I realize that today’s article will not win me any popularity contests. Nevertheless I will bravely share my unpopular opinion on popular stocks. My goal is to help investors avoid potentially easy mistakes. I recognize that these companies have good people trying to do great things. The stock price action is what worries me for the next few months. Therefore my comments should not upset the fans of these three stocks to avoid.

For the most part, my beef is only with their stock prices. I caution investors about shorting them, their fans love them too much.

It is important to make the distinction between what’s cool, and what’s profitable for investors. I remember the dot-com bubble days where a lot of great concepts died. One company, Webvan comes to mind. Clearly they had it right early but the stock died in spite of it.

I rarely write about stocks to avoid, but it is important that I do for balance. I don’t do it often because I don’t like to bet against the success of investors. But sometimes it’s my responsibility to point out the potentially easy mistakes. I tweeted about one of them recently, and that was a proper warning (more on this later).

There is a common thread among these three companies today. They are all pursuing the electric vehicle riches. Tesla (NASDAQ:TSLA) laid the brick path and now hundreds others are seeking EV gold along it.

There will be many failures, so investors need to be very choosy at this stage. One of the three today will have a much better outlook than the other two. For that one, it’s just a matter of entry levels rather than ultimate success.

The EV sector has tremendous upside potential. However, it has harsh limitations for the newcomers. We already know that all the legacy car makers committed to it. I can attest to seeing more of them in my neighborhood in southern California. The world produces more than 80 million vehicles per year, so the switch over to EV will take decades. We also have battery limitations that we have to consider, so the ramp up will taper off at some point.

Nevertheless, the opportunity is incredibly big but not all EV companies will win in the end. There are many other facets to this arena, so we are merely scratching the surface. My goal is to point out the potential short-term pitfalls, so that retail investors would be ready for them. Wall Street professionals have many advantages over home gamers, so readers should welcome the criticism with the proper perspective.

Here are my three stocks to avoid today:

- QuantumScape (NYSE:QS)

- Lucid Motors (NASDAQ:LCID)

- Lordstown Motors (NASDAQ:RIDE)

Stocks to Avoid: QuantumScape (QS)

Source: Charts by TradingView

Source: Charts by TradingView

I will start with the most obvious one, because QuantumScape is trying to accomplish what’s nearly impossible. I am an electrical engineer, but I don’t claim to be an expert in the field. However, I know enough to have serious doubts about their ultimate success.

I realize that making a solid state battery is possible. I question the application they are seeking for the electric vehicle. The load is too large, and the environments are too diverse. In other words, it is achievable in a lab setting with near perfect conditions. Making it work across the world with different size vehicles is what makes it unlikely.

Maybe this can happen in a decade when we have better technologies. But for the time being QS stock went too high. I tweeted mid-November about the level risk to warn investors. The stock fell 20% from that point. My comments were purely technical, and I will revisit that opinion from here.

The QS chart suggests that there might be more downside before it hits support. However, I also realize the Reddit environment that currently exists. The bulls would have a mega-spike opportunity if they take out $44 per share level. Therefore, this is not a call to short QS stock, but rather to avoid it.

Ultimately time will be the judge of its successes and failures. My main concern is helping investors avoid potential bull traps.

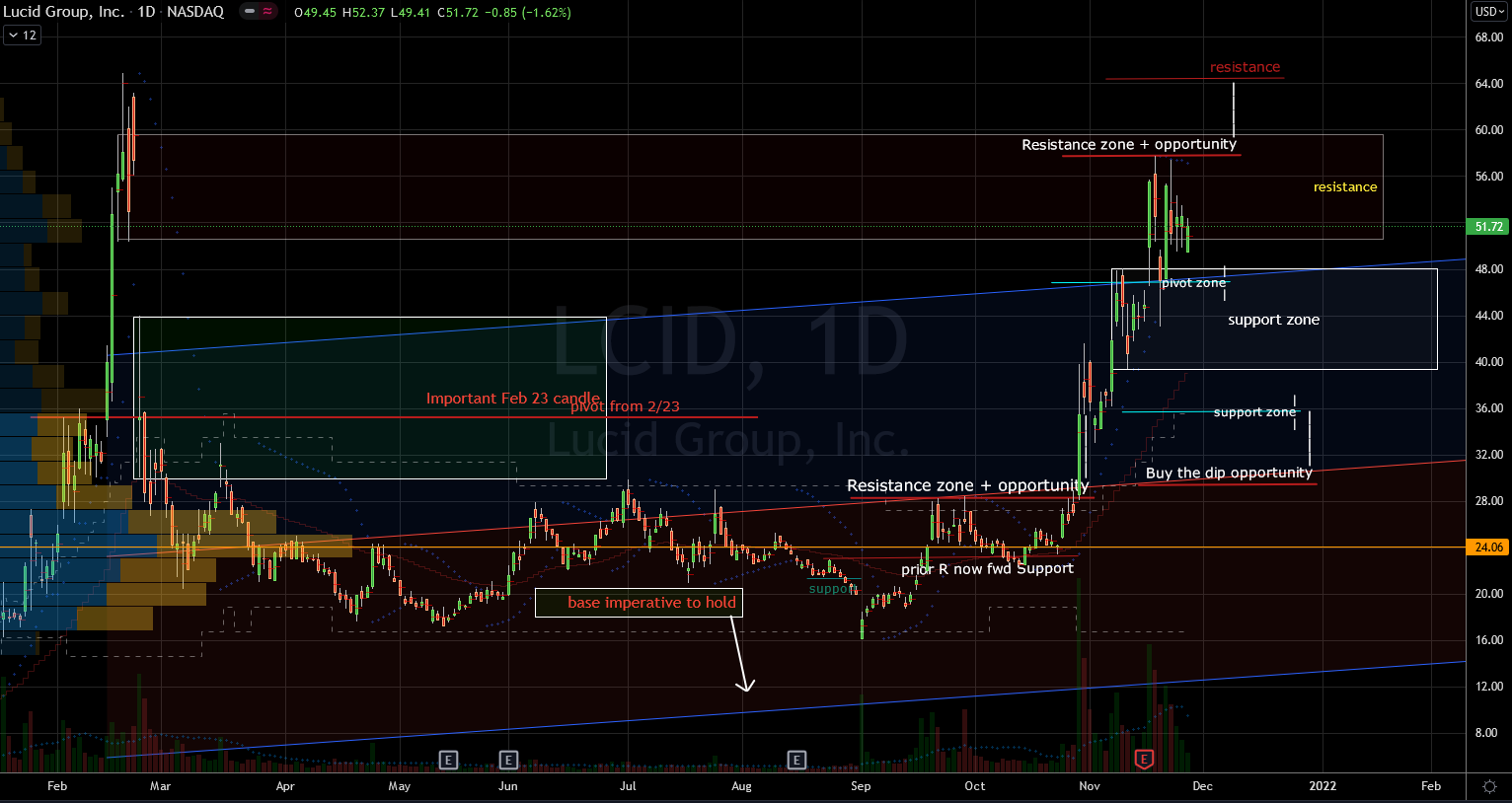

Lucid Motors (LCID)

Source: Charts by TradingView

Source: Charts by TradingView

My second pick today is my most controversial. Its stock is too high to chase and too hot to short. I absolutely realize that they have a gorgeous car with solid technology behind it. However, LCID stock is way too high for the current fundamentals.

I promise you that this was the toughest to put on my list of stocks to avoid. First of all, they started delivering, which is a huge milestone. Secondly, they have an incredibly attractive vehicle, which will gain popularity. However, LCID stock may also have operational limitations.

The company needs to expand its throughput drastically and quickly. Otherwise the expectations that are currently in the stock might prove too big. I am in no way suggesting that they will fail in their venture. Quite the opposite because I expect them to sell out of all vehicles. I am dampening the idea that this is a “Tesla slayer,” not for years. The math just isn’t there with their current setups.

They will have to drastically ramp up their production capacity. At current rates, Lucid has about half of Nio’s (NYSE:NIO) unit production. Before it can challenge the king Tesla, it has to first face all the other challengers below it.

Most often losses on Wall Street are because of bad expectations, not bad results. This is my restatement that I believe in the company but not in the stock levels for now. Later I would change my mind when the math also changes. For now, this LCID stock level is one I would avoid for a few months. Even at the risk of missing out on some upside in the meantime.

Lordstown Motors (RIDE)

Source: Charts by TradingView

Source: Charts by TradingView

My third pick today is the obvious of the bunch. When the company says it’s struggling to exist, that’s all I really need to avoid the stock. Those who keep buying it hoping for a miracle recovery are not being sensible. The stock market has hundreds of others alternatives, so there’s no need to chase struggling stocks like Ride.

A miracle headline may bring riches, but that’s more hope than investment strategy. Some believe that they know more about the company, so they stay long for that long shot bet. But I would avoid adding to current risk. The practice of averaging down is for surer thesis stocks.

I fail to see the need for the general investors to pile into this broken stock. In the end, it may turn out to be a broken company as well. Since it is not the only stock available to me, I should seek others. There are better outlooks even in the sector of startup EV car makers.

It is not alone there, I hold about the same opinion of Nikola (NASDAQ:NKLA) stock. I hope that for the sake of current investors RIDE forms the right alliances it needs. But until then it belongs on my list of stocks to avoid.

— Nicolas Chahine

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place