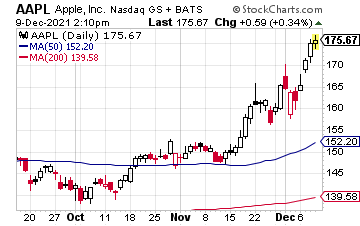

Apple Inc. (AAPL) doesn’t seem to know the meaning of down.

Since finding support around $137.50 in October, the $2.87 trillion tech giant’s stock exploded to a high of $174.59—and according to Morgan Stanley analyst, Katy Huberty there’s further upside ahead. In fact, Huberty believes Apple could race to $200 a share, and become a massive $3 trillion stock, near-term.

She bases her prediction on the idea that new Apple products, such as augmented reality and a self-driving car haven’t been priced into the stock, writing in a note to investors: “Today, we know that Apple is working on products to address two significantly large markets—AR/VR and Autonomous Vehicles—and as we get closer to these products becoming a reality, we believe valuation would need to reflect the optionality of these future opportunities.”

At the same time, investors are shrugging off the idea that iPhone 13 demand is weakening.

In fact, The Fly notes that Wedbush analyst Daniel Ives has a set near-term price target of $200, and adds that Ives believes AAPL could be a $3 trillion stock. As The Fly’s summary of Ives’ recent research note to investors explains: “Apple is now on course to sell north of 40M iPhones during the holiday season, despite the chip shortage headwinds.”

While recent earnings weren’t as hot as expected, it’s not slowing AAPL stock.

While recent earnings weren’t as hot as expected, it’s not slowing AAPL stock.

In its fourth quarter, Apple revenue fell short of expectations, which CEO Tim Cook blamed on supply issues with iPhones, iPads, and on its Mac computers.

Fourth-quarter earnings per share (EPS) of $1.24 matched estimates; however, revenue of $83.36 billion missed expectations for $84.85 billion. Still, this number was up 29% year over year. Revenue generated just from iPhone sales was $38.87 billion for the quarter, as compared to estimates at $41.51 billion—but was up 47% year over year. Mac revenue came in at $9.18 billion, which missed estimates for $9.33 billion, but was still up 11.5% year over year. The only number to beat expectations came from iPad revenue, which reached $8.25 billion, compared to forecasts for $7.23 billion. Revenue from iPad sales was also up 21.4% year over year.

While recent earnings were nothing to write home about, markets still love the Apple stock.

Remember, two analysts say this could be a $200 stock, with a $3 trillion valuation, near-term. That’s a lot to like right there.

— Ian Cooper

3 stocks to Change Your Life [sponsor]Brace yourself... because I'm about to flip everything you thought you know about dividend investing on its head. I'm going to show you how you can achieve 101% yields from dividends in just a few years. Best of all, it's as easy as buying 3 stocks and clicking a few buttons. And if you invest in these 3 stocks, you'll never have to worry about a bear market again. Folks it's time to take control of your retirement. Let me show you the way. Click here to discover how 20,000 other retirees are earning 101% yields from their dividends.

Source: Investors Alley