With global leaders demanding millions of electric vehicles (EVs) hit the roads over the next decade, Market Research Future predicts the electric vehicle market will soar to $957.42 billion from $208.95 billion, as noted by TheStreet.com.

“Tax breaks, non-monetary benefits such as new car registration and carpool lane access, increased vehicle range, active participation of OEMs, provision of charging infrastructure in regular places, and other factors can all contribute to the expansion of EV market trends,” the report added.

“Tax breaks, non-monetary benefits such as new car registration and carpool lane access, increased vehicle range, active participation of OEMs, provision of charging infrastructure in regular places, and other factors can all contribute to the expansion of EV market trends,” the report added.

Major automakers are also jumping on the EV bandwagon. General Motors just announced it will boost global spending on EVs to $35 billion through 2025. Ford increased its spending to more than $30 billion by 2030.

There’s just one problem: the world is running short on lithium, as demand skyrockets.

“There is the quadrupling of demand in just five years and probably a growth of six or seven times over 10 years. So, clearly the industry is not prepared today for that level of demand—the amount of incremental capacity that the industry needs over the next 10 years is at least 1.5 million mt (metric tons) and in terms of capital investment, will probably require $45 billion–$50 billion of investment into new projects or expansions of existing operations,” said iLi Markets partner Daniel Jimenez, as quoted by S&P Global Platts.

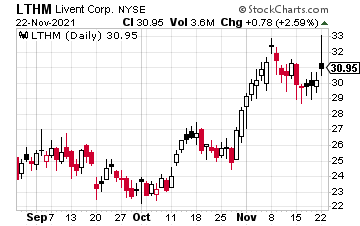

However, there’s hope lithium companies, like Livent Corp. may be able to help.

Livent Corp. (LTHM) is moving forward with its lithium hydroxide project in North Carolina, and its carbonate expansion in Argentina.

Livent Corp. (LTHM) is moving forward with its lithium hydroxide project in North Carolina, and its carbonate expansion in Argentina.

It will also start a phase-two carbonate expansion in Argentina, with commercial production expected to begin by 2023.

Even better, says Paul Graves, Livent’s president and CEO: “The strong growth in lithium demand that we saw in the first half of 2021 shows no signs of abating. Published and contracted prices for lithium in all forms pushed even higher in the third quarter, driven by multiple factors.”

In its most recent quarter, Livent’s revenue came in at $103.6 million, up 43% year over year. Its GAAP net loss was $12.6 million, or eight cents per diluted share. Adjusted EBITDA was $14.9 million, as adjusted EPS came in at three cents per diluted share.

Livent has also raised its guidance. It now expects to see revenue of $390 million to $410 million, as compared to earlier guidance of $370 million to $390 million. It also expects to see adjusted EBITDA of $62 million to $72 million, from a prior range of $55 million to $70 million. Again, with the lithium story showing no signs of cooling, LTHM may be a solid bet.

— Ian Cooper

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley