruments for the pharmaceutical, chemical, food, manufacturing, and other industries. In addition, it manufactures metal detection, x-ray, check weighing, and other end-of-line product inspection systems used in production and packaging.

Despite the pandemic and the subsequent fall in overall industrial demand, Mettler Toledo’s business has held up relatively well.

Despite the pandemic and the subsequent fall in overall industrial demand, Mettler Toledo’s business has held up relatively well.

The company delivered a 7% rise in net earnings to $603 million in 2020, while registering an adjusted operating profit margin of 27.2%.

Most impressively, its profit margin has now nearly tripled since the turn of the century. Also in 2020, Mettler Toledo’s return on assets came in at 19.3%, two percentage points ahead of its long-term average.

Their momentum has continued into 2021. In its latest quarter, Mettler Toledo’s sales were up by a third from the year-ago period, and its management raised guidance.

The Key to Mettler Toledo’s Success

There an explanation for why Mettler Toledo has weathered the pandemic storm better than many other industrial companies.

Part of the he company’s success comes from its diversity of products. Another big plus is Mettler Toledo’s geographical spread—it was one of the first manufacturers to reopen in China after the coronavirus lockdown.

But the real reason behind Mettler Toledo’s success is its business model. The company has tailored its business model to allow it to shift the segments it focuses on; in 2020, Mettler Toledo profited from growth in life sciences (thanks to COVID), as well as the defensive food production sector.

So, has the company just been lucky in focusing on certain sectors at certain times? Not really—instead of relying on luck, Mettler Toledo is using technology in a smart way. A major part of the company’s sales operations involves the use of advanced analytics to determine which end markets were most likely to be pandemic resilient.

Mettler Toledo has also nimbly transformed what it calls its “Go-to-Market approach” by quickly moving to telesales to address the lack of direct access to customers’ physical places of business. It also went online with its after-sales channels, keeping customers informed (and happy) using a combination of webinars and online training.

Growth Momentum to Continue

Mettler Toledo company beat Wall Street expectations in every quarter of 2021, and growth momentum looks set to continue into 2022, led by the lab business and a recovery in the industrial sector.

Here is what Morningstar said about Mettler Toledo: “We expect ongoing record sales in the lab business will push firm-wide revenue growth above 16% for the year…to put this growth in context, Mettler has not reported full-year sales growth above 10% since 2011.” I’m in full agreement with this analysis.

Keep in mind that there is a substantial level of customer stickiness in the lab segment, which accounts for 50% of total sales. Mettler does have a leading market position in balances and scales, and the business accounts for 15%-20% of total revenue (30%-40% of the lab division). This business is Mettler’s “bread and butter,” with market leadership stretching back decades.

In addition to balances and scales, Mettler Toledo also has a strong market position in analytical instruments, such as titrators, dispensers (like pipettes), and automated chemistry technologies.

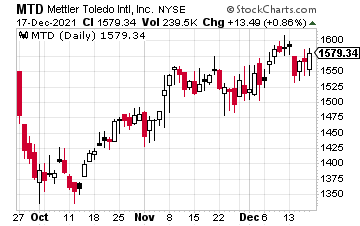

With free cash flow rising and the company buying back about a billion dollars of its stock, Mettler Toledo looks like a good play on science, no matter the state of the pandemic. The stock is up 35% to 36%, both over the past year and year-to-date. And it’s up about 165% over the past three years. Any price in the $1,500 to $1,550 range is a good entry point for MTD.

— Tony Daltorio

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Investors Alley