Despite elevating risks for companies listed in China, Nio (NYSE:NIO) stock is holding up well.

NIO stock is not facing the same volatility as that of Alibaba (NYSE:BABA), as investors focus on its shipments and outlook.

Optimism for Nio’s electric vehicles in China remains high. The company forecasts weaker deliveries for the third quarter while shipments fell in August.

The company posted deliveries of 5,880 in August, up 48.3% year-over-year but down sequentially by 25.9%. The comparison to July’s 7,931 is more relevant because the Covid-19 pandemic in 2020 exaggerates the yearly increase. Still, Nio recorded all-time high new orders, driven by the strong interest in ES6 and EC6.

In the month, Nio delivered 1,738 ES8s, its six-seater model and 2,342 ES6s, a five-seater premium sports coupe SUV.

Looking ahead, continued uncertainty and volatility from semiconductor supply are disrupting production. As a result, Nio’s management adjusted its delivery outlook for the third quarter.

It expects vehicle production and deliveries in the range of 22,500 to 23,500 vehicles.

Nio Stock Buying Opportunity

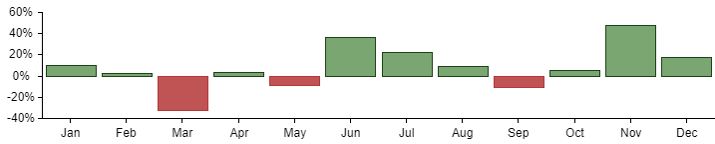

Source: Chart by StockRover.com

Source: Chart by StockRover.com

Nio stock briefly dipped after the monthly delivery report but promptly recovered. Markets rewarded investors for buying the dip. Since the stock is trading far from its 52-week high of $66.99, investors are betting on renewed growth.

Analysts are also forecasting smaller losses.

For example, analysts call for estimated earnings per share loss of 7 cents in the third quarter. This is a sharp improvement from the Q3/2020 loss of 14 cents a share and matches the 7-cent loss in Q2/2021.

As shown in the seasonal performance against the S&P 500 above, Nio usually under-performs in September. From October through to February, the stock will out-perform the index.

Investors could use this as a guide from the Stock Rover research to buy shares soon. As the stock pulls back this month on worries of weak demand, Nio will fall to a better buying price.

Next month, markets will overcome concerns about growing EV competition, and once Nio posts stronger monthly deliveries, the stock will rebound.

Competitor Tesla (NASDAQ:TSLA) is facing backlash in China for its poor quality Model 3. Demand for Tesla vehicles is weakening so much that the company had to cut prices by $2,323 in July.

Nio has positive consumer buying interest and strong orders to grow its market share as Tesla struggles further.

Risks and Upside

XPeng (NYSE:XPEV) posted strong delivery results for August. The EV supplier began to transition production for the G3 SUV to a G3i model.

This mid-cycle facelift negatively affected production in August. This month, the start of G3i deliveries could pressure Nio. Nio also delivered fewer units than XPeng in July.

Fortunately, Nio has a network of 2,025 battery swap stations. This keeps the prices of Nio vehicles low and is a source of recurring subscription revenue. Competitors cannot match the offering nor may it sell EVs that exclude the cost of the battery.

The chip shortage hurting the entire EV market shows no signs of improving. Nio may adjust its quarterly delivery forecast lower. Others may do the same, forcing investors to accept another loss for the next few quarters.

On Wall Street, the average analyst has a price target on Nio stock at $66, according to Tipranks. This interactive five-year discounted cash flow revenue exit model validates the analyst price target.

The model uses a revenue exit multiple to calculate the terminal value after five years. Readers may adjust the multiples and the revenue growth rate to re-calculate the fair value in the mid-$65 range.

Your Takeaway

Investors are still willing to hold Nio shares even as it loses money. The chip shortage will delay Nio’s path to profitability.

If stock markets are bullish, shareholders will ignore the losses for now. Conversely, market sentiment may shift unexpectedly. That would pressure Nio’s stock performance to the downside.

Seasonal patterns may repeat, which suggests that a drop is a good buying opportunity for investors not holding Nio. Wait for another downtrend in the stock this month and start an initial position. The company’s prospects are still strong. Investors with a long-term time horizon will come out ahead.

— Chris Lau

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place