I’ve made a ton of videos on a simple concept that I can’t seem to hammer home enough. Don’t chase yield. I really can’t say those three words enough.

Despite my best efforts, we continue to get comments left and right about high-yield junk stocks. Patience is a virtue. And it requires patience to see the compounding process play out over time.

If you invest in high-quality dividend growth stocks, you’ll likely see your wealth and passive dividend income exponentially grow. Now, it takes time for that to happen.

But I’m talking about returns that can beat the market over the long run. And dividend growth that can beat inflation. So it’s having your cake (wealth) and eating it, too (income).

High-quality dividend growth stocks are like golden geese that lay ever-more golden eggs. But high-yield stocks that can pay out lots of income today entice naïve investors.

Today, I’m going to share with you two high-yield stocks to avoid and two high-quality dividend growth stocks to consider buying instead. Ready? Let’s dig in.

The first high-yield stock to avoid is AGNC Investment (AGNC).

AGNC is a real estate investment trust that primarily invests in residential mortgage-backed securities.

This is a classic high-yield trap that ensnares unsuspecting investors who look at the high yield and get all starry eyed. But here’s the thing. AGNC has been a terrible investment for as long as I’ve been investing.

The stock yields a monstrous 9%.

Awesome, right? Wrong. The yield only looks great because the stock continues to head downward year after year. Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield. So high-yield stocks almost naturally tend to be limited to the worst-performing stocks.

This stock has declined by almost 20% over the last five years alone.

During one of the most robust five-year period of the entire US stock market’s history, this stock goes down. I mean, if that doesn’t tell you to stay away, I don’t know what will. Meanwhile, they continue to cut the dividend left and right. The current dividend is 40% lower than it was in 2016. Investors who bought this stock five years ago have seen the indignation of seeing both their wealth and passive dividend income drop severely. That’s a no-go.

During one of the most robust five-year period of the entire US stock market’s history, this stock goes down. I mean, if that doesn’t tell you to stay away, I don’t know what will. Meanwhile, they continue to cut the dividend left and right. The current dividend is 40% lower than it was in 2016. Investors who bought this stock five years ago have seen the indignation of seeing both their wealth and passive dividend income drop severely. That’s a no-go.

Instead, consider buying W.P. Carey (WPC).

Instead, consider buying W.P. Carey (WPC).

W.P. Carey is a real estate investment trust that owns over 1,000 properties mostly in the US and Europe.

While AGNC is dealing in mortgage-backed securities, which is a giant can of worms in and of itself, W.P. Carey does things the old-fashioned way. We’re talking about physical real estate here, which they buy and then net lease to quality tenants. Everything from storage properties to government offices.

This stock yields 5.2%.

No, not as high as AGNC. But what do you get in exchange for giving up some yield? Well, safety for one thing. The current dividend is handily covered by AFFO. And how about solid long-term investment performance and the growth of your passive dividend income?

Whereas AGNC is down by almost 20% over the last five years, W.P. Carey is up by 17% over the last five years.

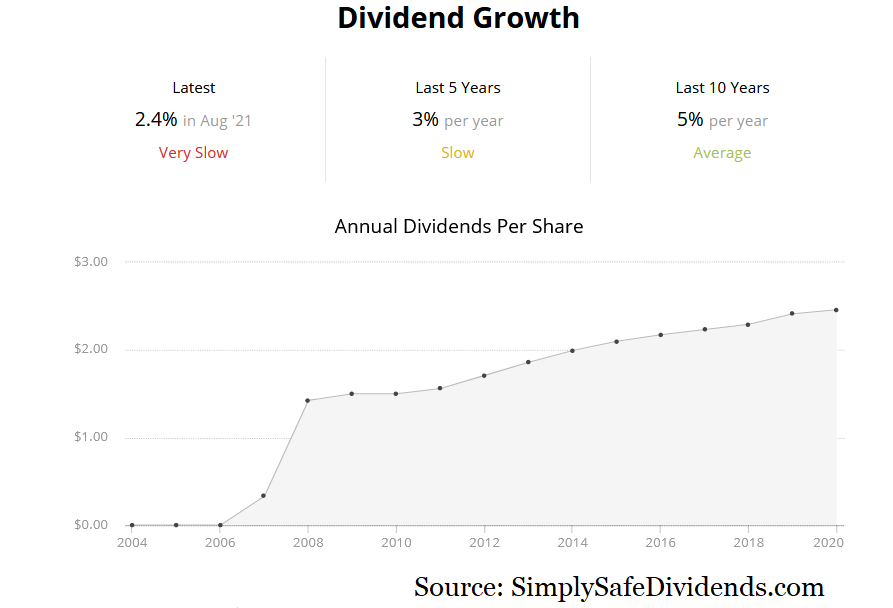

Would you rather lose wealth or gain wealth? Not a difficult choice, really. Meantime, W.P. Carey has increased its dividend for 24 consecutive years. The dividend is up by almost 7% since 2016. High-quality dividend growth stocks like W.P. Carey grow shareholders’ wealth and give them growing dividends, while low-quality high-yield stocks destroy shareholders’ wealth and give them shrinking dividends. With a P/CF ratio of 16.6, this stock remains reasonably valued. And real quick, before I move on, W.P. Carey is one of my top five stocks for 2021.

Would you rather lose wealth or gain wealth? Not a difficult choice, really. Meantime, W.P. Carey has increased its dividend for 24 consecutive years. The dividend is up by almost 7% since 2016. High-quality dividend growth stocks like W.P. Carey grow shareholders’ wealth and give them growing dividends, while low-quality high-yield stocks destroy shareholders’ wealth and give them shrinking dividends. With a P/CF ratio of 16.6, this stock remains reasonably valued. And real quick, before I move on, W.P. Carey is one of my top five stocks for 2021.

Another high-yield stock to avoid is Prospect Capital (PSEC).

Prospect Capital Corporation is a business development company that that makes debt and equity investments in middle-market businesses.

Like moths drawn in by the light of a flame to their own doom, some investors find themselves drawn in by super high yields to their own financial detriment. PSEC is a classic example of this.

This stock yield does yield a mouth-watering 8.8%.

And that’s pretty much where the appeal begins and ends. This stock is down 2% over the last five years, even while the US stock market doubled over that stretch. Anyone who bought PSEC five years ago picked up some nice dividends along the way, but they were seeing their wealth destroyed in the process.

Adding insult to injury, PSEC’s dividend has gone down over the last five years.

The dividend was over 8 cents/quarter per share in 2016. It’s now at 6 cents. Their 28% dividend cut in 2017 has never been rectified. Yield chasers got attracted to the roughly 12% yield the stock offered in 2016. But all they ended up doing was missing out on big gains elsewhere, all while seeing their dividend income drop. It’s the worst of both worlds.

The dividend was over 8 cents/quarter per share in 2016. It’s now at 6 cents. Their 28% dividend cut in 2017 has never been rectified. Yield chasers got attracted to the roughly 12% yield the stock offered in 2016. But all they ended up doing was missing out on big gains elsewhere, all while seeing their dividend income drop. It’s the worst of both worlds.

Instead, consider buying Main Street Capital (MAIN).

Main Street Capital is a business development company that that makes debt and equity investments in middle-market businesses.

Yep. Another BDC. Except Main Street Capital has been run significantly better over the years. I looked at both PSEC and MAIN years ago for an investment in my own portfolio. At the time, if I recall correctly, MAIN yielded about half that of PSEC. But I still chose MAIN because it appeared to be, after my research, the much better business. And I’m glad I chose wisely.

This stock is up 21% over the last five years.

This stock is up 21% over the last five years.

All that stock performance while also spitting out a big, fat dividend that’s been super reliable and has increased regularly. I couldn’t imagine sleeping well at night owning something like PSEC. But MAIN is a stock that has never given me bad dreams. No, it doesn’t yield as much as PSEC. It didn’t when I bought it. It doesn’t now. That’s partially because it performs much better and doesn’t pay out a bigger dividend than it ought to. But it does offer a juicy dividend that is supported by distributable net investment income. And this yield still smokes the market.

The yield on this stock is a very nice 5.9%.

That’s more than four times higher than the broader market’s yield, and the dividend is paid monthly. Plus, you’re getting solid business performance, stock performance, and dividend performance. It’s been said that the safest dividend is the one that was just raised.

That’s more than four times higher than the broader market’s yield, and the dividend is paid monthly. Plus, you’re getting solid business performance, stock performance, and dividend performance. It’s been said that the safest dividend is the one that was just raised.

Well, MAIN has increased its dividend for 11 consecutive years, with their most recent dividend increase coming in only days ago. The dividend is up by nearly 17% over August 2016. With most basic valuation metrics below their respective recent historical averages, MAIN’s valuation looks sensible. If you like lighting money on fire, be my guest and chase yield. But if you want to do well over the long run, stick to high-quality dividend growth stocks that will exponentially grow your wealth and your passive dividend income.

— Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Source: DividendsAndIncome.com

The goal? To build a reliable, growing income stream by making regular investments in high-quality dividend-paying companies. Click here to access our Income Builder Portfolio and see what we’re buying this month.