Investors may want to keep an eye on casino stocks, like MGM Resorts International (MGM).

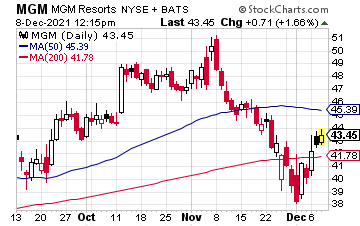

After dropping from a high of about $51 to about $38, it appears the MGM stock has bottomed out. Not only is the MGM stock holding triple bottom support dating back to July, it’s incredibly oversold on relative strength (RSI), MACD, and Williams %R.

The last two times MGM became this technically oversold, it shot higher shortly after.

For example, MGM hit that $38 bottom in July 2021, and rose to a high of $43.64 shortly after; in March 2020, MGM bottomed out around $5.90 and would run to $22.50 shortly after. In addition, both of these times, RSI, MACD, and Williams’ %R were deep in oversold territory, where we also are today.

MGM Resorts is running higher, as investors look beyond the pandemic threat and commercial gaming revenues continue to spike to new highs.

MGM Resorts is running higher, as investors look beyond the pandemic threat and commercial gaming revenues continue to spike to new highs.

In fact, according to the American Gaming Association (AGA), commercial gaming revenue just hit a new quarterly high of $13.89 billion in the third quarter.

In a recent report, the association noted: “With $38.67 billion in revenue through the first nine months of the year, the industry has already passed revenue generated for the full year 2020 and is on pace to smash its annual record of $43.65 billion, set in 2019.”

Even more impressive, analysts are bullish on MGM.

In fact, after the company posted a surprise third-quarter profit, Wells Fargo analysts raised their price target on MGM from $55 to $62, and analysts at Stifel raised their price target on the stock to $54 from $45, with a hold rating.

For Q3 2021, MGM said adjusted EPS came in at $0.03, as compared to expectations for a loss of $0.03. That’s also a massive year over-year-improvement, from a Q3 2020 loss of $1.08 per share. Better, sales came in at $2.71 billion from $1.13 billion year over year.

With the MGM stock just beginning to pivot from strong support, we’d like to see it run from a current low of $42.54 back to $51, near-term.

And all of this, as investors start to roll the dice on casino stocks again.

— Ian Cooper

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley