What if you could mimic the moves of some of the best-informed traders on the planet? That’s the idea behind a new series we’re launching that’s focused on what we’ll call “smart money” option trades.

In short, we’re using Market Chameleon to scan the options market for unusual activity and identifying some of the most interesting mega trades – relatively large volume options trades we can potentially mimic… but on a smaller scale!

While we can’t be 100% certain of the exact options strategies our “smart money” traders are employing on these trades, these are our best guesses based on the information we do have.

That said, here are 5 of the most interesting “smart money” trades we came across in the past week.

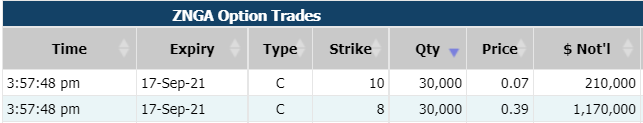

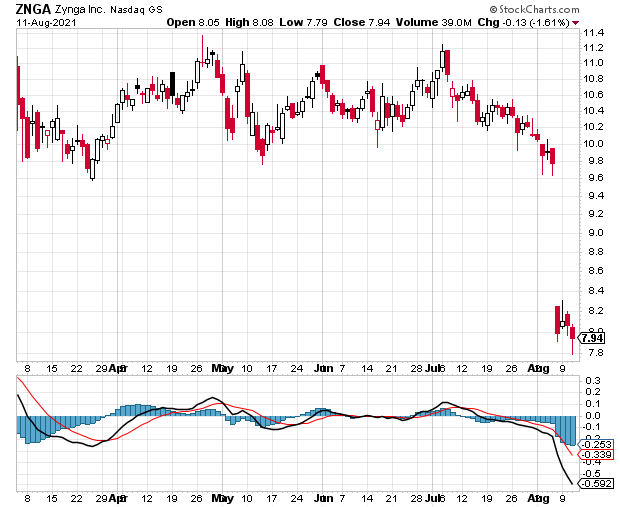

Trade #1: Trader Just Bet $960,000 That Zynga Inc. (NASDAQ: ZNGA) Will Rise 26% in 5 Weeks.

On Wednesday, August 11, 2021, a “smart money” trader seems to have bought 30,000 of the 17-Sep-21 $8.00 call options on ZNGA for $0.39 per share. Her outlay was $1,170,000 for these options. In what appears to be a Bull Call Spread Strategy (wherein the investor buys a call option with a lower strike price and sells a call option with a higher strike price but with the same expiry date), she also seems to have sold 30,000 of the 17-Sep-21 $10.00 call options on ZNGA for $0.07 per share, which is an inflow of $210,000. Her total outlay for this Bull Call Spread Strategy was $960,000.

ZNGA needs to rise to $8.32 for the call option trade to break even – around a 5% return from the current price of $7.94. Then, for every $1 the stock rises above $8.32, our “smart money” trader will make $3,000,000!

She seems to be anticipating the underlying stock to surge until $10.00, which is a nearly 26% return from the current price of $7.94.

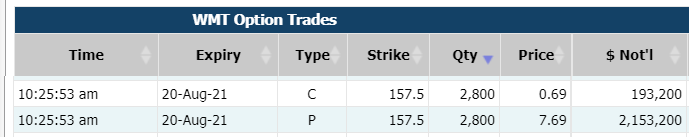

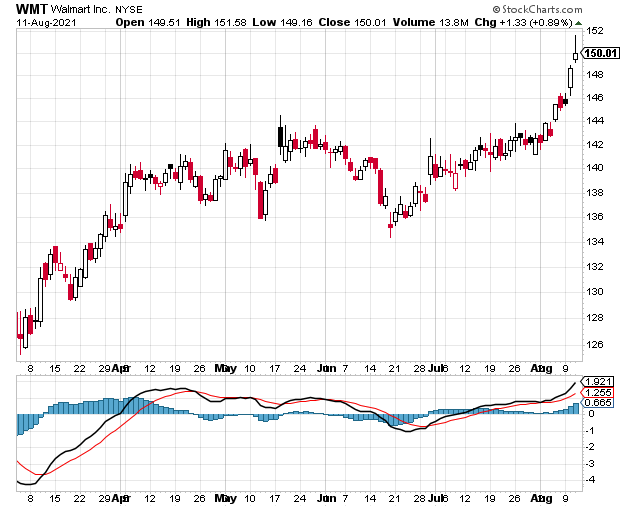

Trade #2: Trader Just Bet $2,346,400 That Walmart Inc. (NYSE: WMT) Will Have a Significant Move in Either Direction in ONE Week.

On Wednesday, August 11, 2021, a “smart money” trader seems to have bought 2,800 of the 20-Augs-21 $157.50 call options on WMT for $0.69 per share. His outlay was $193,200 for these options. In what appears to be a Long Straddle Strategy (wherein the investor simultaneously purchases a call option and a put option on the same underlying asset with the same expiration date and strike price), he also seems to have bought 2,800 of the 20-Aug-21 $157.50 put options on WMT for $7.69 per share, which is an outlay of $2,153,200. His total outlay for this Long Straddle Strategy was $2,346,400.

WMT will need to rise to $165.88 for the call option trade to break even — around an 11% return from the current price of $150.01. And then for every $1 the stock rises above $165.88, our “smart money” trader will make $280,000!

WMT will need to decline to $149.12 for the put option trade to break even — around a 1% return from the current price of $150.01. And then for every $1 the stock decreases below $149.12, our “smart money” trader will make $280,000!

He seems to be anticipating the underlying stock to have a significant move in either direction within the next ONE week.

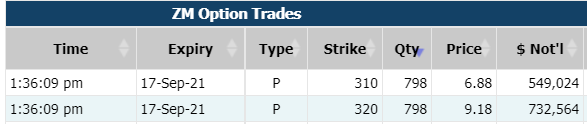

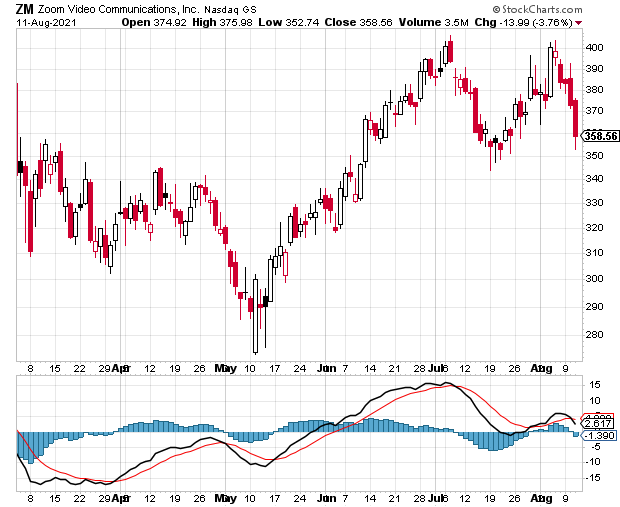

Trade #3: Trader Just Made $183,540 Betting That Zoom Video Communications Inc. (NASDAQ: ZM) Will Stay Bullish For The Next 5 Weeks.

On Wednesday, August 11, 2021, a “smart money” trader seems to have bought 798 of the 17-Sep-21 $310.00 put options on ZM for $6.88 per share. Her outlay was $549,024 for these options. In what appears to be a Bull Put Spread Strategy (wherein the investor buys a put option with a lower strike price and sells a put option with a higher strike price but with the same expiry date), she also seems to have sold 798 of the 17-Sep-21 $320.00 put options on ZM for $9.18 per share, which is an inflow of $732,564. Her total inflow for this Bull Put Spread Strategy was $183,540.

A Bull Put Spread Strategy is typically used to generate premium income based on a trader’s bullish view of a stock or index. She seems to be anticipating that the price of the stock would stay above $310.00 until 17-Sep-2021. The stock’s previous close was $358.56.

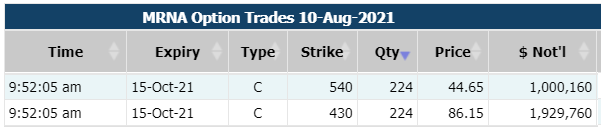

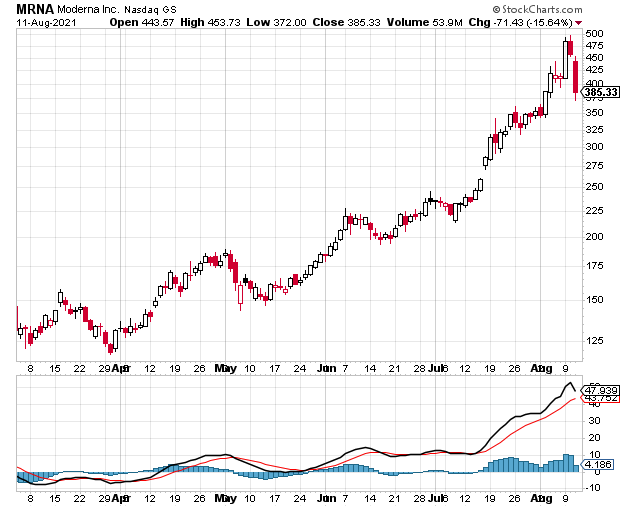

Trade #4: Trader Just Bet $929,600 That Moderna Inc. (NASDAQ: MRNA) Will Rise 40% in 9 Weeks.

On Tuesday, August 10, 2021, a “smart money” trader seems to have bought 224 of the 15-Oct-21 $430.00 call options on MRNA for $86.15 per share. His outlay was $1,929,760 for these options. In what appears to be a Bull Call Spread Strategy (wherein the investor buys a call option with a lower strike price and sells a call option with a higher strike price but with the same expiry date), he also seems to have sold 224 of the 15-Oct-21 $540.00 call options on MRNA for $44.65 per share, which is an inflow of $1,000,160. His total outlay for this Bull Call Spread Strategy was $929,600.

MRNA needs to rise to $471.50 for the call option trade to break even – around a 22% return from the current price of $385.33. Then, for every $1 the stock rises above $471.50, our “smart money” trader will make $22,400!

He seems to be anticipating the underlying stock to surge until $540.00, which is a nearly 40% return from the current price of $385.33.

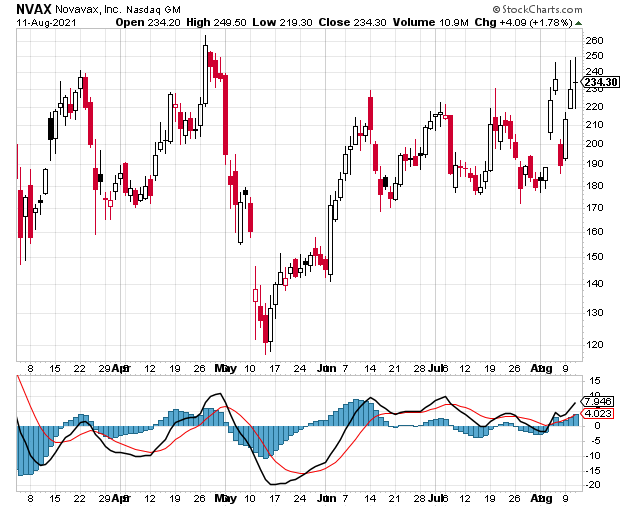

Trade #5: Trader Just Bet $450,000 That Novavax, Inc. (NASDAQ: NVAX) Will Rise 71% in 5 Months.

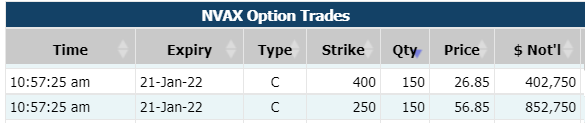

On Wednesday, August 11, 2021, a “smart money” trader seems to have bought 150 of the 21-Jan-22 $250.00 call options on NVAX for $56.85 per share. Her outlay was $852,750 for these options. In what appears to be a Bull Call Spread Strategy (wherein the investor buys a call option with a lower strike price and sells a call option with a higher strike price but with the same expiry date), she also seems to have sold 150 of the 21-Jan-22 $400.00 call options on NVAX for $26.85 per share, which is an inflow of $402,750. Her total outlay for this Bull Call Spread Strategy was $450,000.

NVAX needs to rise to $280.00 for the call option trade to break even – around a 20% return from the current price of $234.30. Then, for every $1 the stock rises above $280.00, our “smart money” trader will make $15,000!

She seems to be anticipating the underlying stock to surge until $400.00, which is a nearly 71% return from the current price of $234.30.

Happy Trading!

— Trades of The Day Research Team

The goal? To build a reliable, growing income stream by making regular investments in high-quality dividend-paying companies. Click here to access our Income Builder Portfolio and see what we’re buying this month.

Source: Trades of the Day