What if you could mimic the moves of some of the best-informed traders on the planet? That’s the idea behind a new series we’re launching that’s focused on what we’ll call “smart money” option trades.

In short, we’re using Market Chameleon to scan the options market for unusual activity and identifying some of the most interesting mega trades – relatively large volume options trades we can potentially mimic… but on a smaller scale!

While we can’t be 100% certain of the exact options strategies our “smart money” traders are employing on these trades, these are our best guesses based on the information we do have.

That said, here are 5 of the most interesting “smart money” trades we came across in the past week.

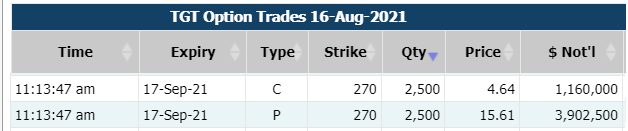

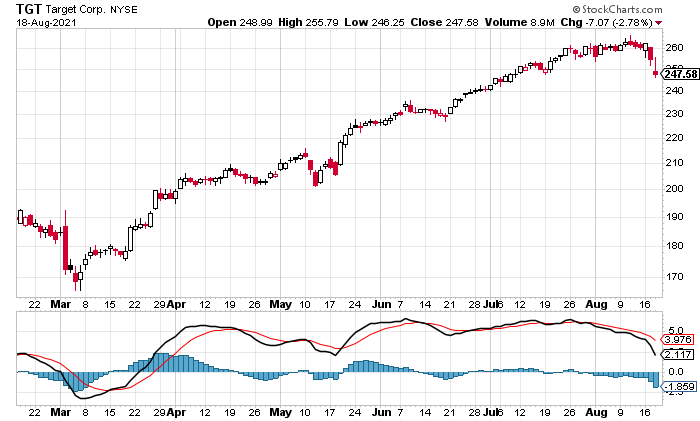

Trade #1: Trader Just Bet $5,062,500 That Target Corporation (NYSE: TGT) Will Have a Significant Move in Either Direction in 4 Weeks.

On Monday, August 16, 2021, a “smart money” trader seems to have bought 2,500 of the 17-Sep-21 $270 call options on TGT for $4.64 per share. Her outlay was $1,160,000 for these options. In what appears to be a Long Straddle Strategy (wherein the investor simultaneously purchases a call option and a put option on the same underlying asset with the same expiration date and strike price), she also seems to have 2,500 of the 17-Sep-21 $270 put options on TGT for $15.61 per share, which is an outlay of $3,902,500. Her total outlay for this Long Straddle Strategy was $5,062,500.

TGT will need to rise to $290.25 for the call option trade to break even — around a 17% return from the current price of $247.58. And then for every $1 the stock rises above $290.25, our “smart money” trader will make $250,000!

TGT needed to decline to $249.75 for the put option trade to break even. And then for every $1 the stock decreases below $249.75, our “smart money” trader will make $250,000!

She seems to be anticipating the underlying stock to have a significant move in either direction within the next 4 weeks.

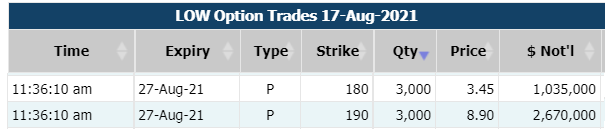

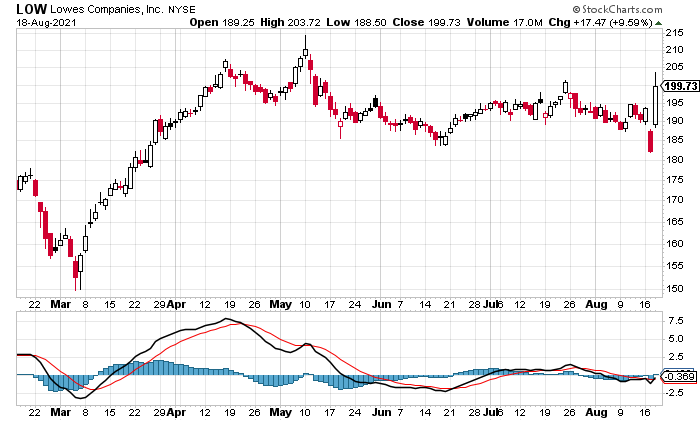

Trade #2: Trader Just Made $1,635,000 Betting That Lowe`s Companies Inc. (NYSE: LOW) Will Stay Bullish For The Next one Week.

On Tuesday, August 17, 2021, a “smart money” trader seems to have bought 3,000 of the 27-Aug-21 $180.00 put options on LOW for $3.45 per share. His outlay was $1,035,000 for these options. In what appears to be a Bull Put Spread Strategy (wherein the investor buys a put option with a lower strike price and sells a put option with a higher strike price but with the same expiry date), he also seems to have sold 3,000 of the 27-Aug-21 $190.00 put options on LOW for $8.90 per share, which is an inflow of $2,670,000. His total inflow for this Bull Put Spread Strategy was $1,635,000.

A Bull Put Spread Strategy is typically used to generate premium income based on a trader’s bullish view of a stock or index. He seems to be anticipating that the price of the stock would stay above $180.00 until 27-Aug-2021. The stock’s previous close was $199.73.

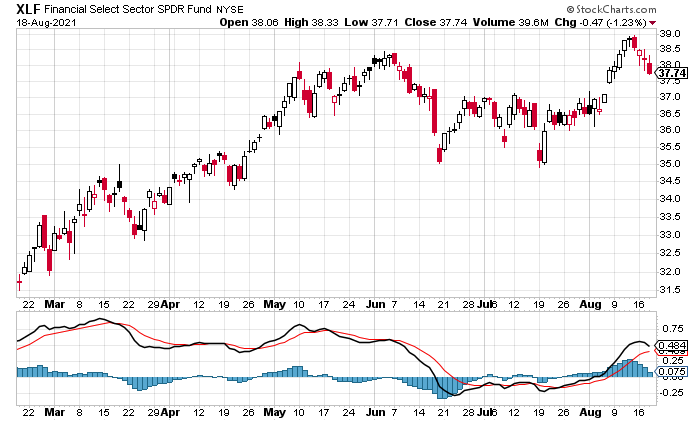

Trade #3: Trader Just Bet $14,770,000 That Financial Select Sector SPDR Fund (NYSE: XLF) Will Have a Significant Move in Either Direction in 4 Weeks.

On Wednesday, August 18, 2021, a “smart money” trader seems to have bought 35,000 of the 17-Sep-21 $42 call options on XLF for $0.02 per share. Her outlay was $70,000 for these options. In what appears to be a Long Straddle Strategy (wherein the investor simultaneously purchases a call option and a put option on the same underlying asset with the same expiration date and strike price), she also seems to have bought 35,000 of the 17-Sep-21 $42 put options on XLF for $4.20 per share which is an outlay of $14,700,00. Her total outlay for this Long Straddle Strategy was $14,770,000.

XLF will need to rise to $46.22 for the call option trade to break even — around a 23% return from the current price of $37.74. And then for every $1 the stock rises above $46.22, our “smart money” trader will make $3,500,000!

XLF needed to decline to $37.78 for the put option trade to break even. And then for every $1 the stock decreases below $37.78, our “smart money” trader will make $3,500,000!

She seems to be anticipating the underlying stock to have a significant move in either direction within the next 4 weeks.

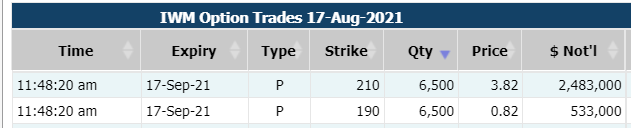

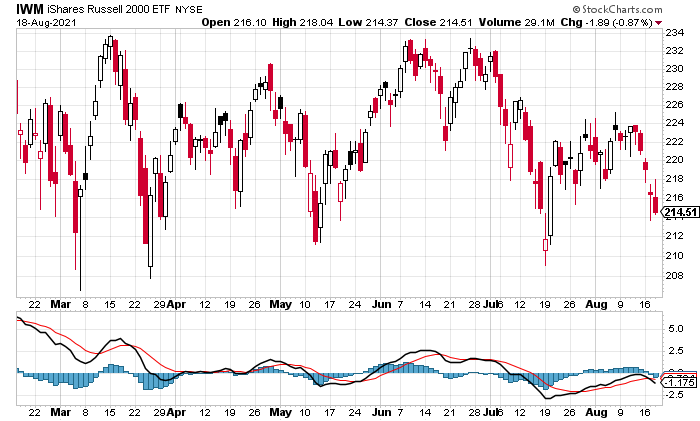

Trade #4: Trader Just Bet $1,950,000 That iShares Russell 2000 ETF (NYSE: IWM) Will Decline 11% in 4 Weeks.

On Tuesday, August 17, 2021, a “smart money” trader seems to have bought 6,500 of the 17-Sep-21 $210.00 put options on IWM for $3.82 per share. His outlay was $2,483,000 for these options. In what appears to be a Bear Put Spread Strategy (wherein the investor buys a put option with a higher strike price and sells a put option with a lower strike price but with the same expiry date), he also seems to have sold 6,500 of the 17-Sep-21 $190.00 put options on IWM for $0.82 per share, which is an inflow of $533,000. His total outlay for this Bear Put Spread Strategy was $1,950,000.

IWM needs to decline to $207.00 for the put option trade to break even — around a 4% return from the current price of $214.51. Then, for every $1 the stock moves below $207.00, our “smart money” trader will make $650,000! It may be noted that the trader’s profit will be limited till the price of $190.00 as he had sold the $190.00 strike price put options.

He seems to be anticipating the underlying ETF to decline until $190.00, which is a nearly 11% return from the current price of $214.51.

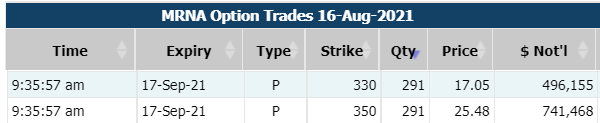

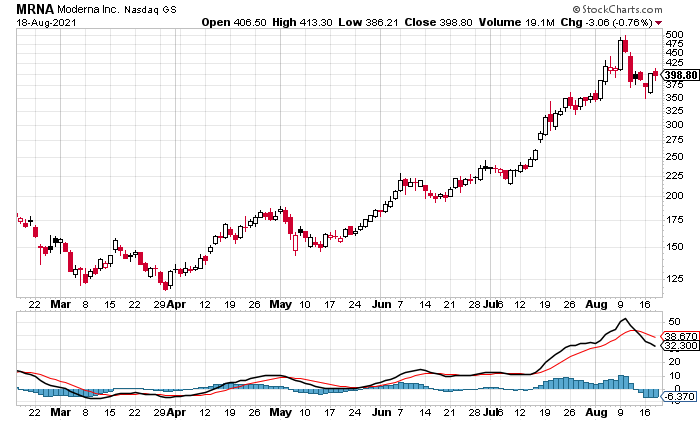

Trade #5: Trader Just Made $245,313 Betting That Moderna Inc. (NASDAQ: MRNA) Will Stay Bullish For The Next 4 Weeks.

On Monday, August 16, 2021, a “smart money” trader seems to have bought 291 of the 17-Sep-21 $330.00 put options on MRNA for $17.05 per share. Her outlay was $496,155 for these options. In what appears to be a Bull Put Spread Strategy (wherein the investor buys a put option with a lower strike price and sells a put option with a higher strike price but with the same expiry date), she also seems to have sold 291 of the 17-Sep-21 $350.00 put options on MRNA for $25.48 per share, which is an inflow of $741,468. Her total inflow for this Bull Put Spread Strategy was $245,313.

A Bull Put Spread Strategy is typically used to generate premium income based on a trader’s bullish view of a stock or index. She seems to be anticipating that the price of the stock would stay above $330.00 until 17-Sep-2021. The stock’s previous close was $398.80.

Happy Trading!

— Trades of The Day Research Team

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Trades of the Day