Many technology stocks share a similar fate: they are at the mercy of unrealistically high expectations from Wall Street. If they don’t meet these “pie-in-the-sky” expectations, their stock is savaged.

We saw a perfect example of this recently with Twilio (TWLO). This company provides tools to firms, such as Uber, that want to integrate their communication services. These services—via calls or messaging—allow them to connect with their customers or employees. The more that companies interact remotely with people, the more useful Twilio’s services become.

As you can imagine, tools like Twillio’s became very useful during the pandemic.

As you can imagine, tools like Twillio’s became very useful during the pandemic.

That’s why the company stock had nearly quadrupled since the pandemic began. But that led to Wall Street expecting Twilio to grow exponentially forever, which led to disappointment.

In the past quarter, the company topped forecasts for both revenue and earnings. Twilio also still enjoys elite retention rates for the software industry, with gross retention hovering around 97% and net dollar retention north of 120%.

Yet, even the slightest dip in revenue growth from existing customers, plus a higher-than-anticipated forecast for losses, knocked the shares down 13% in a flash. Twilio shares are now down 11% year-to-date.

Twilio’s Evolution

Twilio was founded in 2008 by Jeff Lawson and went public via an IPO in 2016. The company has been a standout leader in the so-called communications platform as a service sector (CPaaS).

But now, competition is piling into the sector, including from tech giant Microsoft (MSFT).

This has forced Twilio to spend money to try to stay ahead. Its largest acquisition to date was a $3 billion purchase of the customer data company Segment last year.

On Twilio’s website, it described the reasoning behind the acquisition: “Segment is the market-leading customer data platform (CDP) that helps you collect, clean, and control your customer data. It enables developers to unify customer data from every customer touchpoint, and empowers marketing, sales, and customer service leaders with the insights they need to design and build relevant, data-driven customer engagement.”

The website went on say that “…a combined Twilio and Segment means Twilio can help any business make their customer engagement across every channel more personalized, timely, and impactful.”

This deal continues Twilio’s evolution into a full-service platform. Previously, it had expanded from text chat and calls to email with the 2018 purchase of email platform SendGrid.

Macroeconomic Tailwinds

The good news for Twilio is that it has very strong macroeconomic tailwinds behind it.

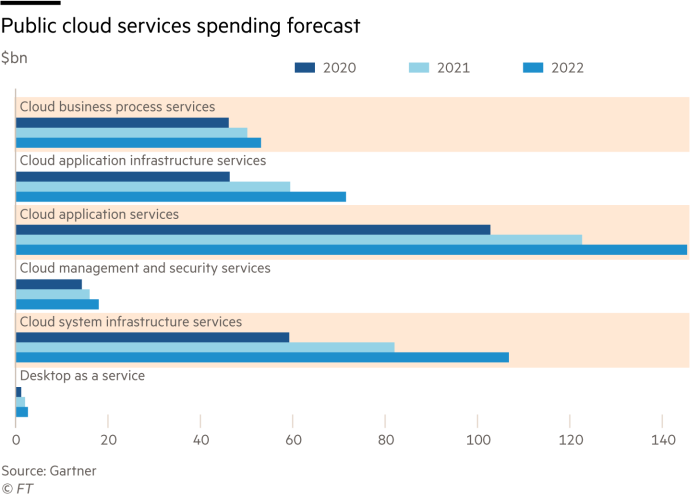

The company is in the middle of a broad, global digital transformation. Companies are redirecting their budgets to cloud-based services that can facilitate their growing online operations, which is why the tech consultancy firm Gartner forecasts total public cloud services spending to continue to grow rapidly. Here is what Gartner said its most recent report, released in August:

The economic, organizational and societal impact of the pandemic will continue to serve as a catalyst for digital innovation and adoption of cloud services,” said Henrique Cecci, senior research director at Gartner. “This is especially true for use cases such as collaboration, remote work and new digital services to support a hybrid workforce… Today, the cloud underpins most new technological disruptions, including composable business, and has proven itself during times of uncertainty with its resiliency, scalability, flexibility and speed.

Hybrid, multicloud and edge environments are growing and setting the stage for new distributed cloud models. In addition, new wireless communications advances, such as 5G R16 and R17, will push cloud adoption to a new level of broader, deeper and ubiquitous usage. Use cases such as enhanced mobile banking experiences and healthcare transformation will also emerge… As a result, global cloud adoption will continue to expand rapidly. Gartner forecasts end-user spending on public cloud services to reach $396 billion in 2021, and grow 21.7% to reach $482 billion in 2022. Additionally, by 2026, Gartner predicts public cloud spending will exceed 45% of all enterprise IT spending, up from less than 17% in 2021.”

In other words, Twilio is in the sweet spot for many years to come.

In other words, Twilio is in the sweet spot for many years to come.

The company’s bright future was described perfectly in an opinion column in Financial Times Lex, as it criticized Wall Street’s focus on the very short term: “Focusing on quarterly dollar-based net expansion rates ignores the strength of this wider [macro] trend. An expansion rate of 131% in the third quarter is down from 137% in the same period last year. But it still proves that customers are spending more over time. They pay per service. As they grow, so does Twilio. In the past quarter, revenue rose 65% to $740 million. There is more to grab. In the next four years, the [CPaaS] market is forecast to reach $14 billion.”

Hereisanotherbig theme regarding Twilio: companies that communicate with customers via social media platforms now have to rethink customer engagement amid rising concerns about protecting users’ privacy.

This issue has come to the fore—think advertisers on Snapchat and Facebook who saw ad efforts there struggle due to changes in Apple iOS operating system software related to privacy.

Twilio, with its text, email, and other avenues, gives businesses an opportunity to directly engage with their customers. This is a competitive advantage, especially when you consider that restrictions on digital privacy are only likely to increase.

So, take advantage of Wall Street never looking beyond its nose and pick up Twilio at current prices.

— Tony Daltorio

Collect up to 5 dividend checks per week [sponsor]Hi, I'm Tim Plaehn, and I just did the math in my own, real-money portfolio. I'll be collecting 70 dividend checks this quarter. That's nearly 5 per week on average. Automatically… no trading, no options, no work. You don't need a lot of money. You can be retired or near retirement... Either way, I'll show you my #1 plan to quickly collect dividends like clockwork from high-quality, cash-flowing business. Click here to learn how to collect up to 5 dividends a week.

Source: Investors Alley