As Christmas Day draws ever nearer, it is clear which companies are making the most of the holiday rush and which are falling behind.

I like focusing on the winners for my readers out there, so in today’s watchlist I’ve got some companies who have lorded over this holiday season – beating Wall Street expectations at almost every turn.

First up, I’m watching C3.ai Inc. (NYSE: AI), the California-based enterprise artificial intelligence software company.

On Dec. 1, the company reported its second-quarter revenue which reached $58.3 million, up 41% year-over-year. During the quarter, it posted an adjusted loss of 23 cents per share.

This was in the face of Wall Street expectations. Analysts expected the company to report a loss of 29 cents a share on $57 million in revenue.

Additionally, the company increased its customer count to 104. That means the company beat estimates on the top and bottom lines, and increased its customer count by 63%, yet the stock dropped as much as 27.86% between the announcement and Dec. 2.

At issue was the impact of the company’s remaining performance obligation (RPO) with Baker Hughes Company (Nasdaq: BKR). Not only did C3.ai extend the contract term from five to six years, but it also significantly increased the dollar value of the agreement from $45 million to $495 million.

Without the expanded BKR deal, C3.ai’s RPO declined 16%.

That was enough to drive shares down.

The market saw the sell-off as an overreaction and by that Thursday, the stock had gained back as much as 26.48%.

And then, later that same day, the company announced it had established a new, $500 million five-year agreement with the U.S. Department of Defense (DoD).

That drove shares of AI up, more than 13.2% in early Friday trading.

Which is great for the stock, but with this ebb and flow in the price… I mean, as you already know I don’t like chasing stocks that gap up. Even if the gap is on the back of good news.

If shares of AI pull back to $34.00 by the end of this week, buy the AI April 14, 2022 $35/$40 Call Spread for $1.90 or less. Plan on selling the AI April 14, 2022 $35/$40 Call Spread for a 100% profit or if shares of AI close below $31.00.

Next up, I’m watching Lululemon Athletica Inc. (Nasdaq: LULU), the Vancouver-based athletic apparel company.

Last Thursday, the company reported its third-quarter net revenue, revealing year-over-year growth of grew 32% to $1.45 billion. Adjusted earnings for the quarter were $1.62 per share.

Looking ahead, the company increased full-year guidance to adjusted earnings per share between $7.69 and $7.76, that’s up from previous guidance of as much as $7.48.

The Street was expecting revenue of $1.44 billion and adjusted EPS was $1.40, which means the company basically hit the mark on the top line, easily beat on the bottom line, and significantly increased its full-year guidance.

Very solid results.

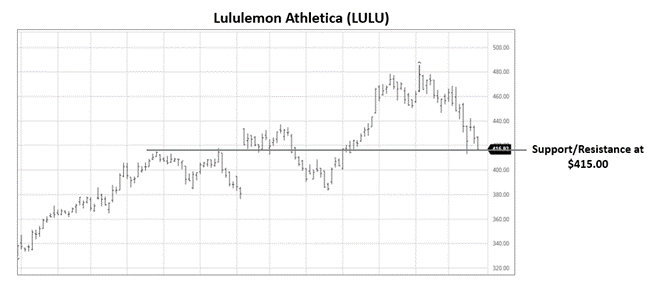

Before Thursday’s news, the stock had pulled back to a key support/resistance level and it drifted slightly lower in early Friday trading.

Chart: courtesy of Barchart.com

Chart: courtesy of Barchart.com

Given the strong Q3 results and the fact that the stock is trading near a key technical level, I like targeting LULU, right here.

Buy the LULU March 18, 2022 $430/$440 Call Spread for $3.00 or less. Plan on selling the LULU March 18, 2022 $430/$440 Call Spread for a 100% profit or if shares of LULU close below $390.00.

Cheers,

— Shah

Source: Total Wealth