The classic get-rich-quick scheme is called a scheme because, well, it’s a scheme. Can you get rich quickly? Maybe. But I’ll tell you what.

In the pursuit of such a thing, you’re far more likely to lose everything and end up quickly poor. Getting rich slowly isn’t sexy. That’s why it’s not a scheme.

But if you have some patience and can let compounding go to work for you over the long term, you’re almost guaranteed to not end up poor.

In fact, boring, obvious, everyday companies you see all around you are slowly making people incredibly wealthy. How wealthy? You might be surprised.

Today, I want to tell you about three millionaire-making Dividend Aristocrats that are making their shareholders rich. Ready? Let’s dig in.

The first Dividend Aristocrat that is making its shareholders rich is Johnson & Johnson (JNJ).

Johnson & Johnson is a global healthcare conglomerate.

Johnson & Johnson is about as obvious and boring as it gets. You and everyone you know has heard of Johnson & Johnson. They make the pharmaceuticals, medical devices, and consumer products that people all over the world rely on. That’s how they became a $455 billion by market cap company.

But boring isn’t a bad thing. Boring can be beautiful. Especially if you like making money.

Johnson & Johnson is a Dividend Aristocrat, which is a special status reserved for stocks that have increased their dividends for 25 or more consecutive years. Only the best of the best businesses can do such a thing because of how difficult it is to manage something like that. Johnson & Johnson has actually increased its dividend for 59 consecutive years. They’re a Dividend Aristocrat more than twice over. With more than 50 straight years of dividend increases, it’s a Dividend King

Johnson & Johnson is a Dividend Aristocrat, which is a special status reserved for stocks that have increased their dividends for 25 or more consecutive years. Only the best of the best businesses can do such a thing because of how difficult it is to manage something like that. Johnson & Johnson has actually increased its dividend for 59 consecutive years. They’re a Dividend Aristocrat more than twice over. With more than 50 straight years of dividend increases, it’s a Dividend King

This is a classic blue-chip Dividend Aristocrat that is making people rich.

Investing $5,000 into Johnson & Johnson 30 years ago would have turned into more than $230,000 today, good for a compound annual rate of return of nearly 14%.  That’s almost 50 times your original starting sum. On a boring, everyday business that anyone can understand. Is 30 years quick? No. But whereas people all over the place are falling for sad crypto scams and losing all of their money, Johnson & Johnson just quietly and slowly compounds its shareholders money.

That’s almost 50 times your original starting sum. On a boring, everyday business that anyone can understand. Is 30 years quick? No. But whereas people all over the place are falling for sad crypto scams and losing all of their money, Johnson & Johnson just quietly and slowly compounds its shareholders money.

The second Dividend Aristocrat I want to tell you about is Procter & Gamble (PG).

Procter & Gamble is a multinational consumer goods company.

You know Procter & Gamble. And if you think you don’t, you do. That’s because you at least know its many brands. Think Crest, Downy, and Gillette. Their brands are so broad and powerful, the company has 25 different billion-dollar brands. They’re slowly making their shareholders millionaires on the back of these brands doing billions in annual sales. And that’s built the company’s market cap into $345 billion.

Soap and toothpaste? It’s that simple to get rich?

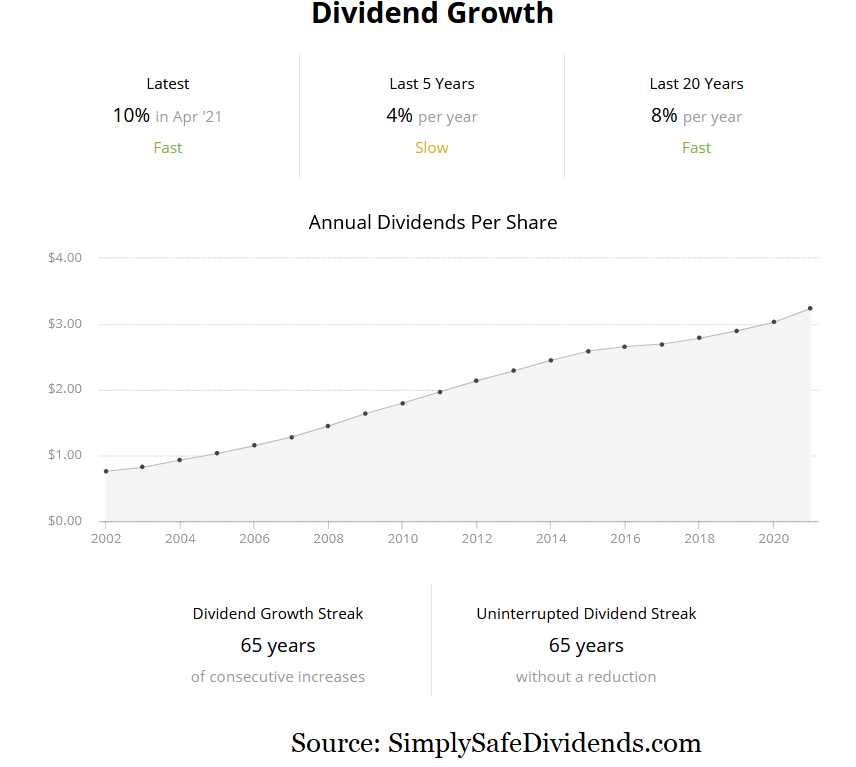

Yep. It really is. But the hard part, of course, is having the patience to see the compounding process play out and let that investment quietly build success for you over years and years. A lot of people can’t do that. But what makes it easier with these high-quality Dividend Aristocrats is the reliable, rising cash dividends they send to their shareholders, which gives them that constant source of income and taste of success while they wait for the big payoff. Indeed, Procter & Gamble has increased its dividend for an incredible 65 consecutive years.

While those dividends grow, so does the stock.

While those dividends grow, so does the stock.

See, growing dividends are funded by growing profit. And as a business becomes more profitable, its stock value rises. And we can see that all play out here. Investing $5,000 into Procter & Gamble stock 30 years ago would have compounded at an annual rate of almost 14% and turned into $250,000.  50 times your money on a simple, boring, easy-to-understand business. A business which is probably providing you a lot of the products you use every single day. Why not invest in some of those products and earn a handsome return back on your spending? This stock won’t get you rich quick. But it can definitely make you very wealthy over time.

50 times your money on a simple, boring, easy-to-understand business. A business which is probably providing you a lot of the products you use every single day. Why not invest in some of those products and earn a handsome return back on your spending? This stock won’t get you rich quick. But it can definitely make you very wealthy over time.

Last but not least, let’s talk about the Dividend Aristocrat that is Aflac (AFL).

Aflac is a supplemental insurance company primarily doing business in the United States and Japan.

Aflac might not be the same household name that the other two are, but with a market cap of nearly $40 billion, it’s no small fish. And I’m sure a lot of you viewers have heard of this company. I know I did long before I became an investor. I still remember one of their sales reps regularly stopping by my old car dealership day job and chatting it up with co-workers. I was way too poor back then to even consider supplemental insurance. But I’m no longer poor, partially because I bought Aflac stock a while back.

Their duck mascot likes to quack, but I think shareholders are more likely to quietly smile.

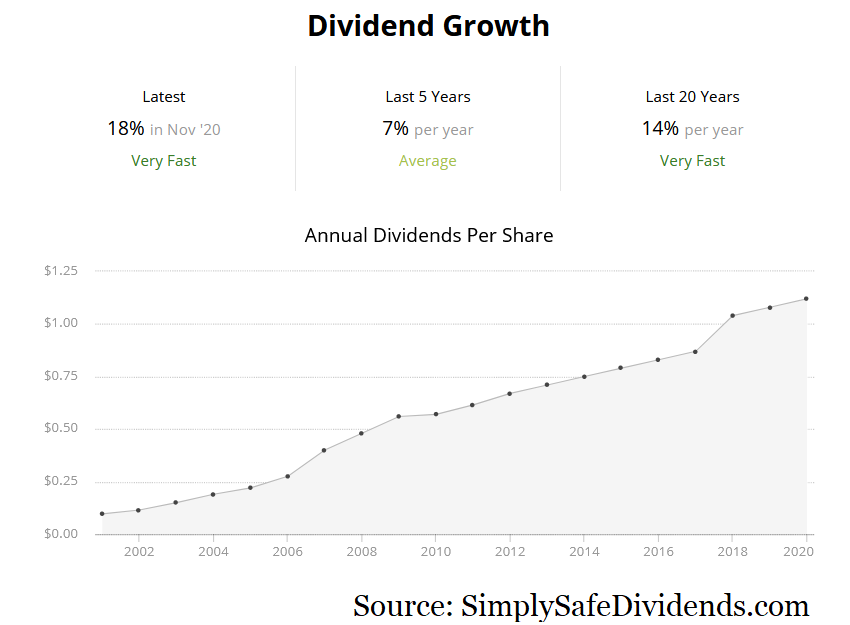

Why wouldn’t you feel like smiling when a high-quality company like this is exponentially growing your wealth and passive income. Speaking of passive income, Aflac has increased its dividend for 39 consecutive years. It’s well into Dividend Aristocrat territory. While patient shareholders let those shares steadily compound away, Aflac is busy growing the business, increasing profit, and rewarding shareholders with rising dividends.

You know what else is rising? Shareholders’ wealth.

You know what else is rising? Shareholders’ wealth.

Supplemental insurance. What a snoozefest, right? Well, I think this ought to wake you up. Investing $5,000 into Aflac stock 30 years ago would have turned into almost $925,000 today, with that investment compounding at an annual rate of slightly over 19%.  So having $15,000 invested in these three high-quality dividend growth stocks in August 1991 would have turned into a bit over $1.4 million today. These millionaire-making Dividend Aristocrats are boring, everyday businesses that made investors wealthy slowly and combined to increase the initial investment by almost 100 times. Don’t risk losing everything by chasing after get-rich-quick schemes. Instead, invest intelligently into high-quality businesses that will slowly make you wealthy while also exponentially increasing your passive dividend income.

So having $15,000 invested in these three high-quality dividend growth stocks in August 1991 would have turned into a bit over $1.4 million today. These millionaire-making Dividend Aristocrats are boring, everyday businesses that made investors wealthy slowly and combined to increase the initial investment by almost 100 times. Don’t risk losing everything by chasing after get-rich-quick schemes. Instead, invest intelligently into high-quality businesses that will slowly make you wealthy while also exponentially increasing your passive dividend income.

— Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Source: DividendsAndIncome.com

The goal? To build a reliable, growing income stream by making regular investments in high-quality dividend-paying companies. Click here to access our Income Builder Portfolio and see what we’re buying this month.