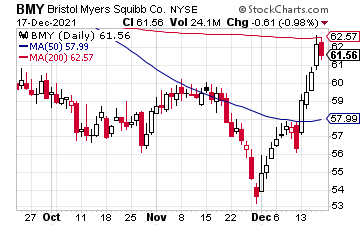

After falling from $68 to a about $55, the oversold pharmaceutical stock is just starting to pivot higher. From a current price of $60.82, we’d like to see the stock retest $69.19.

Over the last few days, Bristol Myers Squibb raised its quarterly dividend to $0.54 per share from $0.49, boosting the annual dividend to $2.16. The new dividend rate will first be paid out on February 1 to shareholders of record as of January 7, 2022.

Even better, the company just approved a $15 billion buyback program.

The company’s financial position is strong, and we remain committed to a consistent, balanced capital allocation strategy,” Giovanni Caforio, Bristol Myers Squibb board chair and chief executive officer, said in a company press release.

He continued: “With significant free cash flow of $45 billion to $50 billion expected between 2021 and 2023, investment in business development continues to be a key priority for the company in driving innovation and sustained growth as we return capital to shareholders through the dividend increase and expanded share repurchase authorization. We remain committed to maintaining a strong investment grade credit rating and reducing our debt.”

In addition, Wells Fargo recently initiated coverage of the BMY stock with an equal weight rating and a $58 price target.

In addition, Wells Fargo recently initiated coverage of the BMY stock with an equal weight rating and a $58 price target.

Also, in mid-November, BMO Capital initiated coverage with an outperform rating and a $72 price target.

Helping, the Food and Drug Administration just approved the company’s Orencia drug for the prevention of acute Graft versus Host Disease, which, according to Imbruvica.com, “…is a common complication after receiving a donor stem-cell or bone marrow transplantation. Sometimes, the graft doesn’t recognize the host as being friendly. In fact, it sees your body as a threat.”

With plenty of strong catalysts, shares of BMY are just beginning to pivot higher. From a current price of $60.82, we’d like to see it test its prior high of $69.19 again soon. Longer-term, we’d like to see BMY closer to $80 per share.

— Ian Cooper

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley