The online betting space is a crowded field, but one that is expected to reach $127 billion by 2027. The market is expected to gain traction over the next several years as the smartphone adoption continues to increase and online casino gaming platforms become easier to access.

Other factors, such as higher internet penetration and cost-effective mobile applications for betting, are also expected to drive market growth over the next several years. Plus, the industry is not limited to just sports betting; other activities such as poker, bingo, and lotteries are also gaining traction.

Concerns surrounding the ongoing pandemic have accelerated the demand for online gambling over the past couple of years, a trend that will likely continue for the foreseeable future.

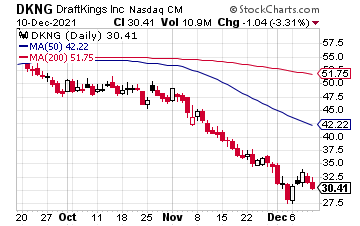

One of the more popular players in the space—and the current leader in the sports betting industry—is DraftKings (DKNG). Despite its esteemed position, the stock has been in a correction since peaking at a 52-week peak north of $74; it recently set a 52-week low of $27.48 earlier this month.

DKNG isn’t profitable and is expected to post continued losses into 2022. In its most recent quarter, the company reported a loss of $1.35 a share versus expectations for red ink of $1.06 a share. Third-quarter revenue of $213 million also missed forecasts of $236 million.

For the current quarter, analysts expect the company to post a loss of $0.76 per share on revenue of $441 million. For fiscal year 2022, Wall Street is penciling in an average loss of $2.38 per share on revenue of $1.87 billion.

DKNG had 1.3 million unique paying customers engaged with its betting services during each month of the third quarter of this year. While this is impressive, the company will need to exponentially increase this number in the coming years to offset losses.

This might be a tall order, given the extreme competition from competitors such as Penn National Gaming (PENN), Caesars Entertainment (CZR), MGM Resorts International (MGM) and others in the industry.

This might be a tall order, given the extreme competition from competitors such as Penn National Gaming (PENN), Caesars Entertainment (CZR), MGM Resorts International (MGM) and others in the industry.

There are also whispers that Walt Disney (DIS) could enter the arena.

On that note, Disney’s division of ESPN’s interest in online sports betting could cannibalize industry leaders, specifically DraftKings and FanDuel, which control roughly 75% of the market. A push from ESPN could weigh heavily on DraftKings’ market share and seriously damage management’s 15%–25% long-term growth targets.

The current chart for DKNG shows shares bouncing off a near-term double bottom at $27.50. This level was tested in back-to-back sessions after entering extreme oversold conditions, with the relative strength index (RSI) dipping below the 15 level. Key resistance is at $35 and prior support from late November. Despite the rebound, the fundamental valuation for DraftKings still looks extremely expensive. To make matters worse, increased competition in the space could lead to continued losses beyond 2022 with the likelihood of decreased growth, margin challenges, and increased spending for the company.

— Rick Rouse

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley